Demand Destruction

It is incredibly difficult to look around the macroeconomic corner and try to pre-position a portfolio to that guess. It’s far wiser to use sound principals when investing and apply those to our allocated portfolios.

Five Basic Rules for Equity Investors:

- Individual Investors Tend to Underperform

- Diversification: The Only Free Lunch in Finance

- Markets Move In Brief Bursts: Miss Just a Few Days & You Lose All the Advantage

- Time Shapes Risk

- Pain is Part of the Process

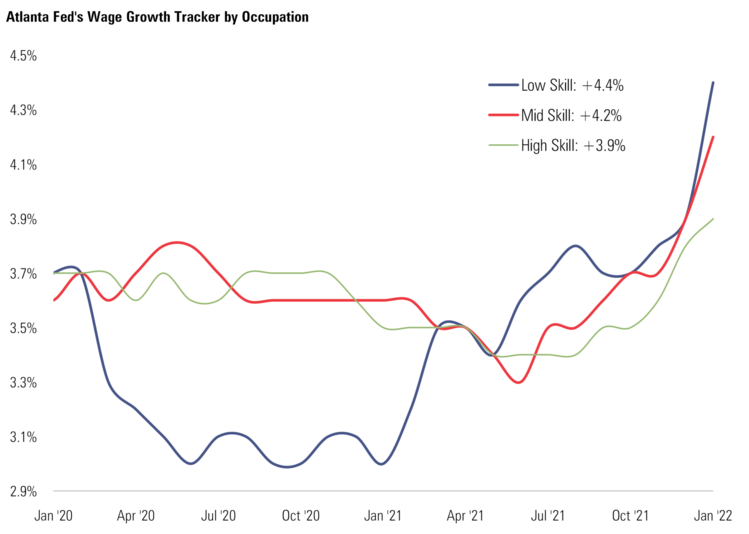

Simultaneously, we need to be mindful of regime changes. It’s clear that the Fed is in regime-change mode—moving from stimulating the bottom up in wage growth to fighting inflation. By the way, mission accomplished for the Fed. 1

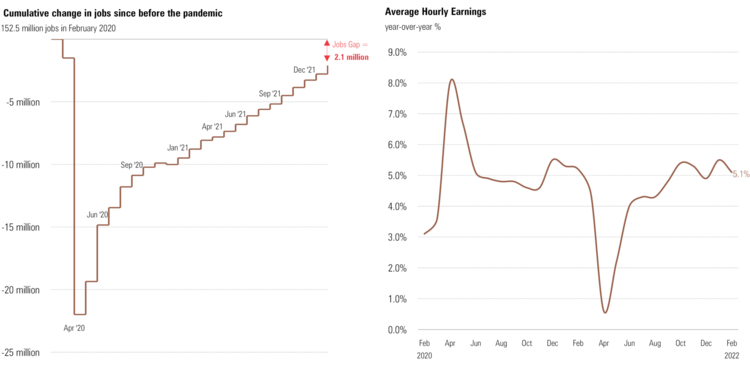

The jobs recovery is almost back to pre-pandemic levels. The U.S. economy added jobs in nearly every sector in February, for a total of 678,000 jobs added. Further, year-over-year wages grew by 5.1%. 2

In last week’s congressional testimony, Federal Reserve Chairman Powell basically guaranteed the start of the rate increase cycle:

“We have an expectation that inflation will peak and begin to come down this year. To the extent inflation comes in higher or is more persistently high…we would be prepared to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings.”

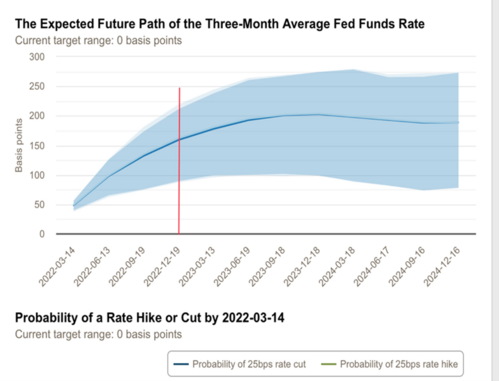

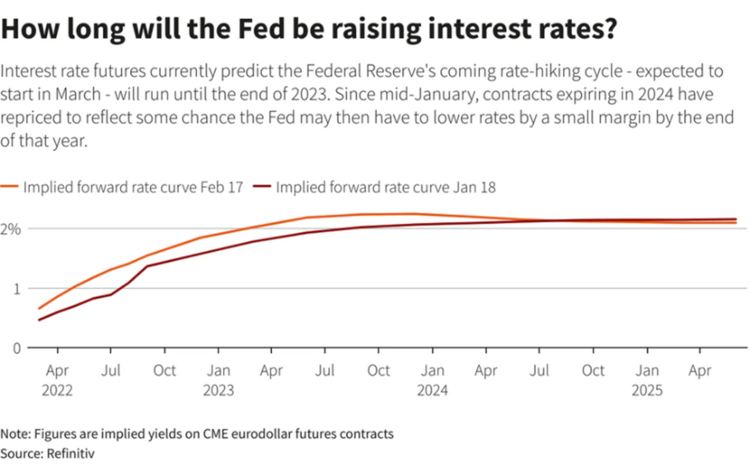

Fed futures markets are predicting about 6-25 basis point rate increases in 2022. 3

Fighting inflation is going to supersede wage growth for the time being. It is now a matter of “how much?” If you believe much of the current inflationary pressures are driven by supply constraints and that includes the war in Ukraine, how impactful will rate increases be?

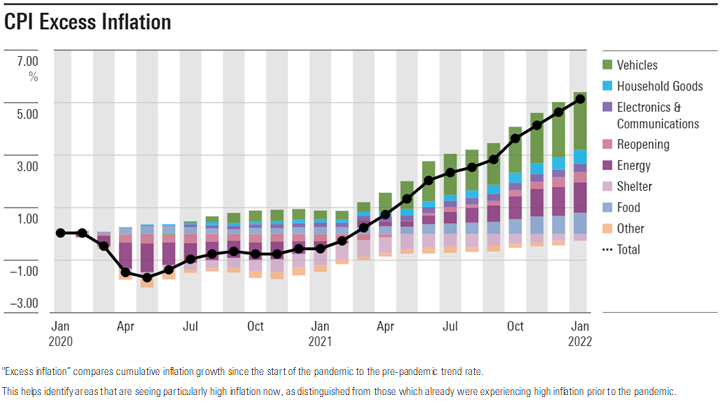

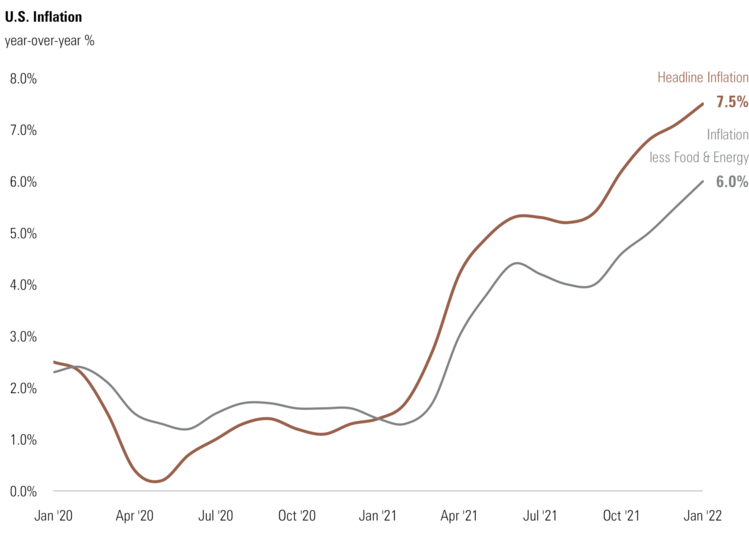

Much of the inflationary spiral is still being driven by a base effect from last year, although that is going to diminish. 4

The other major contributors to inflation are coming from food and energy. 5

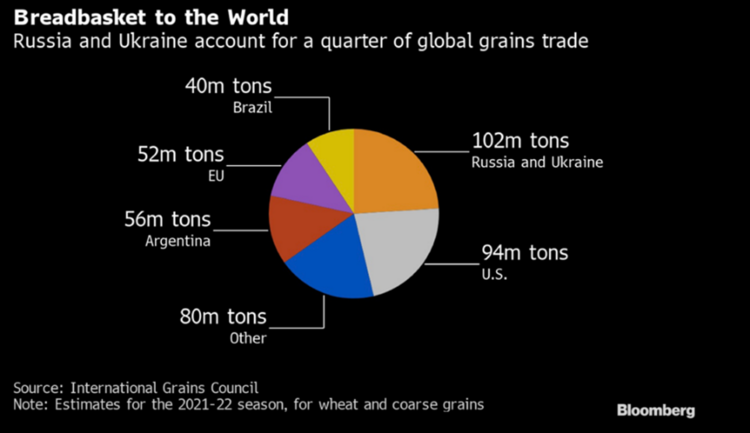

Food prices have been up 7% recently and you can expect them to continue to rise as Russia and Ukraine produce 25% of the world’s grains. 6

While we can certainly cushion the blow to the U.S. consumer, the loss of large suppliers has implications for everyone.

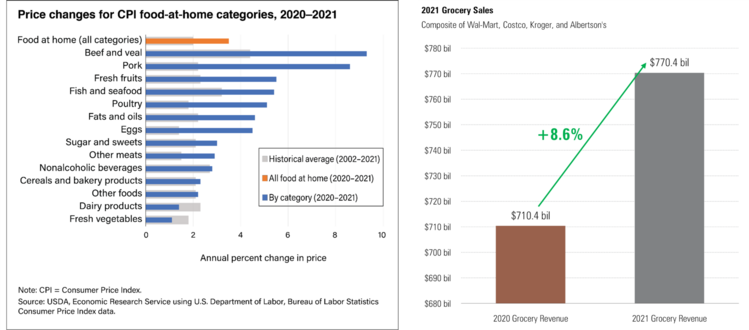

People need to eat regardless of food prices. Grocery prices were up an average of 3.5% in 2021. Simultaneously, revenue for grocery stores (groceries only) were up about 8.6%. 7

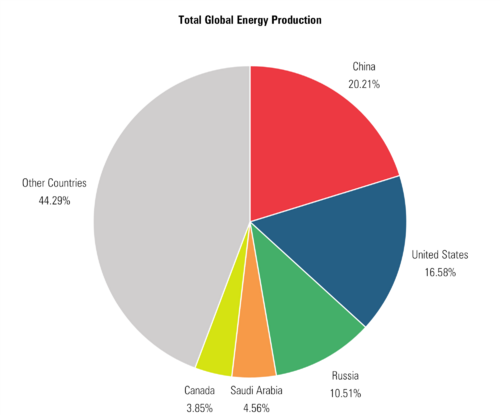

More obvious are the global sanctions on Russia, one of the world’s largest producers of oil and gas. 8

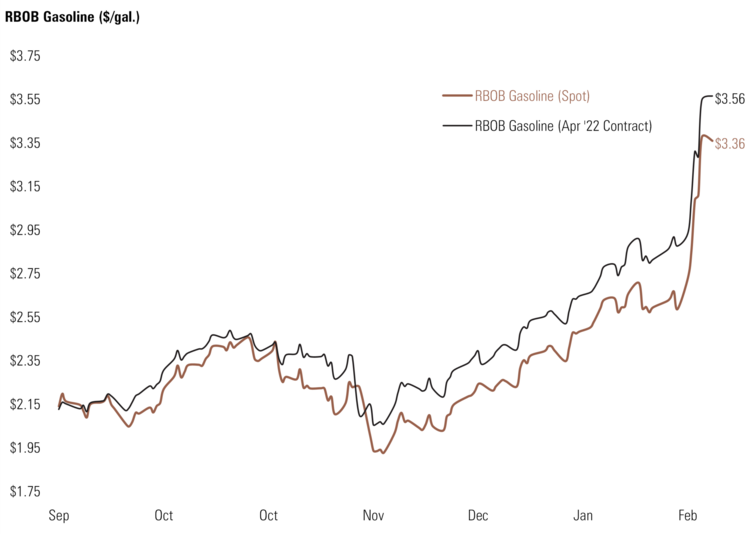

Gas prices have increased by 57% in the last six months and April gasoline futures are suggesting another 6% increase in prices. That might be conservative if the U.S. blockades Russian energy imports. 9

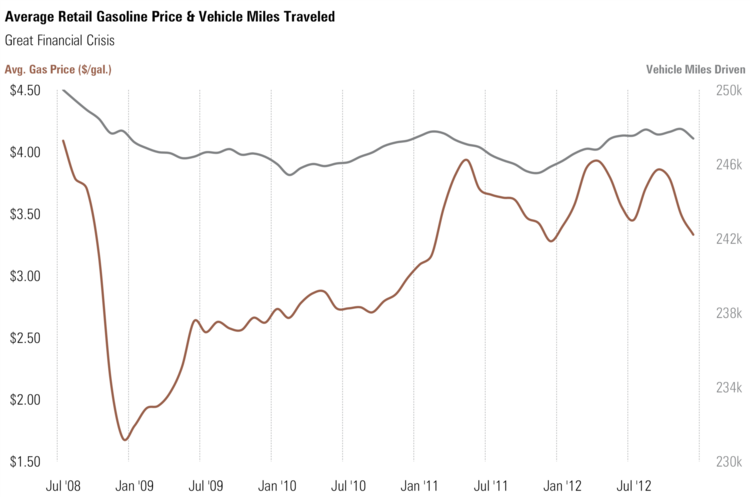

The last time gas prices were near these levels, during the Great Financial Crisis, total miles driven barely budged. 10

Can the Fed orchestrate demand destruction when it comes to food and energy prices?

Rising rates won’t change the rate of consumption in food and gas prices alone—These are basic necessities and it is hard to bend the demand curve.

The real demand destruction will occur in crowding out spending on discretionary items like travel, leisure, dining out, and other service-related industries as consumers pay higher prices at the pump and grocery store.

So, while the Fed helped lift wages (with much lower rates) in the service sector, they are on the precipice of destroying consumption in those same sectors.

Inducing a strategic, targeted, sector-driven recession will not help lower income families. That is why it’s my view that rate increases will be much less than the market anticipates and, in fact, futures markets are anticipating rate cuts. That’s right, rate cuts in 2023 or 2024. 11

Orchestrating demand destruction won’t solve commodity-driven inflation. It will only hurt those that have finally been helped. That’s exactly why the Fed Chairman said several weeks ago: 12

“And I stress again that we’ll be humble and nimble. We’re going to have to navigate crosscurrents and actually two-sided risks now.”

I expect fewer rate increases – more like three or four rather than the six or seven markets are anticipating. Stocks will react favorably when investors come to this same conclusion.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.atlantafed.org/chcs/wage-growth-tracker

- https://www.bls.gov/news.release/empsit.nr0.htm

- https://www.atlantafed.org/cenfis/market-probability-tracker

- https://www.morningstar.com/articles/1078786/7-charts-on-the-big-cpi-rise-fed-rate-hike-outlook

- https://www.bls.gov/cpi/

- https://www.bloomberg.com/news/articles/2022-03-01/wheat-steams-toward-10-as-russian-invasion-stifles-shipments

- https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=76961

- https://www.eia.gov/international/rankings/world

- https://www.cmegroup.com/markets/energy/refined-products/rbob-gasoline.quotes.html

- https://fred.stlouisfed.org/graph/?g=MHzJ

- https://www.reuters.com/business/finance/eurodollar-futures-market-betting-hawkish-fed-could-ease-rates-slightly-2024-2022-02-18/

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220126.pdf