China will Need to be China (mostly)

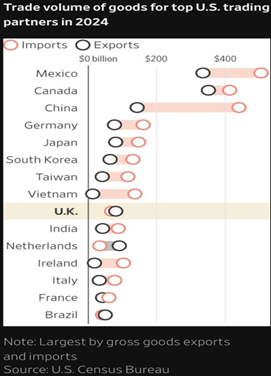

We finally had our first tariff off-ramp. Last week, the Trump administration announced a trade deal with the United Kingdom. It reflected deep economic alignment, strategic trust, and a shared framework of market capitalism. It was also because the trade difference between the two countries is so minuscule it could hardly matter. 1

Many have asked why China—far larger and more economically intertwined with the U.S.—can’t strike a similar deal. The answer lies in the fundamental differences in China’s industrial policy, the strategic imperative to support manufacturing employment, and the ways China navigates global tariffs, including transshipment strategies.

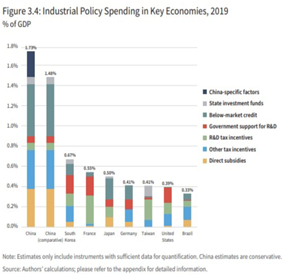

At the heart of China’s challenge is its state-led industrial policy. The Chinese Communist Party (CCP) directs capital, controls key industries through state-owned enterprises (SOEs), and uses subsidies to dominate sectors deemed strategic—everything from semiconductors to electric vehicles. Industrial policy is well in excess of 2% of their GDP and perhaps as much as 4x what the United States spends. 2

Any deal between the U.S. and China would require China to open these protected markets and unwind many of its domestic subsidies—an unlikely scenario given the CCP’s commitment to economic control.

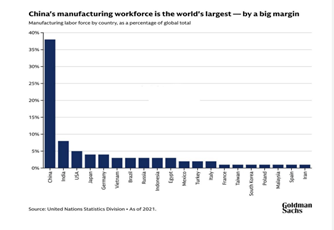

Unlike the UK or other post-industrial economies, China has hundreds of millions of people who rely directly or indirectly on manufacturing. Many of these jobs exist in lower-tier cities where alternative employment opportunities are scarce. Over 35% of their workforce is in manufacturing. 3

The CCP views full employment—especially in industrial zones—as critical to social stability and regime legitimacy. Slowing exports or reducing output due to tariff-related slowdowns could create mass unemployment, leading to unrest. Conversely, in command economies, the government continues to prop up factories with subsidies, cheap credit, and favorable policies, even when doing so violates global trade norms.

This priority makes it hard for China to agree to trade terms that would reduce its export competitiveness or force it to shut down inefficient industries.

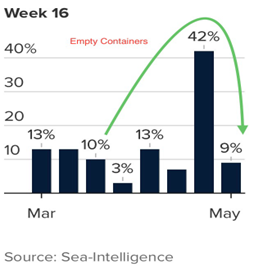

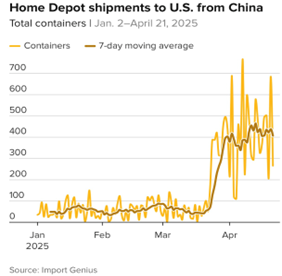

While exports have slowed coming directly from China, Asia in general has rebounded when measured by empty containers.4 Take for example Home Depot. While container delivery is volatile, it’s still in a healthy average zone. 5

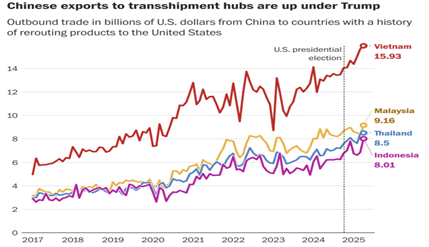

Rather than reforming its trade practices or reducing its export dependency, China has increasingly turned to transshipment—the practice of routing goods through third countries to mask their origin and circumvent tariffs.6

This is particularly prevalent in Southeast Asia. Chinese goods are sent to countries like Vietnam, Malaysia, or Thailand, where they undergo minimal processing or simply receive new paperwork before being re-exported to the U.S., making it very difficult for U.S. Customs to intervene.

Just as the UK trade deal contained a 10% tariff, it’s more likely than not that the 10% threshold will also prevail in China. According to the Peterson Institute, there is a diminishing return on revenue as you escalate past the 10% level due to more drag on U.S. companies and the consumer. Any trade deal with China will likely contain a minimum 10% tariff.7

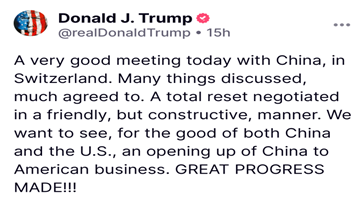

While there is tremendous hope following this morning's announcement of the 90-day pause in the China-U.S. trade war, unless we let China be China, a final deal will be hard to cut with them.8

If a U.S. trade deal allows China to protect its manufacturing jobs, we can find a path for success. China needs to be China.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1.) For context… | William Yii, CMT

2.) It's out! Check out our estimates on industrial policy spending in 8… | Ilaria Mazzocco

3.) Rewiring global trade: Tariffs rewrite the map

4.) Sea-Intelligence - Press Room

5.) https://www.zhihu.com/question/1898492637964645096/answer/1899014982710042744

6.) https://x.com/himalaya777/status/1920900545742606490

7.) Trump's tariffs could bring new revenue but would also reduce other tax revenue | PIIE

8.) https://x.com/Pascal242127657/status/1921343967167148481

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.