Consumers and CEOs

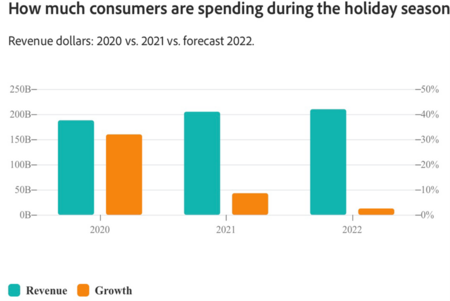

The ultimate consumer shopping days are now in the books and the outcomes are impressive. According to recent transaction data from Adobe, consumers have spent more this holiday season than 2020 or 2021.(1) While growth rates are modest, raw dollars being spent are remarkable, inflation or not.

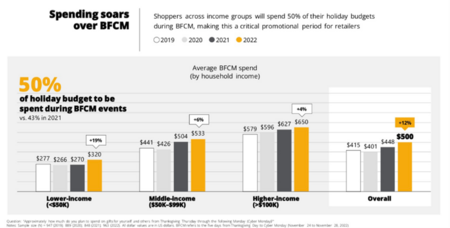

Expectations for the consumer to outspend this Black Friday/Cyber Monday period are promising across most income cohorts. Those in lower income brackets are expected to spend nearly 19% more than last year, based upon a recent consumer survey by Deloitte.(2)

The National Retail Federation confirms as much, suggesting retail sales are expected to surpass prior year periods and outperform pre-Covid numbers.(3)

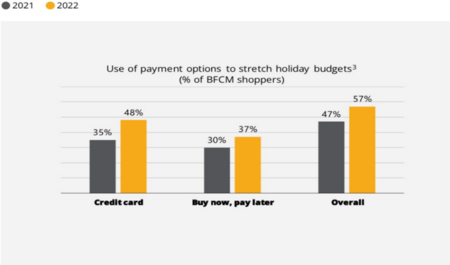

It won’t come as a surprise that over half of all consumers are relying on some form of credit to extend their purchasing power during this holiday season.(4)

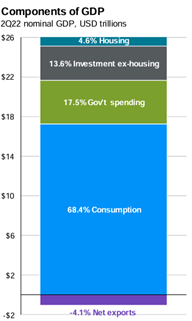

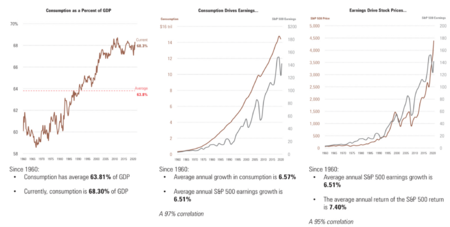

When you consider nearly 70% of our economy is based on consumption, it’s pretty clear we are not in any danger of a Q4 recession.(5)

Unfortunately, one group, company CEOs, are less optimistic.

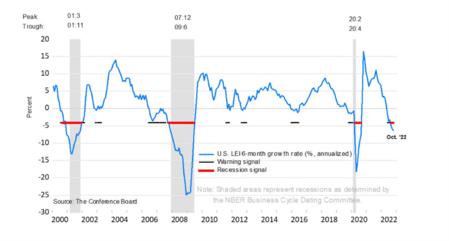

Leading economic indicators suggest something different especially when you survey corporate CEOs. Last week the Conference Board, a leading economic research organization, reported their summary data on economic indicators. Almost all of which suggest a high probability of an impending recession.(6)

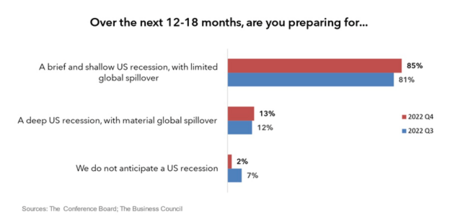

Their survey data of CEOs suggests just about the same thing; a recession is in the making. 85% of CEOs surveyed believe there is a mild recession coming in the next 12-18 months.(7)

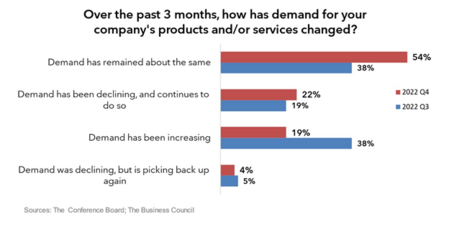

Oddly, this dour viewpoint is in spite of 54% saying demand has remained the same; with only 22% saying demand has been declining.(8)

Both can be true. The US consumer can continue to spend, and corporate sentiment can continue to deteriorate, but not in the long run. Over very long periods of time, consumption drives our economy, and that same consumption is highly correlated to corporate earnings, and ultimately, to stock performance. (9)

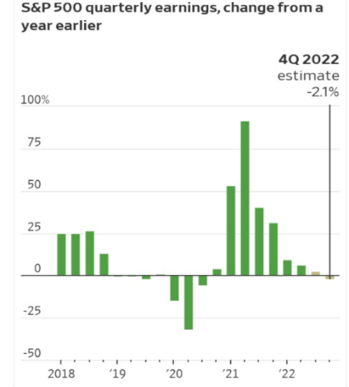

Earnings have been marked down in Q4, perhaps reflecting the negative sentiment from CEOs. That’s not surprising since the Fed has been on a consumption destruction cycle.(10)

However, the Consumer will have the last word on Q4 outcomes and it’s very possible earnings expectations are more gloomy than the reality. That might be a catalyst to lift equity prices in the coming weeks.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://business.adobe.com/resources/holiday-shopping-report

- https://www2.deloitte.com/content/dam/insights/articles/us175738_holiday-retail-travel/DI_2022-Black-friday-cyber-monday.pdf

- https://nrf.com/media-center/press-releases/record-1663-million-shoppers-expected-during-thanksgiving-weekend

- https://www2.deloitte.com/content/dam/insights/articles/us175738_holiday-retail-travel/DI_2022-Black-friday-cyber-monday.pdf

- https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/mi-guide-to-the-markets-us.pdf

- https://www.conference-board.org/topics/us-leading-indicators#:~:text=The%20CEI%20rose%20by%201.1,the%20previous%20six%2Dmonth%20period.

- https://www.conference-board.org/topics/CEO-Confidence/press/CEO-confidence-Q4-2022

- https://www.conference-board.org/topics/CEO-Confidence

- Bloomberg

- https://www.wsj.com/