Does Perception Create a New Reality?

As we enter the fourth week of combatting the coronavirus, global perceptions about the impact are starting to take shape.

Let’s start with the latest on the spread of the virus from the World Health Organization (WHO). [i]

Despite having spread across the globe, the exposure within each country is incredibly small especially as you look at the possible cases of transmission outside of China.

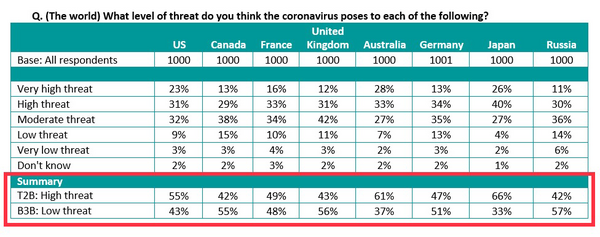

Now let’s overlay the widespread, albeit limited, numbers to current perceptions. First, a survey from IPSOS of over 8,000 respondents. [ii]

As you can see from the summary table above, the threat is perceived to be equally weighted between a “high” and “low” threat.

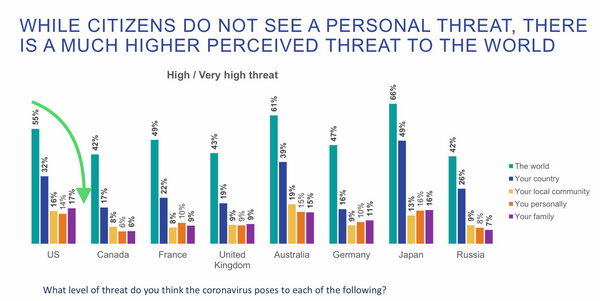

Interestingly, most respondents espouse the NIMBY “not in my backyard” mindset. The threat is high out in the world, but the threat to their family is pretty low. [ii]

In the United States, 55% of respondents see the virus as a “high” or “very high” threat to the world, but only 17% suggest it’s a “high” or “very high” threat to their families. Perhaps they are more attuned to the WHO data than we think.

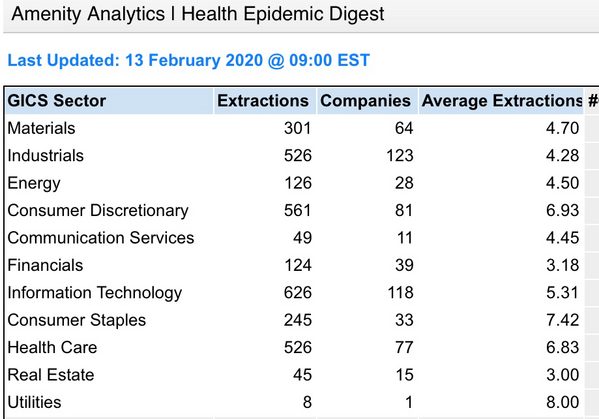

As it relates to businesses, the virus is gaining significant attention on earnings calls. As of Friday, 421 global companies talked about the coronavirus on their earnings calls, according to Amenity Analytics. [iii]

It’s not surprising to see sectors like Consumer Discretionary and Health Care average 6.9 mentions per call.

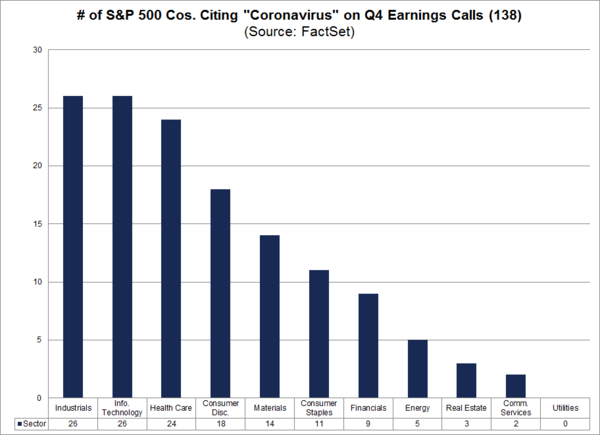

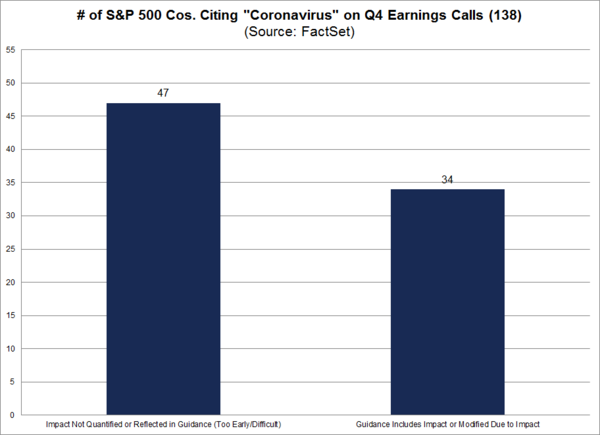

Looking at the S&P 500, here is what FactSet found when they searched for the term “coronavirus” in earnings call transcripts: “Of the 364 S&P 500 companies that conducted fourth quarter earnings conference calls from January 1 through February 13, 138 (38%) cited the term ‘coronavirus’ during the call. At the sector level, the Industrials (26), Information Technology (26), and Health Care (24) sectors have seen the highest number of companies discussing ‘coronavirus’ on earnings calls of all 11 sectors.” [iv]

There are still a significant number of companies that have not factored the virus into 2020 guidance. We expect companies to continue to quantify the impact on upcoming calls, potentially leading to increased volatility. [iv]

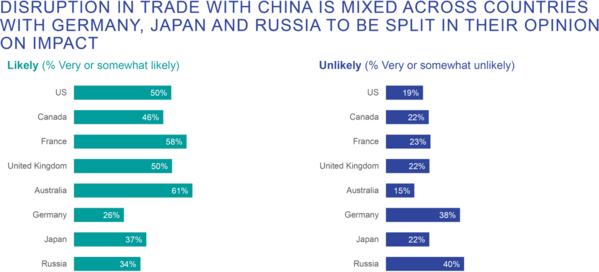

While companies continue working to understand the impact to their business, those that responded to the IPSOS survey have mixed views on the impact to trade. [ii]

|

Instead of guessing, we engaged with our in-country China research team at CICC. They will be hosting a call on February 25th with their Chief China Economist, Dr. Hong Liang, to discuss the global economic implications of the coronavirus. You can register by clicking the link here. Understanding current perceptions might help us plot our course through much of this troubling event. One reality is certain though: Central Banks across the globe are poised to provide extra stimulus and that’s especially true in China. Join the call and find out for yourselves. SIGN ME UP! |

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.who.int/docs/default-source/coronaviruse/situation-reports/20200215-sitrep-26-covid-19.pdf?sfvrsn=a4cc6787_2

ii. https://www.ipsos.com/sites/default/files/ct/news/documents/2020-02/coronavirus-topline-results-ipsos.pdf

iii. https://www.amenityanalytics.com/blog-articles/amenity-health-epidemic-tracker

iv. https://insight.factset.com/are-sp-500-companies-lowering-guidance-due-to-the-coronavirus