Defying Gravity

Defying Gravity

The S&P 500 rallied 4.59% over the last month.This rally continues to mystify conventional thinking— that is, for those that believe market reactions should be conventional. [i]

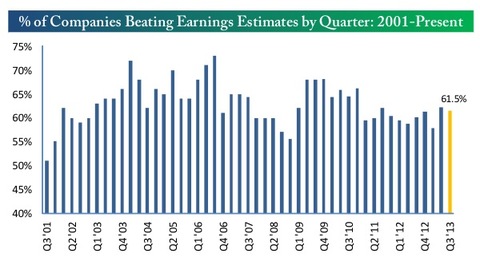

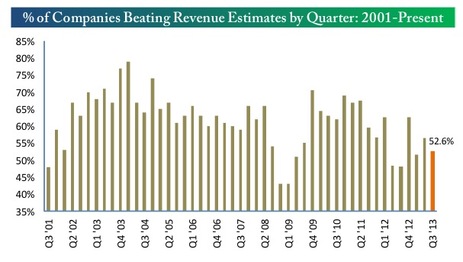

Conventional thinking goes something like this: Earnings continue to come in at weaker levels than expected by Wall Street analysts, and revenue expectations continue to disappoint. [ii]

Conventional thinking would suggest that the market would pull back, yet the market continued to rally in the face of such headwinds.

However, like most things investing, the non-conventional and counterintuitive generally prevails (at least it has for the 28 years of my professional investing career).

Try this on for counterintuitive. The trillions of dollars in pension funds, endowments, foundations and insurance companies must achieve a fairly high bogey for a return. In all likelihood, they will simply not meet their payout mandates with 4% returns. Couple this with the pressure to meet performance benchmarks and the career risk these "professionals" face if they slip too far behind their peers. This will certainly drive more dollars to chase equity performance regardless of the facts.

Pan y agua

Seniors in this country cannot live off bread and water alone. On average, savings accounts are yielding 0.06%. [iii] On a $100,000 account, that will give a whopping...60 dollars per year in interest. With over $563.2 billion in personal savings, there may be a continued push toward risk. [iv]

The Fed’s zero interest rate policy and the on-going incompetence of policy makers are punishing retirees who have worked hard to build their savings. While we manage risk in our allocated accounts, so many others simply do not. Blind speculation in hopes of a return seems to be an investment strategy being used by so many.

Total Retirement Assets in Trillions

Further, the sheer numbers of retirees compounds the investment challenge. The number of retirees is 40.3 million according to the Social Security Administration: [v]

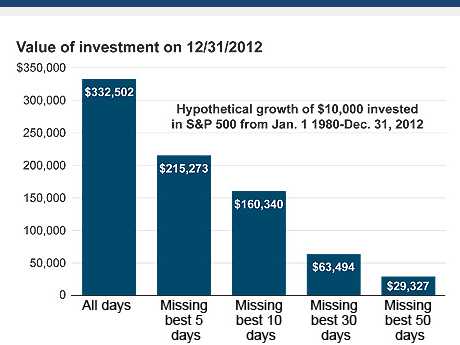

Make no mistake about it: speculation can last a lot longer than most anticipate. Certainly trying to time the markets is an absolute fool’s game. Just look at the data below. If you miss just a few key days in the market, you miss all the advantage. [vi]

I can probably list another 6 reasons to expect this market to continue its rally. The real lesson is the futility in trying to time the market. The only investment strategy I have relied on is to use time to shape the risk in a portfolio. When risk management is done properly, short term swings matter so much less.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] Bloomberg LP

[ii] “The Bespoke Report”, Bespoke Investment Group, November 1, 2013

[iii] “Savings accounts with the highest yields”, CNN Money, October 1, 2013

[iv] “Savings Deposits—Total (SAVINGSL)”, Federal Reserve Economic Data

[v] “Benefits paid by type of beneficiary”, Social Security Administration

[vi] “The pros’ guide to weathering volatility”, Fidelity, February 19, 2013