Counterintuitive!

We are entering the phase of the economic cycle where things can look and feel a little painful. Yet equity returns can act in a counterintuitive manner.

Let me explain.

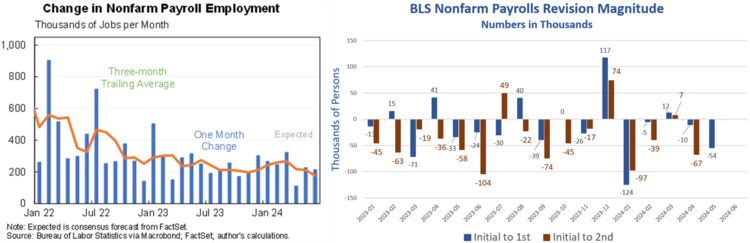

The recent jobs report suggested that the labor market was in good shape. However, when you look at the revisions to prior months you see an entirely different perspective. 1 2

The revisions to the surveys the Bureau of Labor uses to measure jobs has been consistently adjusted much lower from the first report. The three-month trailing average for jobs is down to 2021 lows. Growth is definitely slowing.

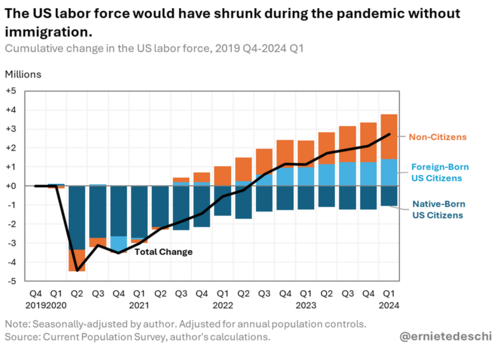

In fact, when you look at the composition of who has made up most of the growth in jobs, it’s from legal and illegal immigrants. Moreover, without non-citizen workers, we might not have any job growth. 3

The slowdown has also found its way into a rapid deterioration of GDP growth expectations. A month ago, the Atlanta Fed expected Q2 to come in at a very strong 4% growth rate and now they are tracking toward less than 2% GDP growth. Higher interest rates are having an impact on the overall economy and the consumer. 4

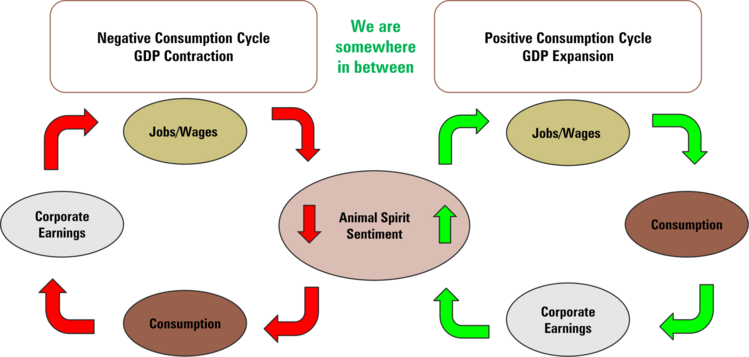

The tricky part of macroeconomic growth watching is the delicate perch the U.S. economy is on. The “animal spirits” of the consumer can be dramatically influenced by further weakening in the jobs picture. It’s critical for the U.S. economy to moderate consumer animal spirits but not crush them. I believe we are at that balancing point now. 5

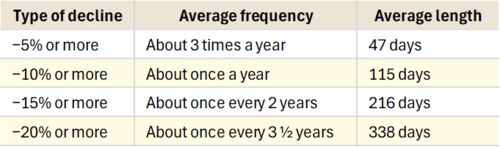

While there can be a drawdown in equity prices at any time, moderate pullbacks (5%-10%) happen often. 6

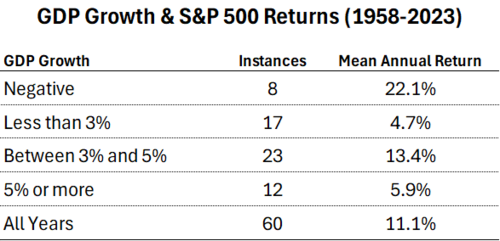

Oddly enough, the counterintuitive point is that some of the best equity price growth occurs during GDP contractions. 7 8

You might ask, how is that possible? The art of investing rests somewhere between current data and future expectations. When it comes to GDP contractions, investors discount current events and look forward to a host of positive inputs such as:

- Interest Rate Cuts

- Corporate restructurings and cost cuts

- Valuation adjustments within sectors

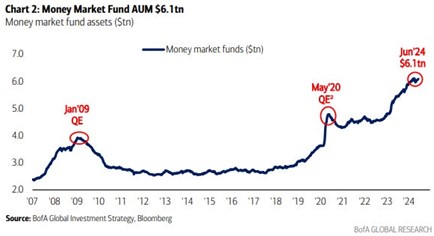

- Record cash in money markets flooding back into equities 9

Anticipating these events – along with a host of others – can act as an anchor to windward. That’s the counterintuitive nature of investing in these tricky times.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/jasonfurman/status/1809211776619147323

- https://mishtalk.com/economics/how-much-faith-do-you-have-in-bls-job-reports/

- https://x.com/ernietedeschi/status/1807806743788888287

- https://www.atlantafed.org/cqer/research/gdpnow

- https://PHILLIPSANDCO.COM/download_file/4446/

- Bloomberg

- https://ycharts.com/indicators/us_real_gdp_growth_yoy

- https://ycharts.com/indicators/sp_500_return_annual

- https://www.threads.net/@leadlagreport/post/C8SgxxOvQT-