China’s Second Bounce

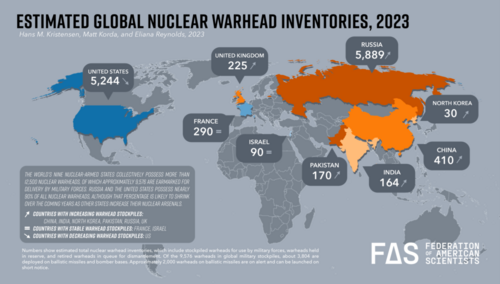

The world continues to provide a multi-crisis economic backdrop, making equity investing challenging. The biggest news has been the instability in Russia, the largest nuclear power in the world. 1

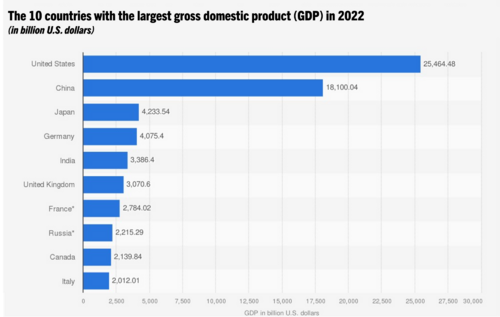

Assuming cooler heads prevail as domestic instability in Russia unfolds, the real focus should be on the second largest economy in the world, China. 2

Right now, China is in the midst of shaking off the aftereffects of a prolonged Covid lockdown. The re-opening trade earlier in the year has fizzled and China’s domestic equity market is reflecting some macroeconomic challenges. 3

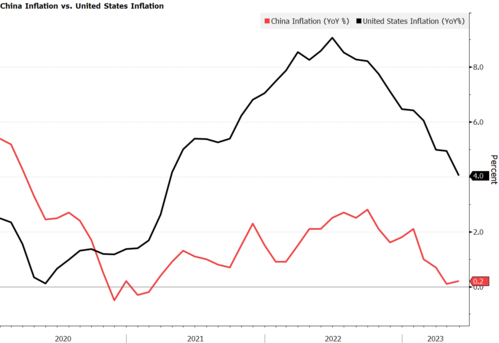

China never delivered direct-to-consumer stimulus like we did during the Covid outbreak. They focused on stimulating small and medium-sized business and providing foodstuffs to consumers. As a result, China is not facing the same inflationary challenges as we are. 3

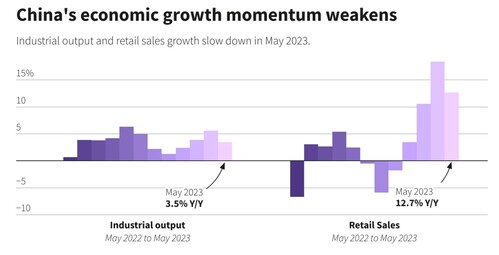

Unfortunately, that lack of consumer stimulus is creating a soft pocket in their economy. Both industrial output and retail sales pulled back in May. While year-over-year growth is strong, China is bouncing off a low base from the 2022 lockdown. 4

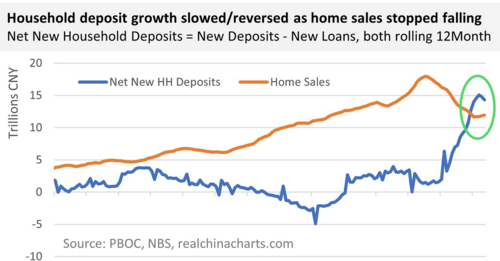

Chinese citizens are voracious savers, perhaps as a reflection of the long-standing minimal retirement and healthcare system. In any case, the Chinese consumer goosed up their savings when they were not purchasing homes. Only recently has that trend reversed. 5

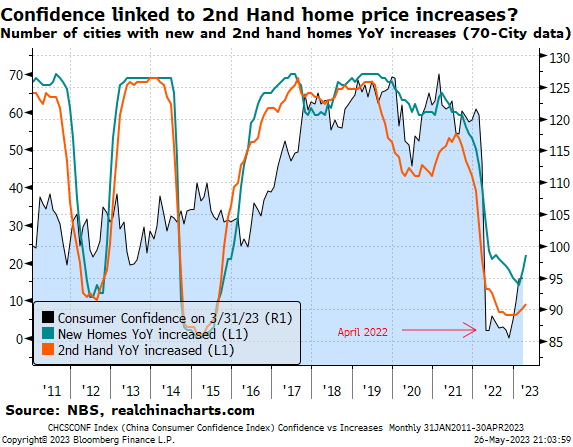

Consumer confidence also bounced off the lows set during the 2022 Covid lockdowns. Interestingly, the Chinese consumer’s confidence is highly correlated to their price of second-hand homes (used homes). 5

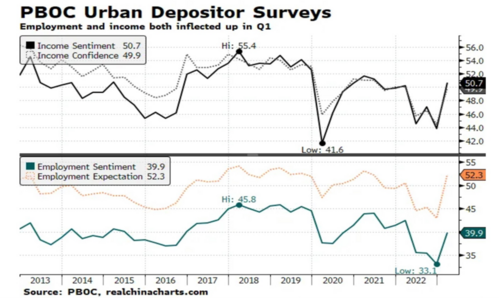

Further sentiment improvements can be found in both income and employment expectations going forward. 5

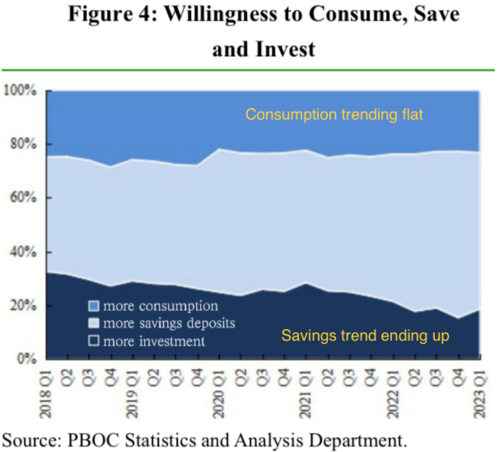

Expectations were for the consumer to shift from saving and investing to consumption, but that trend has not yet materialized.6

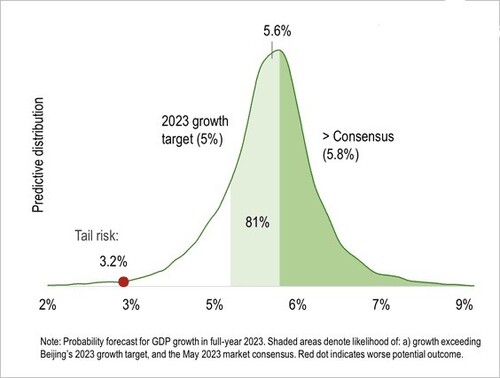

Overlay this with continued bullish expectations for GDP growth by the government at 5% growth and economists at over 5.5%. In fact, current GDP forecasts suggest an 81% chance China grows their economy at over the 5% target. 5

It’s clear to the CCP that more stimulus is going to be needed. Just look at the headlines: 7 8

Current stimulus has been focused on the housing and property sector in addition to tax breaks for small businesses.

Recent Stimulus Actions (with more to come)

- Cut the 1-year Loan Prime Rate (LPR), 5-year LPR, and the Medium-Term Policy Rate by 10 bps

- Announced a $72.3 billion package of tax breaks over four years for electric vehicles

- Announced that small businesses with monthly sales of less than 100,000 yuan ($14,000) would be exempt from value-added tax for 2023

We can expect more direct-to-consumer stimulus and a strong second bounce in Chinese equities.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fas.org/initiative/status-world-nuclear-forces/

- https://www.statista.com/statistics/268173/countries-with-the-largest-gross-domestic-product-gdp/

- Bloomberg

- https://www.reuters.com/world/china/chinas-economy-slows-further-may-weak-demand-drags-2023-06-15/

- https://www.realchinacharts.com/

- https://www.stats.gov.cn/english/

- https://www.wsj.com/articles/china-cuts-rates-to-prop-up-flagging-recovery-6fe3ec72

- https://www.scmp.com/economy/china-economy/article/3224445/chinas-state-council-fans-stimulus-hopes-economic-plan-faltering-growth