Checking on China

With progress being made on Phase 1 of Trump’s trade war with China is there a chance they could be at a cyclical low?

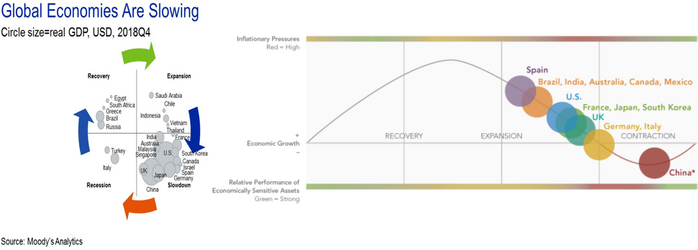

Both Fidelity and Moody’s believe China has entered, or is about to enter, a recession. [i] [ii]

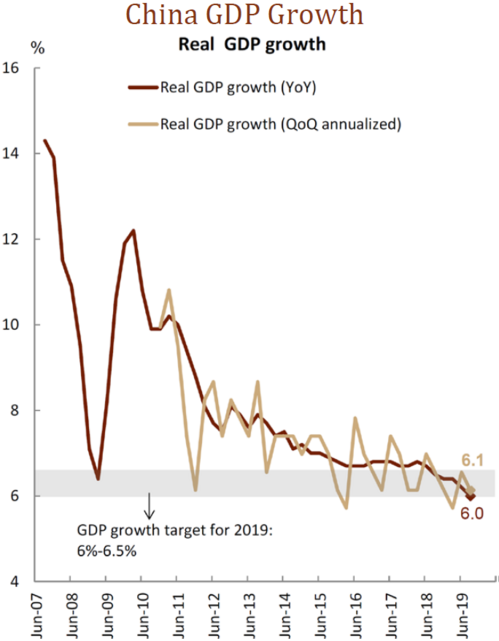

While recessions are traditionally defined as two consecutive quarters of negative GDP growth, that apparently does not apply to China as pundits are suggesting China is in recession territory. They still boast the fastest GDP growth in the world. [iii]

The Chinese economy is still growing around 6%, but you’d think it was in a depression the way the media makes their economy look.

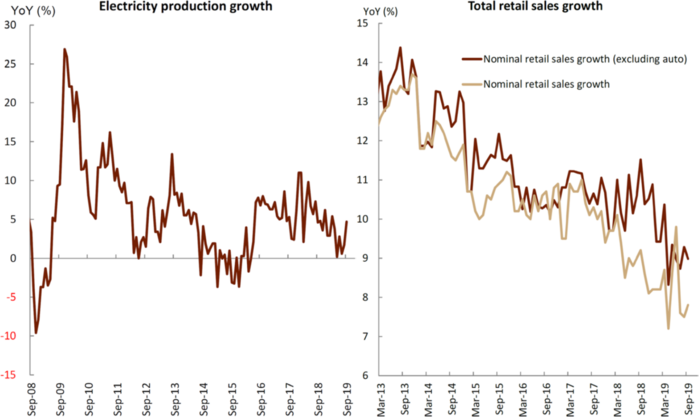

Perhaps China growth is bottoming. When you look at indicators like electricity and retail sales (ex-autos) you can see a bottom forming. [iii]

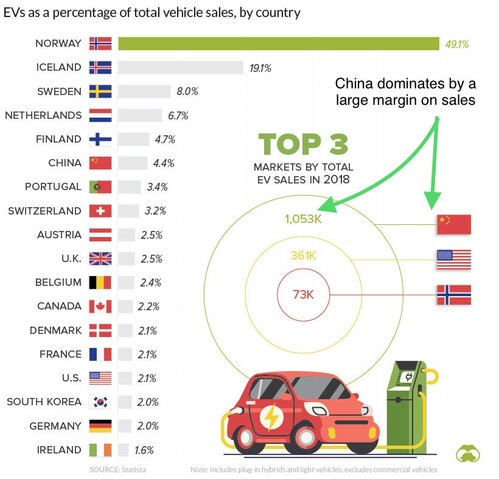

Why ex-autos? China recently removed their subsidies for electric vehicles (EV) and that’s a big deal as they are the largest maker of electric vehicles in the world. [iv]

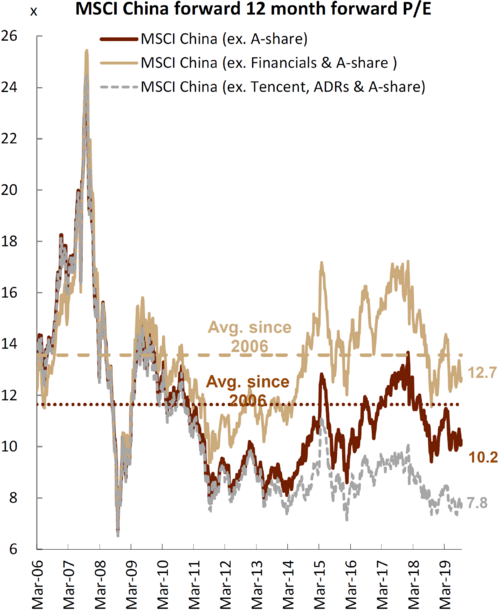

Further, valuations on their stocks are near historic lows and that can make for outstanding stock picking. [iii]

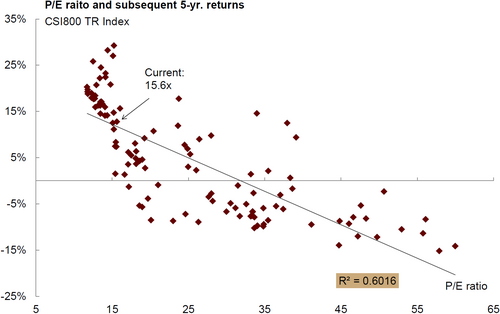

When you consider historic price-to-earnings and subsequent returns, you can see some reasons for optimism. [iii]

Take a look at our full China Review Deck here.

While I highlight some cyclical themes, our macro themes still exist:

- China’s dominance as the leading multinational player

- Best spot to find growth

- Transitioning to consumption from planned investment

To see our full Review and Look Ahead on China, click here.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.economy.com/dismal/analysis/todays-economy

ii. https://institutional.fidelity.com/app/item/RD_13569_40890/business-cycle-update.html

iii. https://phillipsandco.com/files/5715/7229/4717/CICC_China_Chartbook_4Q19.pdf

iv. https://www.statista.com/chartoftheday/electric%20vehicles%20electric%20cars/