Consumer Caution & Policy Uncertainty

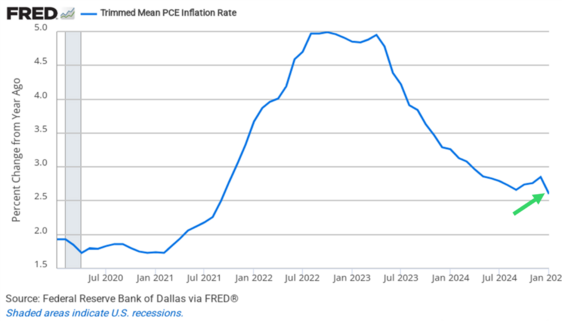

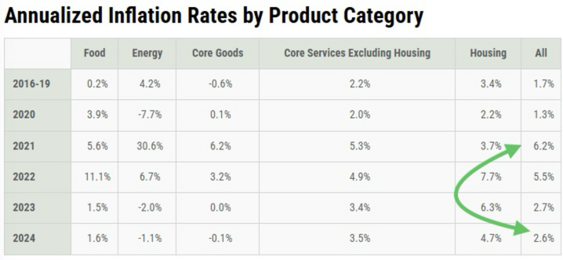

As discussed in last week’s post, the Friday charts on inflation told us a lot about the direction of interest rates and the economy. Fortunately, according to the Federal Reserve’s favored indicator (PCE), inflation is back to trending favorably. 1

Across almost all categories, inflation on a year-over-year basis is going in the right direction again and that provided the relief equity investors needed. 2

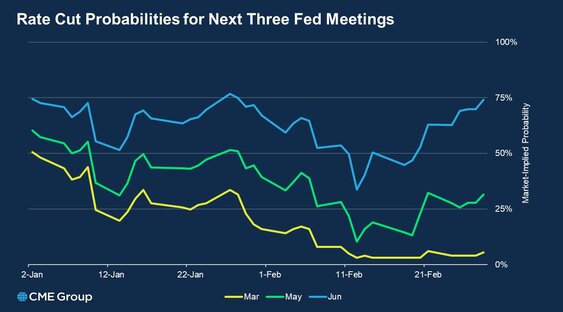

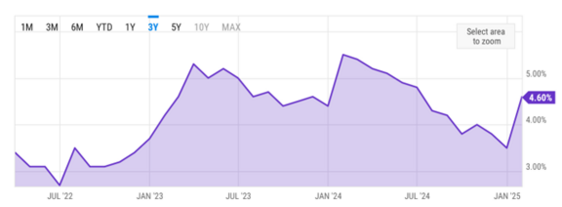

With inflation trending in the right direction, the Federal Reserve has some room to cut interest rates again. Remember, the cost of capital (interest rates) impacts the value of your investments in almost all circumstances. 3

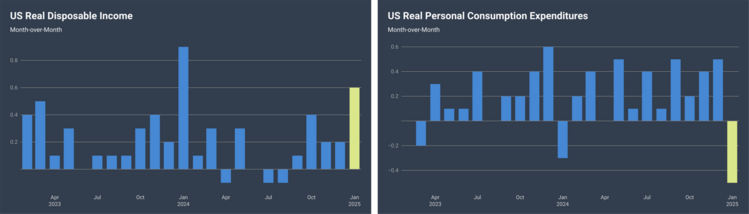

This is especially important when you consider some other underlying weaknesses in the U.S. economy. While disposable personal income rose the most since January 2024, real personal spending dropped the most since 2021. 4 5

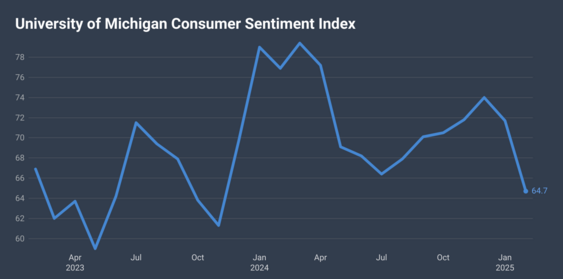

That coincided with a large drop in consumer sentiment. 6

And that led to a large jump in the savings rate. 7

This is great news for future consumption as long as the macro shifts in U.S. policy don’t rattle the U.S. consumer’s animal spirits to spend.

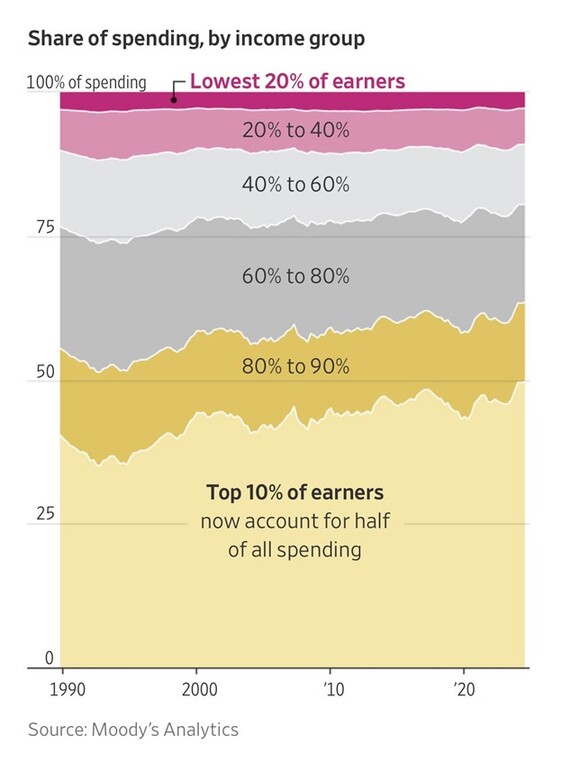

Shockingly, the largest income earners – those making over $170k per year – drive over 50% of all consumption in America. That is a large shift in who is driving our economy, as 70% of our GDP is a result of consumer spending. 8

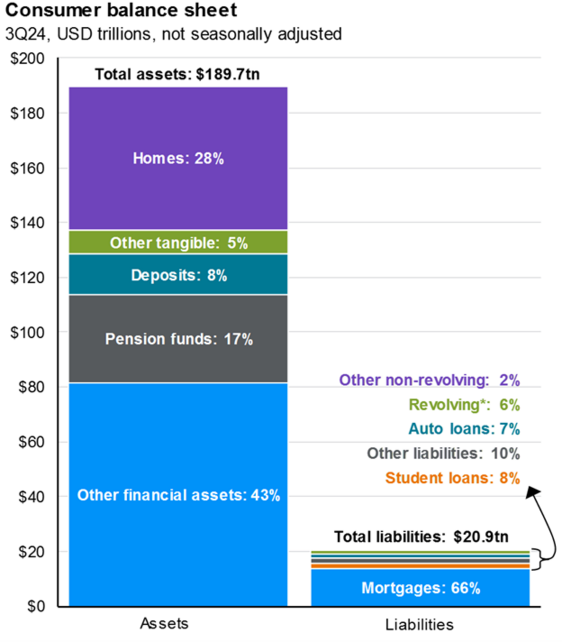

The upper 10%’s willingness to consume is largely driven by their feelings about their wealth and well-being. When you consider what makes up their asset base (homes and equity investments), the current higher prices for those assets has been remarkable. 9

While we’ve experienced a drawdown in equity assets over the last several weeks, the overall trend is still favorable for the U.S. economy and consumer. However, the consumer will dictate how much policy uncertainty they will tolerate, and they will express their views with their checkbooks and credit cards.

The Fed might need to be in the business of offsetting any adverse policies that impact the consumer. 10

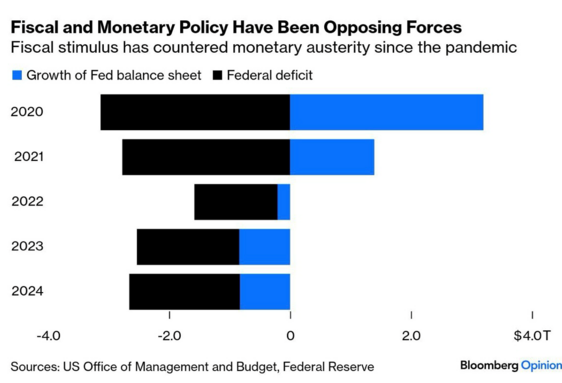

While fiscal stimulus has offset monetary austerity in the past, those roles could be reversed depending on how much the consumer reacts to the current policy uncertainties.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fred.stlouisfed.org/graph/?g=1E8kt

- https://x.com/stlouisfed/status/1894598363326124516

- https://x.com/Interest_Rates/status/1895496804671586748

- https://fred.stlouisfed.org/graph/?g=1E8p8

- https://fred.stlouisfed.org/graph/?g=1E8pm

- http://www.sca.isr.umich.edu/

- https://fred.stlouisfed.org/graph/?g=1E8q7

- https://www.wsj.com/economy/consumers/us-economy-strength-rich-spending-2c34a571

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=economy/gtm-cnsmrfinances

- https://www.bloomberg.com/opinion/articles/2025-02-28/trump-might-force-the-fed-to-lower-rates-with-fiscal-policy

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.