Check Up

As we near the end of Q1 and what started off as the worst start to a year in U.S. stock market history, perhaps it's time to look at what actually drives most corporate earnings: Consumption.

In one form or another, the U.S. consumer drives corporate sales which should lead to corporate profits. There’s no denying U.S. corporate profits have been under pressure in 2015. In fact, in the latest update for U.S. GDP, "corporate profits fell 7.8% (not annualized) in the fourth quarter after decreasing 1.6% in the third quarter," according to Moody's analytics. This was the largest drop in profits since early 2011. Further, they fell 3.2% for all of 2015 which is the first time since the Great Recession. [i][ii]

However, looking backward is really no way to invest. So let's take a look at how the U.S. consumer could look in the coming quarter.

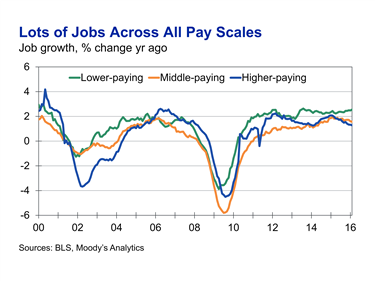

First, job growth is up. Not only are jobs up, but employment is up in all segments of income.

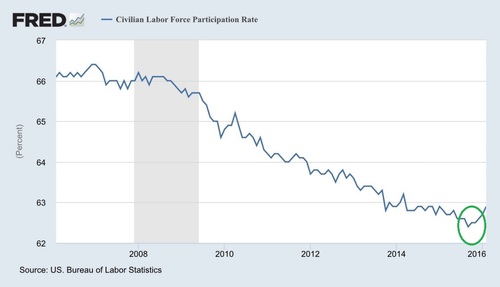

Second, we are seeing more workers re-enter the labor force, in spite of an aging working population. This is a significant uptick rarely seen since the Great Recession. [iii]

The recent uptick suggests that the improving labor market is encouraging Americans to come off the sidelines. That supports some economists’ contention that there is a large pool of potential workers who aren’t formally part of the labor force right now but who would be willing to work under the right circumstances. [iv]

The consumer has plenty of dry powder in the form of savings and credit availability.

The U.S. savings rate is still higher than it had been before the financial crisis. While it does suggest some reluctance by the consumer, it certainly can be a powerful force once they regain some confidence.

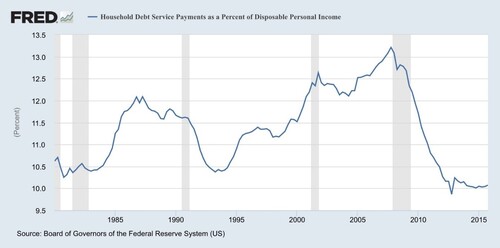

Most certainly consumers have plenty of credit capacity when looking at their debt payments compared to their disposable income. [v]

We have most definitely seen a resurgence in the consumer’s desire to borrow on credit cards which also added fuel to their consumption habits.

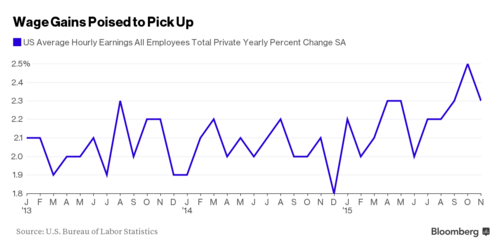

Let's not forget wages. Wages have been on the rise and as the labor market continues to tighten we can expect this trend to continue. [vi]

Think of consumption driven by a few simple inputs: Wages, spending from savings, borrowing from credit cards and income from investments (like real estate and dividend stocks). All of these inputs require the natural "animal spirits" of the consumer showing little fear and unleashing their natural power to drive more consumption.

With a recovery in the stock market, perhaps fear will abate and we can see some of this dry powder unleashed on the economy.

My check up on the consumer suggests lots of good health but a little unwillingness to spend down their current good fortune.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.marketwatch.com/story/4th-quarter-gdp-raised-to-14-but-corporate-profits-sink-2016-03-25

[ii] http://www.tradingeconomics.com/united-states/corporate-profits

[iii] https://www.moodys.com/

[iv] https://research.stlouisfed.org/fred2/series/PSAVERT

[v] https://research.stlouisfed.org/fred2/series/PSAVERT

[vi] http://www.bloomberg.com/news/articles/2015-12-21/u-s-workers-may-finally-catch-a-break-as-wages-look-set-to-rise