Bullish Signals

The U.S. economy has shown remarkable resilience in the face of higher interest rates, with a combination of factors contributing to continued economic growth and a positive outlook for the stock market.

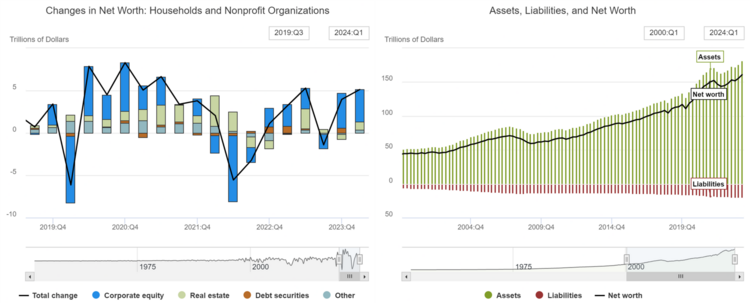

One of the most significant factors supporting the U.S. economy is the unprecedented growth in investment income. According to the Commerce Department, Americans earned approximately $3.7 trillion from interest and dividends in the first quarter of 2024 – a staggering $770 billion increase from just four years earlier. In the last quarter of 2023, wealth held in stocks, real estate, and other assets such as pensions reached the highest level ever observed by the Federal Reserve. 1 2

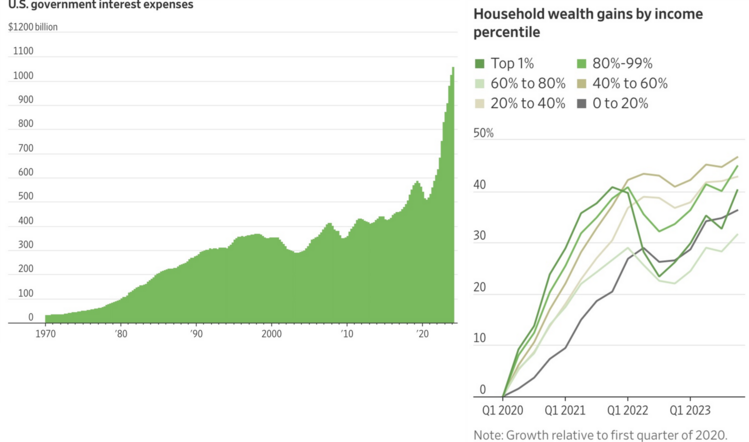

While the negative of higher rates has been an explosion in interest expense paid by the government, with government interest expenses reaching $1.1 trillion in the first quarter, Federal data suggest Americans’ wage and wealth growth in recent years spanned every income bracket. In sheer dollar terms, the investor class – primarily those in the top quartile of income cohorts – have received a large share of wealth gains through ownership of assets such as homes and stocks. 3

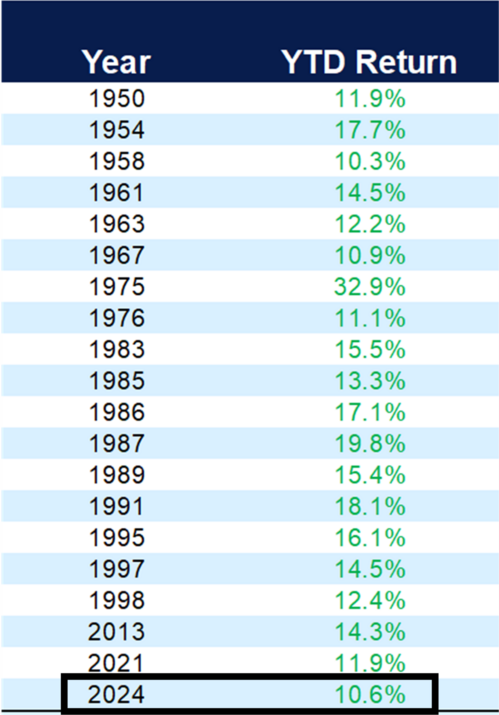

The combination of ballooning investment income for the investor class, which is fueling continued consumption and investment, along with near-full employment and higher wages across the board, has propelled the S&P 500 to one of its best starts to a year on record, gaining double-digits through May. 4

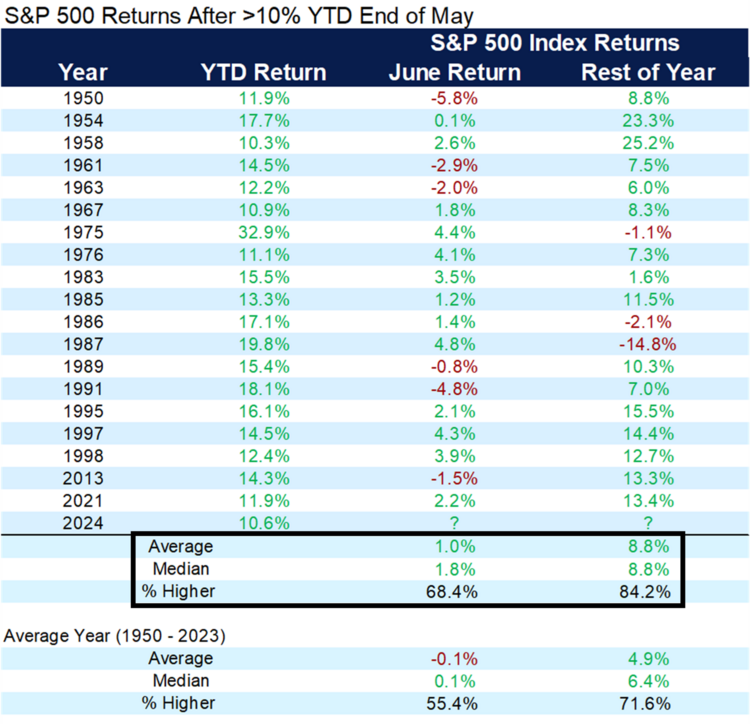

What could this mean for the rest of the year? History suggests the returns after previous 10% or more year-to-date gains through May tend to be quite impressive, with June up 1.0% on average and the rest of the year up 16 out of 19 times (84.2%) with a solid 8.8% gain on average. 4

While investors and policymakers must stay attentive to evolving market and economic conditions, the U.S. economy and stock market have thus far demonstrated noteworthy resilience despite the headwind of higher interest rates. This bodes well for continued growth ahead, although vigilance remains crucial.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: