Discombobulating the Combobulated

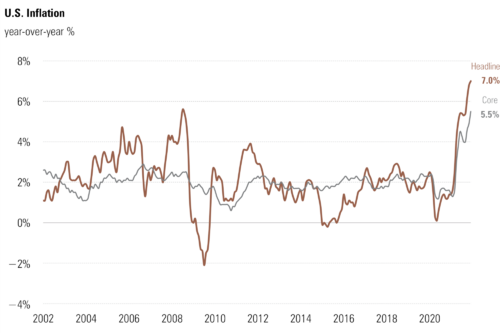

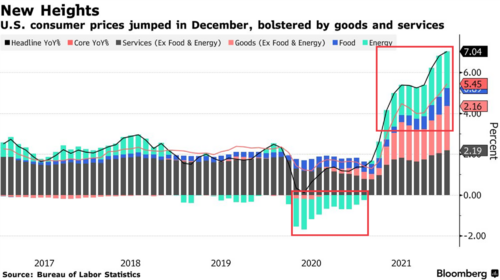

The recent print on U.S. inflation, as expected, was a record setting 7.0% year-over-year at the headline level. 1

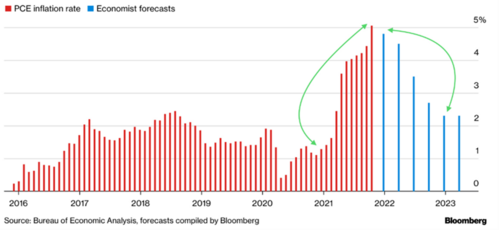

I’ve been a broken record in repeating the fact that inflation is measured on a monthly rate of change basis compared to this time last year. While prices may not drop, the rate of change will moderate. (Discussed this in our Q1 2022 Look Ahead, which you can view here)

In December 2020, we were still in the throes of the lockdown phase of the pandemic and services (hotels, restaurants, air travel) were still on life support with massive deflation. 2

Between the supply chain bottlenecks, the expansion and contraction of Covid on consumption, and the simple math of measuring rates of change year over year; this is no ordinary business cycle. We’ve never experienced a country-wide lockdown and then restart so, any comparison of today’s inflation to the 1970s is simply not logical. It’s a different type of input and circumstances.

Here’s what I see happening: Retail sales (ex-autos) were exceptional on year-over-year basis as of the latest reading. The consumer looked to be in solid shape during the holidays. 3

However, going forward looks to be a different story:

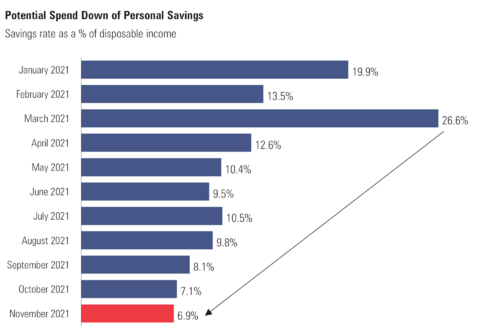

According to the latest reading on the savings rate the consumer continues to spend down their precautionary savings. 4

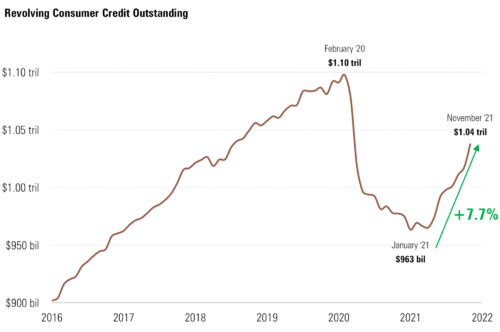

Simultaneous to the winding down of some of this excess monthly savings is the ramping up of revolving credit. 5

Put another way, the consumer will start shifting to credit cards to support their consumption.

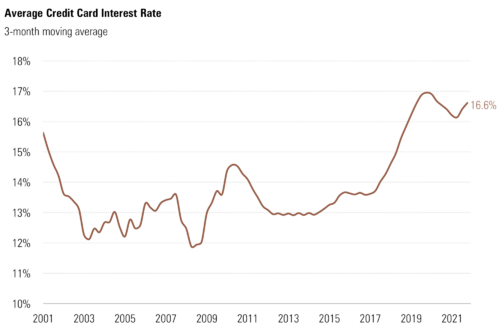

However, we know interest rates are going to rise and that will certainly impact some use of credit cards. 6

How much will consumers use high-cost credit to continue their consumption binge? It is anybody’s guess and consumer sentiment generally dictates aggressive consumer habits.

A couple of other factors to consider when thinking about demand driven inflation is the winding down of rental/mortgage forbearance and student loan forbearance. While specific dates vary, rental and mortgage forbearance generally started to expire in June 2020.

Student loan forbearance ends in May. If you add these two spending items back to the consumers expenses you could see a reduction in purchasing power of approximately 1.65%.

So, now let’s discombobulate all of this.

Yes, inflation is on the rise and probably peaked in December or will in January. Yes, the consumer is facing some significant headwinds in the months to come based upon a reduction in spending down savings, losing pandemic relief in terms of deferred payments, and rising credit card rates.

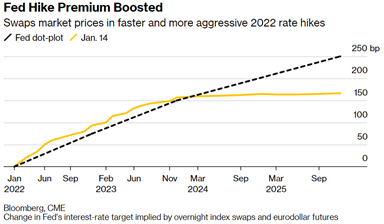

Yet, the Federal Reserve has signaled they are going to raise rates likely 3 times this year. 7

If the Fed treats current inflation like a historical touchstone similar to the 1970s, they will likely make a policy error. Raising interest rates, winding down, or selling off their balance sheet too quickly could force a soft patch in our economy and drive consumers to withdraw the enthusiasm they have recently demonstrated. While not consensus, my view is inflation will moderate significantly in the second half of this year almost solely on its own accord.

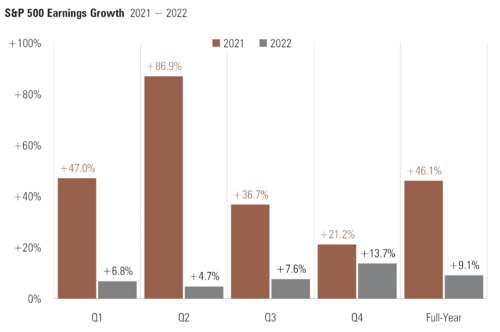

If the Fed were to front load two rate increases combined with tapering their purchases of bonds, they might soft land the economy. If the Fed pushes policy extremes, we could see a sell-off in equites as corporate earnings might get pinched by a cautious consumer. Earnings still matter. 8

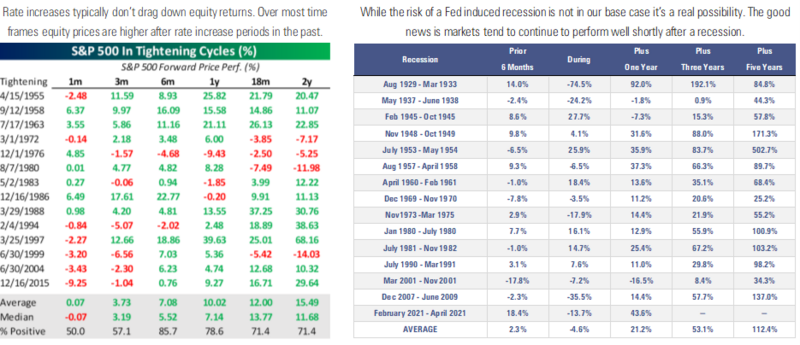

Before you run for cover, realize rate increase cycles have hardly been anything to fear for long-term investors. In fact, they might be a buying opportunity. Historically, rate increase periods—on average—do not suggest any real long-term pain (note that is “on average”).

So, did I just recombobulate the discombobulated? I hope not, but a lot of this stuff is counterintuitive.

See our recent video with author of Psychology of Money, Morgan Housel. He is a great discombobulator.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1. https://www.bls.gov/cpi/

2. https://www.bloomberg.com/news/articles/2022-01-12/inflation-in-u-s-registers-biggest-annual-gain-since-1982

3. https://www.briefing.com/calendars/economic/

4. https://fred.stlouisfed.org/series/PSAVERT

5. https://fred.stlouisfed.org/series/REVOLSL

6. https://fred.stlouisfed.org/series/TERMCBCCINTNS

7. https://www.bloomberg.com/news/articles/2022-01-14/dimon-sees-as-many-as-seven-federal-reserve-rate-increases

8. https://insight.factset.com/topic/earnings