Consumer Resilience – The One Thing

While the governing class debates the merits of opening the economy, it is clear there has been one “return to normal” paradigm: The political class is clearly posturing to again lay blame and claim some political victory.

That’s just a sideshow for investors and, frankly, upcoming earnings reports might also be a sideshow. In a suspension-of-revenue economy, we already know earnings are going to be horrific.

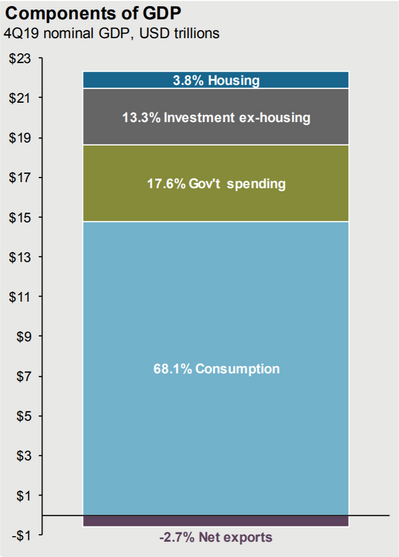

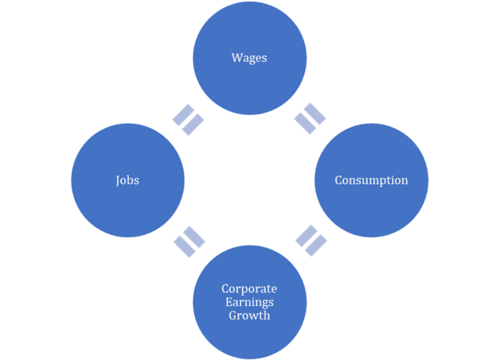

The one thing we must observe is a return to normal for the consumer. Consumption is the one thing that matters as nearly 70% of the economy is consumption based. [i]

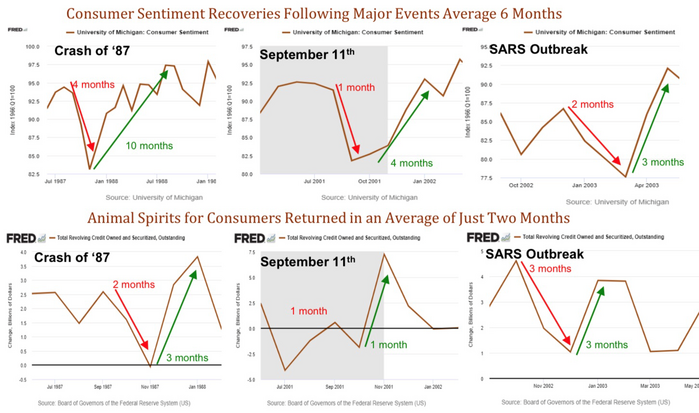

For investors, the question of if the consumer will return needs examination. In our Q2 2020 Look Ahead (link), we examined a few non-financial crisis episodes to study consumer behavior.

Both consumer sentiment and revolving credit dropped rapidly (1-4 months) post-1987 stock market crash, September 11th, and the SARS outbreak. As a professional investor quite new in 1987, it felt like an eternity for the consumer to recover, albeit the actual time was only 10 months, Post-9/11 and SARS the recovery time was within just a few months. The U.S. consumer is tough.

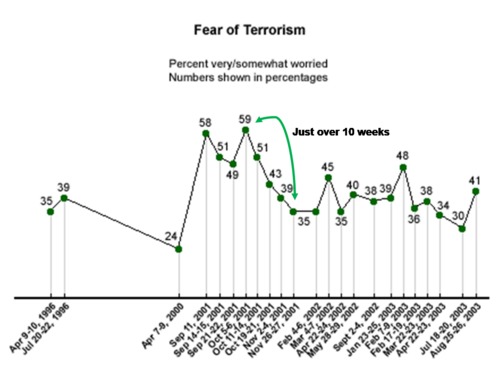

In a Gallup survey done post-9/11, it took only about 10 weeks for the respondent to return to 1996 levels of fear. Ten weeks is an incredibly short period of time for such a life-altering, traumatic event. [ii]

Even during the current health crisis, the U.S. consumer is showing great buoyancy. The news of various cruise ships being infected with COVID-19 cases led some to declare the death of the Cruise Line industry. To the contrary, cruisers are back with a vengeance and already rebooking their trips for next year. In fact, depending on the source, cruise bookings are up between 9% and 40% for 2021. Sure, many of these are rebooking from canceled trips; however, the cruiser had the option of a cash refund or a rebook with some incentive and they are overwhelmingly electing to rebook. [iii]

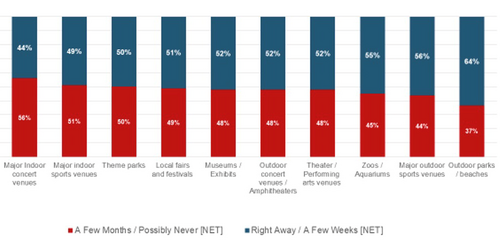

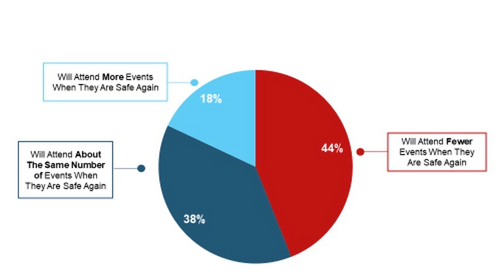

When it comes to attending mass gatherings, it’s almost a coin toss as to when the consumer will return. According to a recent survey by Performance Research, it is a matter of weeks or months before they return to their favorite leisure activity. [iv]

Outdoor activities will snap back quickly but, going back to crowded theme parks right away vs. waiting a few months is about 50-50. Considering our current state of crisis, these numbers are hopeful. Consumer buoyancy is nothing to take for granted.

In fact, 56% of those surveyed said they would attend the same or more events when they are deemed safe again by the CDC. [iv]

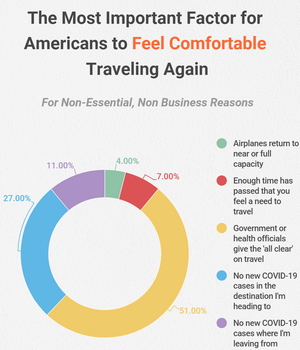

When it comes to air travel, respondents to a wide-ranging survey concurred with the data above. They would return to air travel by and large once it’s deemed safe by government health officials (51%), with 27% saying they would travel with no new COVID-19 cases reported in the destination they are traveling to. [iv]

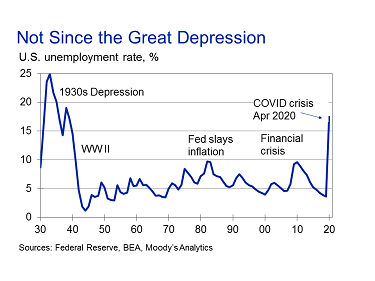

I don’t want to sound too Pollyannaish about the consumer recovery, as it might take some time. Expectations are for massive job losses probably not seen since the Great Depression. This may create significant headwinds to equity markets in the coming weeks. [v]

However, market participants are expecting this to be short lived and with any accuracy in the survey data above, the consumer will return to normal, driving more consumption. [vi]

Proof!

China, which is 50+ days ahead of us, is on a rapid return to normal. So much so that on the first day the luxury brand Hermes reopened in China, they did a record $2.7 million in sales out of one store. [vii]

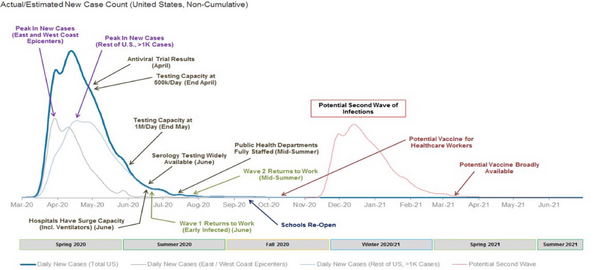

Morgan Stanley did a nice job trying to put a timeline together to allow some calibration. They are forecasting late-April for peak cases and mid-May for extensive testing capacity. Either way, once out of lockdown, my expectation is for the consumer to return to normal consumption patterns by September or October but, we must also be mindful of a potential second wave within the normal flu season. [viii]

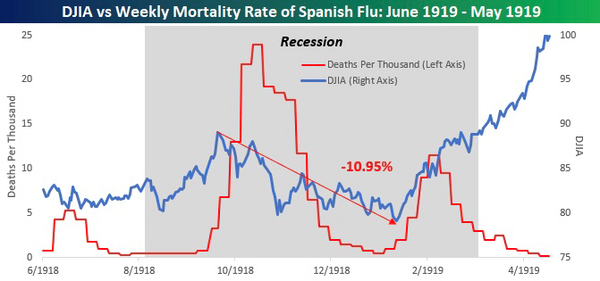

It’s hard to predict how markets will react to this return-to-normal phase. History suggests that it could be quite favorable. The Spanish Flu had three distinct waves and while equity markets fell about 11% during the peak death rate, they soon recovered to rally about 25% even through the third wave. [ix]

We’ve asked the U.S. consumer to do essentially nothing for the last six weeks. It’s my view the consumer will surprise to the upside when released from confinement and begin to consume again. Through the decades they have demonstrated just that behavior. It’s the one thing we are counting on.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_2Q20-Final.pdf

ii. https://news.gallup.com/poll/9208/sept-effects-though-largely-faded-persist.aspx

iii. https://www.businessinsider.com/cruise-ship-bookings-are-increasing-for-2021-despite-coronavirus-2020-4

iv. https://upgradedpoints.com/us-travel-plans-coronavirus-survey

v. https://www.economy.com/economicview/analysis/379198/This-Week-in-the-COVID-Crisis

vi. https://PHILLIPSANDCO.COM/files/2415/8584/3131/Look_Ahead_-_2020Q2_-_Final.pdf

vii. https://www.businessinsider.com/wealthy-chinese-shoppers-slurge-at-hermes-store-in-china-2020-4

viii. https://www.morganstanley.com/ideas/coronavirus-peak-recovery-timeline

ix. https://www.bespokepremium.com/interactive/posts/think-big-blog/how-markets-performed-during-the-spanish-flu