Consumer Whiplash

It’s a rare point in time when consumer sentiment diverges from consumption. Yet that is precisely the moment we are in.

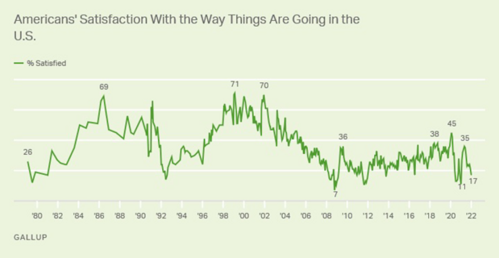

Overall sentiment by the U.S. public is very negative. According to Gallup a whopping 80% of Americans think our country is on the wrong track. This is the lowest reading since the pandemic or the Great Financial Crisis. 1

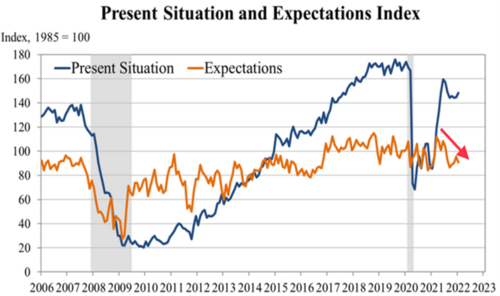

Consumer confidence in January, as reported by the Conference Board, shows deterioration in consumer expectations. While the present situation for the consumer is still strong, expectations for the future are looking weaker. 2

According to the Conference Board “Consumer optimism about the short-term business conditions outlook declined in January. Consumers were also less optimistic about the short-term labor market outlook. Consumers were slightly less positive about their short-term financial prospects.”

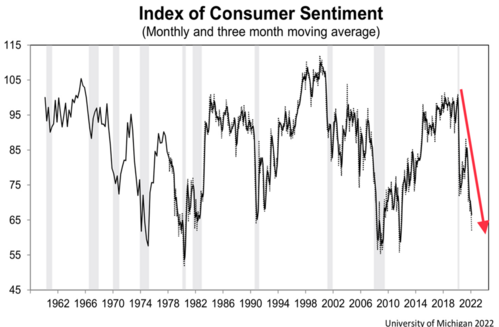

Additionally, the University of Michigan’s survey of consumer sentiment continues its downward trend with a dismal reading from their latest report.3

Their survey results suggest, “The recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government's economic policies (rising rates), and the least favorable long term economic outlook in a decade.” Not to mention the constant war drumbeat between Russia and Ukraine.

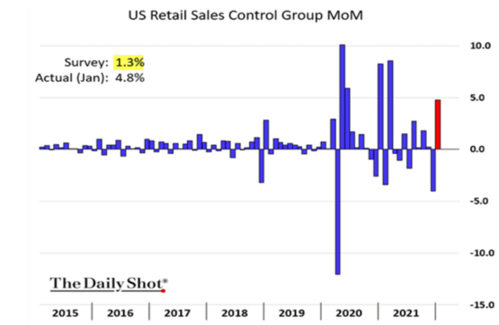

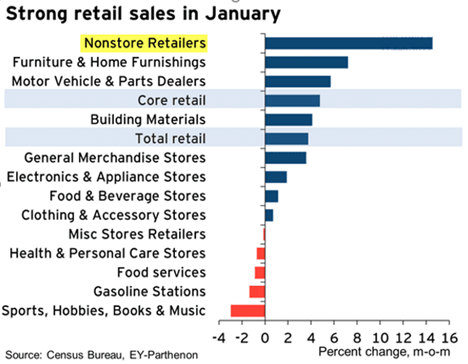

Yet, the U.S. consumer showed remarkable resilience based upon January’s retail sales data.4

Breaking down the component parts shows where the consumer spent. Online retail continues to thrive along with most other categories.

Even if you adjust for inflation, retail sales continue to push above the pre-COVID trend line.

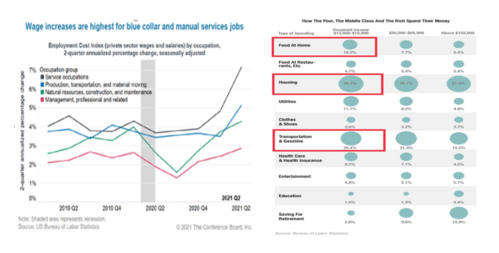

It’s hard for me to reconcile the disconnect between consumer sentiment and consumer spending. However, I believe despite all of the top line negatives the consumer focuses on; their paychecks are as strong as they have ever been. Yet they are spending more money on categories that have inflated the most: food, transportation, and housing. 5 6

Consumer whiplash can only last so long before they want solutions.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Sources:

- https://news.gallup.com/poll/1669/general-mood-country.aspx

- https://www.conference-board.org/topics/consumer-confidence

- http://www.sca.isr.umich.edu/files/featured-chart.pdf

- https://thedailyshot.com/

- https://www.npr.org/sections/money/2012/08/01/157664524/how-the-poor-the-middle-class-and-the-rich-spend-their-money

- https://www.conference-board.org/press/why-wages-are-growing-rapidly