Consumer Strength

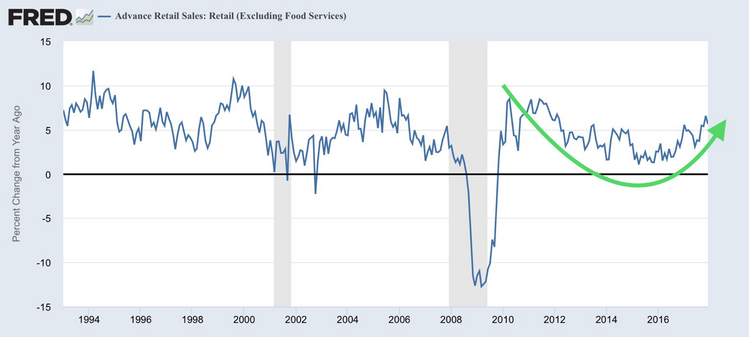

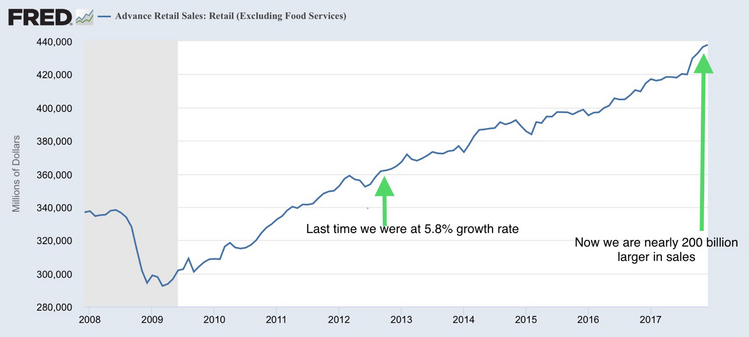

The U.S. consumer did not disappoint this past December. Retail sales grew 5.8 percent year-over-year. [i]

Perhaps retail sales growth can provide a higher growth trajectory for the U.S. economy. What is remarkable about the growth rate is not the 5.8 percent, but the fact that this growth rate is accomplished on a much larger base of retail sales. [i]

The breakdown of retail sales sheds some light on where consumers are spending their money. As you can see, the bulk of U.S. consumer spending is on vehicles, gas, and food and beverage. One thing worth noting is the large year-over-year increases in online retails sales and building materials. [ii]

We continue to believe that this boost in sales will be reflected in U.S. corporate earnings.

FactSet expects Q4 corporate earnings to grow 10.2 percent. [iii]

Thomson Reuters also expects strong corporate earnings growth in Q4 with EPS growth projected at 12.1 percent. [iv]

Once again, as we have reported in many of our previous market commentaries and Quarterly Look Ahead reports, the U.S. consumer appears to be strong and shows no signs of slowing down in the near term.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://fred.stlouisfed.org/series/RSXFS

ii. https://www.census.gov/retail/marts/www/marts_current.pdf

iii. https://insight.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_011218.pdf

iv. http://lipperalpha.financial.thomsonreuters.com/wp-content/uploads/2018/01/SP500_17Q4_DashBoard_180112.png