Count What Counts

Albert Einstein once quipped, “Not everything that can be counted counts, and not everything that counts can be counted.” 1

With the U.S. Presidency being contested and the Democratic Party in chaos following President Biden's withdrawal from the race, it’s easy to get baited into the news churn.

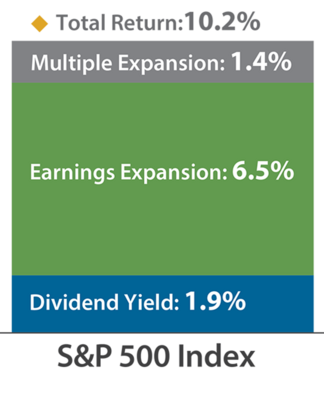

However, we are finally back into earnings reporting season and it’s always critical to remember that stock prices are largely driven by cash flow growth. Dividends and earnings growth make up 82% of what drives stock prices – multiple expansion or speculation, in the long run, doesn't amount to much. 2

The simple message of this post is that growth matters most. While countless factors influence investing, none are as critical as earnings growth and dividends. 3

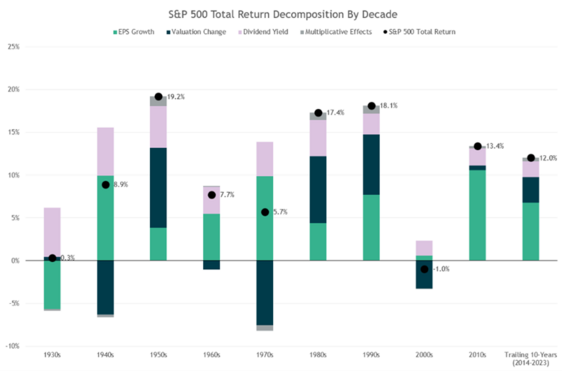

With some variance over the decades, it’s still pretty clear earnings growth and dividend yield drive returns. Yes, in the last decade valuation changes (P/E multiple expansion) have contributed a bit more than usual, but it’s still not the predominant driver of returns.

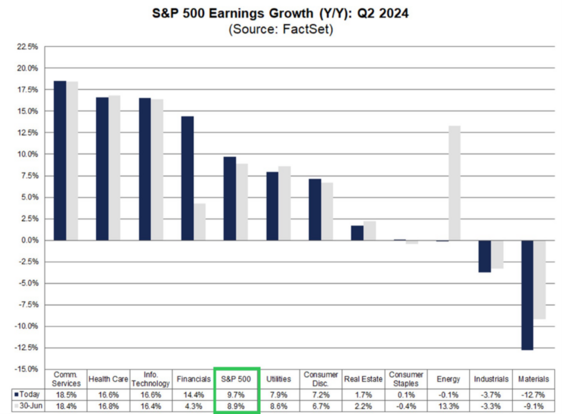

With that in mind, Q2 is shaping up to be a great reporting season for S&P 500 companies. As of June 30th, S&P 500 companies were expected to grow earnings at 8.9%. That’s solid. While it’s still early in the season, S&P 500 earnings growth is coming in at 9.7%. According to FactSet, “If 9.7% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q4 2021 (31.4%).” 4

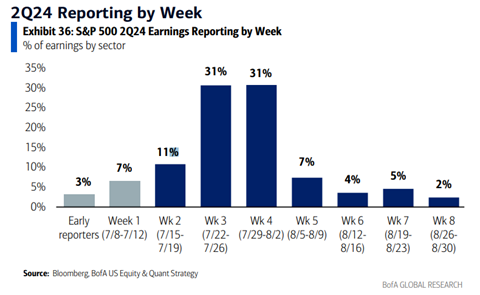

The biggest earnings weeks are upon us and many of those reports will likely dictate short-term market movements. 5

There are some notable companies reporting this week and next that could dictate the volatility we might experience in equity markets. 6

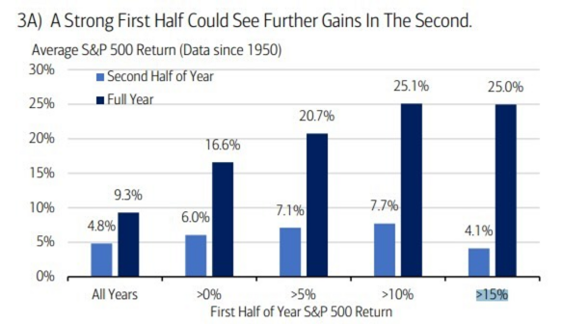

Historically, with a strong first half start of the year to equity performance, the second half is not all that bad. 7

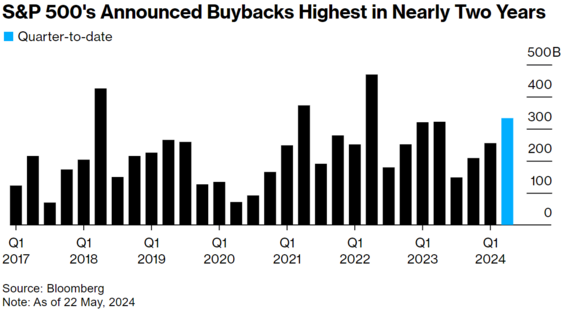

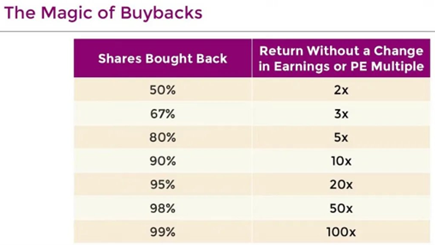

One more thing that counts that rarely gets counted is the amount of share buybacks. That can be especially true now as buybacks are near recent historic highs. 8

Even without earnings growth or dividends, companies can achieve great equity returns by reducing their number of shares outstanding. 9

The real magic is knowing what really counts and being sure to count it.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://quoteinvestigator.com/2010/05/26/everything-counts-einstein/

- https://www.mhinvest.com/blog/depend-on-dividends-and-earnings-growth-not-multiple-expansion

- https://lgam.com/research-update-drivers-of-equity-returns-likely-to-shift-going-forward/

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_071924.pdf

- https://x.com/MikeZaccardi/status/1812792015567958462

- https://x.com/eWhispers/status/1814302026186084545

- https://www.threads.net/@sean.brodrick/post/C9r8NghgTgP

- https://www.bloomberg.com/news/articles/2024-05-30/layoffs-pricing-power-driving-s-p-500-profits-to-highest-in-16-years

- https://x.com/QCompounding/status/1665336677605208064