Consumers Winning - GDP Growth Losing?

We are a couple of weeks away from the first look at how the U.S. economy performed during Q2 2017. Generally, looking in the rearview mirror is useless for investors because we all base our investment decisions on future, rather than past cash flows.

However, GDP growth (the broadest measure of U.S. economic health) generally provides indications of consumer strength, the pace of inflation, and the health of corporate profits.

Here is what we are expecting:

• U.S. economic growth will be muted in Q2; lifting only slightly from the anemic growth of 1.4% that we experienced in Q1. [i]

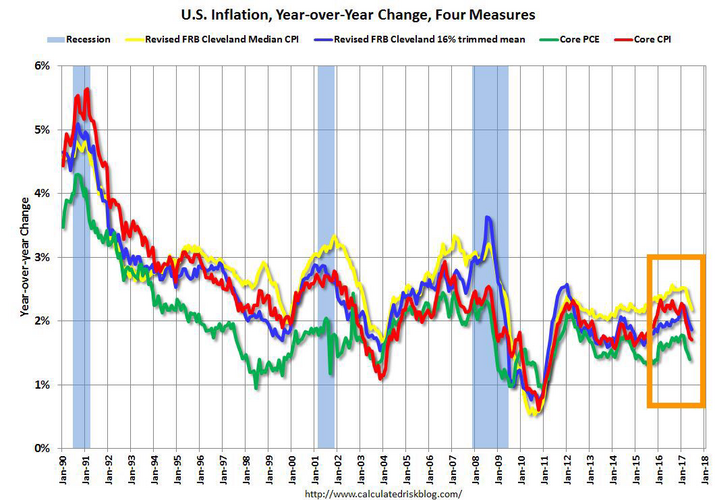

• Muted inflationary pressures may be well below the Federal Reserve target of 2%. [ii]

• Consumer purchases should continue growing, but at lower prices than in prior years.

Much of our assumptions are driven by several widely followed forecasts.

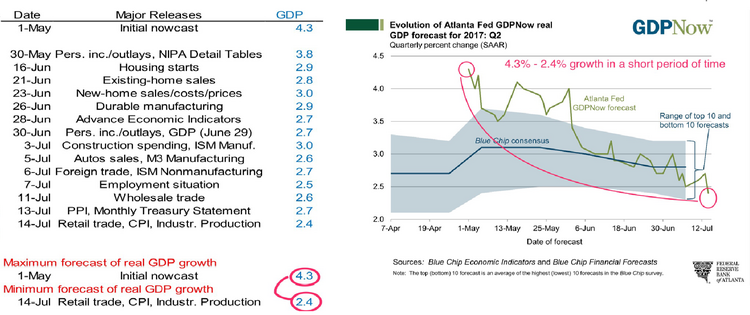

First, forecasts from the Federal Reserve Bank of Atlanta indicate a sharp deceleration in GDP growth for Q2. [iii]

Second, with its own forecast, the Federal Reserve Bank of New York also confirms a slowdown in GDP growth.

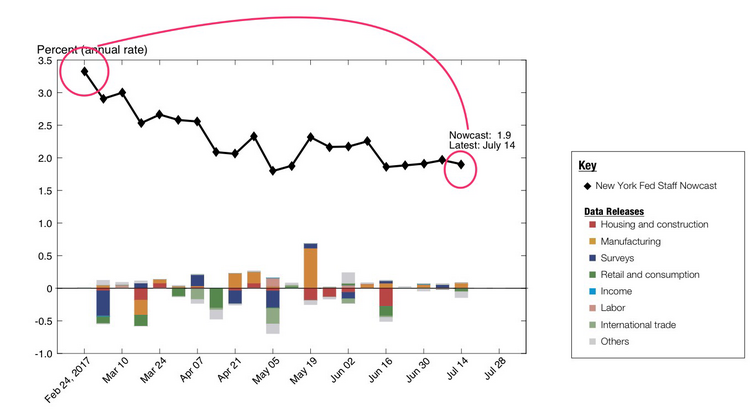

The annual GDP forecast from the Federal Reserve Bank of New York declined from 3.4% growth to 1.9% growth during Q2 2017. [iv] These downward revisions can be attributed largely to the slowing in retail sales. [v] Remember, approximately 70% of the U.S. GDP is driven by consumption.

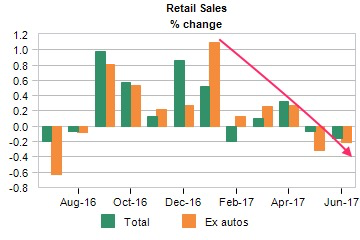

Note the declines in retail sales starting in January with April through June being the most pronounced. In fact, it’s this deceleration in growth that has been the catalyst for both Federal Reserve Banks to revise their GDP forecasts downward. Keep in mind; this is merely slower growth, not a real drop in consumption.

Is this cause for alarm? Not exactly. Under normal circumstances, a slowdown in retail sales would be a much larger issue. I’m not saying that it won’t turn into one, but as of now, it has not.

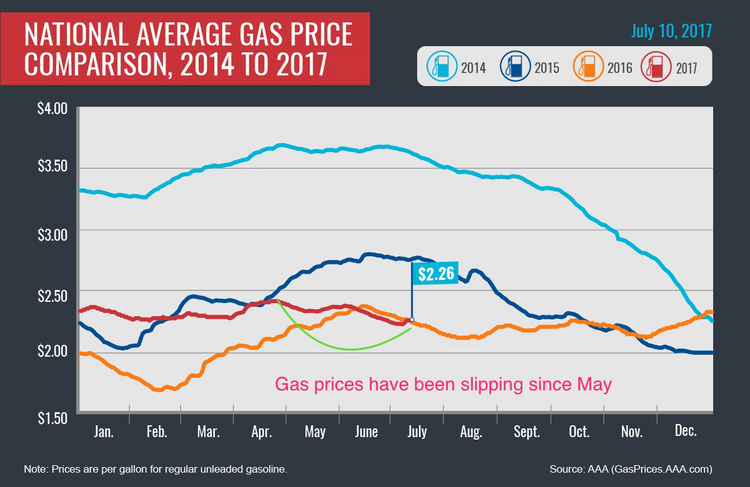

However, this current slowdown in retail sales growth is greatly driven by the drop in gas prices occurring since the beginning of Q2. [vi] Remember, retail sales are driven by our purchasing volume and the prices that we pay. Lower prices offset growth in the volume of our purchases, which is the case today. Consumers are purchasing more goods but at lower prices.

You can also see this trend in the inflation numbers above (something we have written about in recent market commentaries), which has been sloping downward these past several months. [vii]

Additionally, this trend in gasoline is being mirrored in other areas of retail sales as well. Cellular service, grocery, and sporting goods prices are all down. However, the largest drop in retail sales has come at the gas pump. [viii]

While, again, this is not yet any cause for alarm, we should anticipate a few areas in the economy, such as telecom, energy, grocery, and some sectors of general merchandise, showing pressure on earnings.

All in all, the consumer is still winning. If volume can grow, so can corporate earnings.

If you have questions or comments, please let us know. We always appreciate your feedback. You can contact us via Twitter and Facebook, or you can e-mail me directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

ii. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20170614.pdf

iii. https://mail.phillipsandco.com/files/6715/0030/6981/nowcast_2017_0714.pdf

iv. https://mail.phillipsandco.com/files/9315/0030/6973/RealGDPTrackingSlides.pdf

vi. http://gasprices.aaa.com/national-gasoline-price-drops-new-low-2017/

vii. http://www.calculatedriskblog.com/2017/07/key-measures-show-inflation-mostly.html