Can We Have Our Cake and Eat It Too?

Last week’s post focused on earnings, but I included a small teaser on tax policy using the chart below. It generated some interest, so perhaps it's time to take a macro look at the implications of both the Harris and Trump tax policies. 1

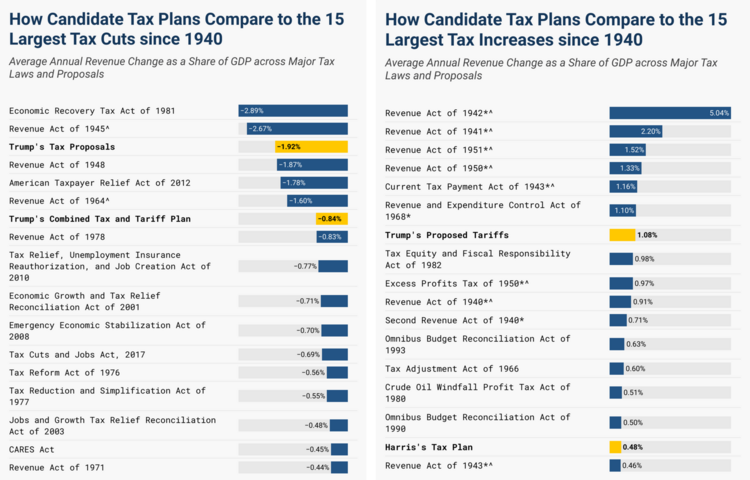

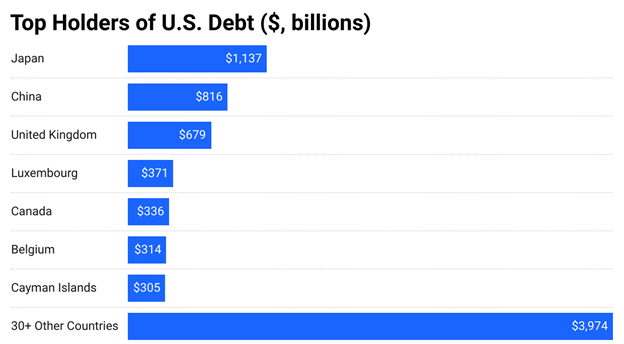

According to the Tax Policy Institute, the Trump tax and tariff plans would have some of the largest fiscal impacts since 1940. But Harris is no fiscal conservative by any means. By allowing the current Tax Cuts and Jobs Act (TCJA) to expire, Harris’s tax plan would have the 15th largest tax increase since 1940. 2

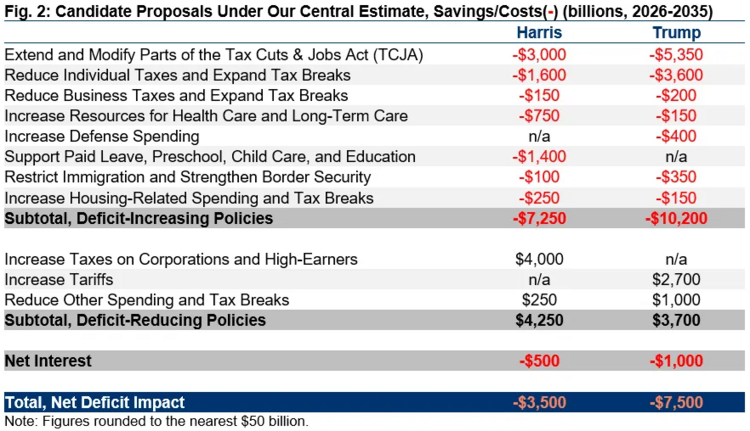

The overall implications look something like this according to the Tax Foundation:

Harris’s plan would drive more revenue into the government, but potentially suppress economic growth, which could result in limited wage growth and job creation over a 10-year period. 3

Trump’s plan, on the other hand, would increase government deficits with his tax cuts, but potentially stimulate economic growth, wages, and jobs over the same period. 4

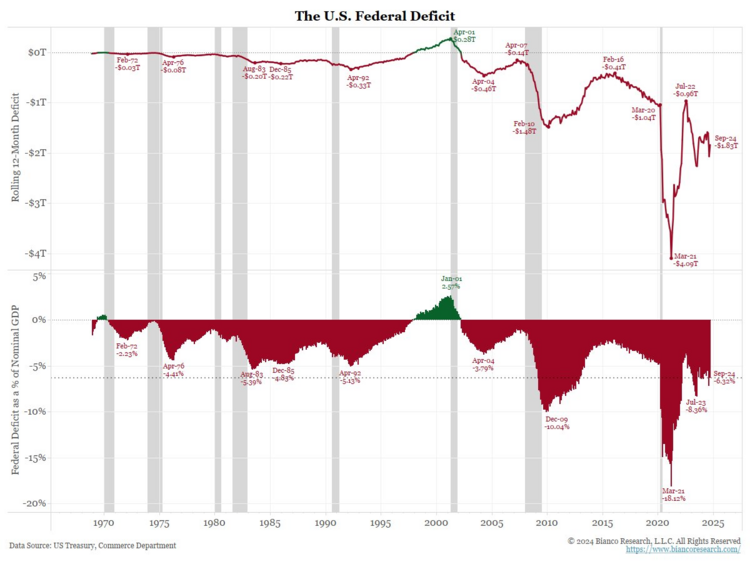

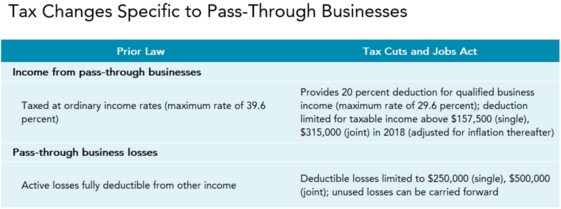

As it stands now, the government is running a $1.8 trillion budget deficit, which is over 6% of GDP. 5

We’ve been running deficits for a long time, and as a percentage of GDP, we are at the higher end but not necessarily the highest. Regarding government spending, taxes cover about 73% of total spending. Again, not the worst levels but certainly high. 5

Here’s the sequence of events that I see as fiscal hurdles:

- Approval of the federal budget during the lame-duck session in Congress.

- The debt ceiling needing to be lifted early next year

- Assuming a divided government where no one party controls both Congress and the presidency, debating and amending the TCJA depending on who becomes president.

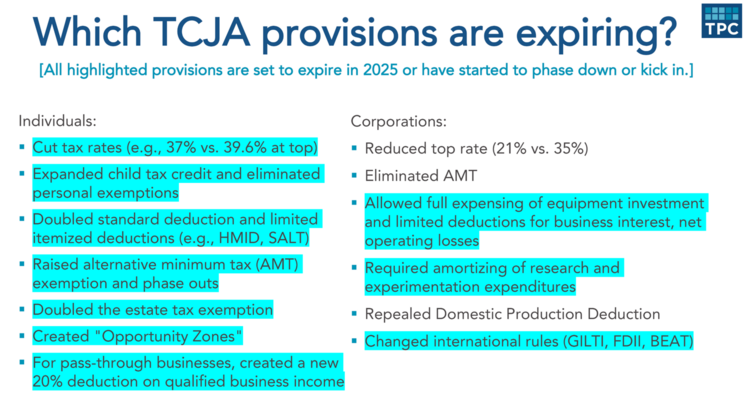

The TCJA will take up much of the congressional agenda in 2025 as it will be the cornerstone of any fiscal policy. 6

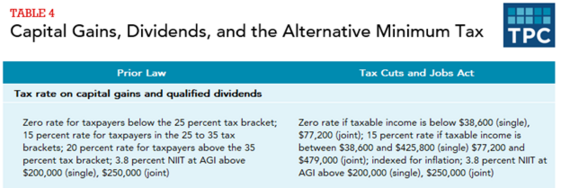

Trump plans to extend the full provisions and calls for future reductions in corporate taxes, while Harris suggests she would allow the provisions to expire and provide tax cuts to those making under $400,000. There might also be some reversion to the old taxes on capital gains. 7

Taxes on pass-through businesses (partnerships and LLCs) will also increase if the TCJA ends. 6

Deficits and debt matter. We are now paying about $1 trillion a year on servicing the national debt. 8

Passing anything in a divided government will be challenging, even with a Republican Senate and presidency. Many senators are skeptical, if not downright hostile, to expanding government deficit spending. The margins in the House and Senate will be razor-thin, which is why I think it will take most of 2025 to pass a revised TCJA bill.

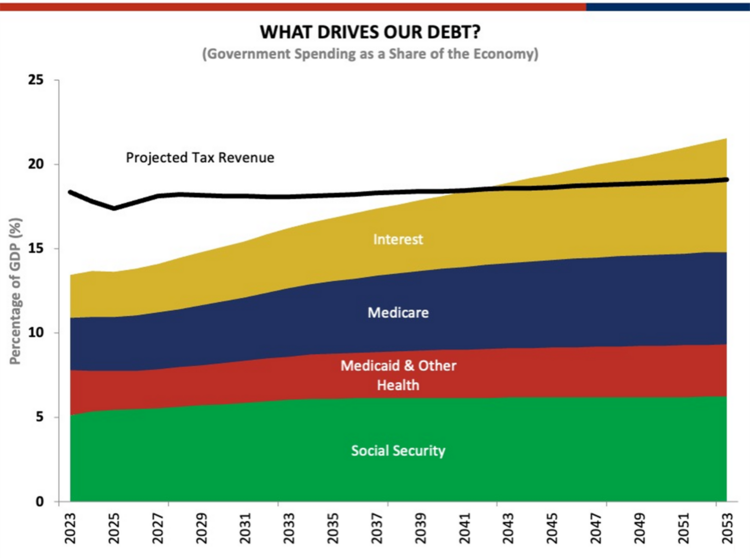

Furthermore, I don’t see massive tariffs from Trump becoming reality. If Americans want lower taxes, we need our foreign trade partners to buy our debt. 9

It’s hard to ask to pay lower interest rates on our debt on the one hand while simultaneously taxing our partners’ exports on the other.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://www.crfb.org/papers/fiscal-impact-harris-and-trump-campaign-plans

2. https://taxfoundation.org/blog/largest-tax-increase-harris-trump/

3. https://taxfoundation.org/research/all/federal/kamala-harris-tax-plan-2024/

4. https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/

5. https://x.com/biancoresearch/status/1847735561249051135

7. https://taxpolicycenter.org/briefing-book/how-did-tax-cuts-and-jobs-act-change-personal-taxes

8. https://www.americanactionforum.org/chartbook/budget-chart-book-fy-2023/

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.