Cash on the Sidelines

With the U.S. stock market reaching fresh highs in the last week[i], attention is turning to the large trove of cash sitting on the sidelines in money market and traditional savings accounts. As of Friday, money market assets topped $3.5 trillion, the highest level since August 2009, and net inflows are approaching $1 trillion over the last three years. [ii]

Some say the growing cash war chest reflects unease regarding the slowing domestic economy and flare-ups from the trade war with China. Others see an investment landscape with room to run, as investors have plenty of money to buy when lower stock prices prevail.

While headline risk regarding the trade war will persist until a resolution is reached, there are a few interesting recent datapoints showing investors may be looking to put money back to work in equities. According to Deutsche Bank, equity ETF and mutual funds saw their biggest inflows year-to-date in September with investors moving strongly into traditionally “risk-on” asset classes like oil, emerging markets, and high yield bonds. One month’s worth of data is too small a sample size to make a definitive call on whether sentiment is in fact changing, but our experience has been that it pays to stay ahead of the curve.

We’ve used the illustration below in the past, but it remains relevant: staying overly defensive and attempting to time the market is simply too difficult to execute with any reliability. As you can see, missing just a few market moves over 30 years can have a dramatic effect on your equity returns. [iii]

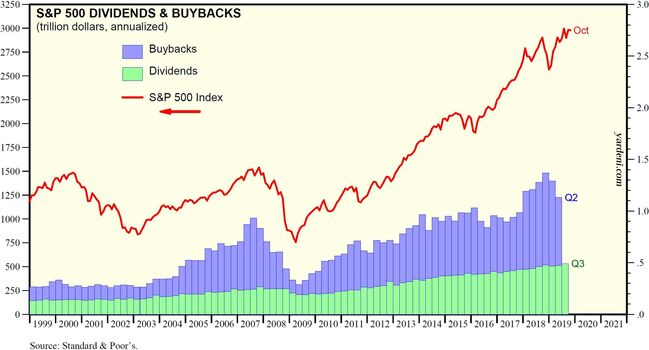

It is also important to note that the health of the stock market in August 2009 and today are vastly different. Last time cash on the sidelines was this high, the global economy was in shambles and investors were reeling from historic volatility in equities. Naturally, capital preservation became key and money flowed to the safest asset classes. Today, with record low unemployment and sustainable GDP growth of 2% the economy remains in solid shape, but is slowing in a couple of areas such as industrial production and housing. Likewise, companies have been buying back stock and paying out dividends at a record pace for almost two years, indicating confidence in their underlying business and earnings power. [iv]

As we’ve mentioned here before, a return to earnings growth heading into 2020 and a resolution to the ongoing trade war with China are the two biggest factors overhanging the market right now. Both could turn on a dime and we don’t want to be watching from the bleachers when that happens.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://www.ici.org/research/stats/mmf/mm_11_07_19

iii. https://www.zacksim.com/perils-moving-investments-cash/

iv. https://www.yardeni.com/pub/buybackdiv.pdf