Earnings are Like Gravity

In the coming weeks, the amount of political noise will be all-consuming. I’m sure it will be sucking all of the oxygen out of the earnings season which will be in full swing by the November election.

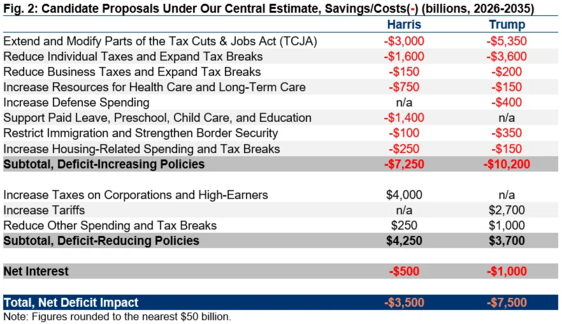

The various tax proposals will be mind-boggling, with daily permutations. Currently the proposals look a little something like this: 1

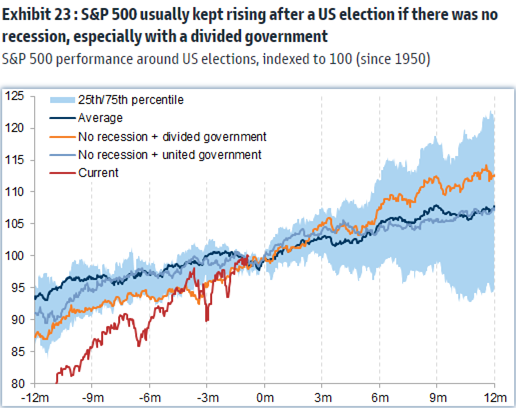

However, it’s important to remember that these proposals may not necessarily come to fruition. Typically, equity market performance is positive post-election if we do not slip into a recession. That fact is especially true in a divided government. 2

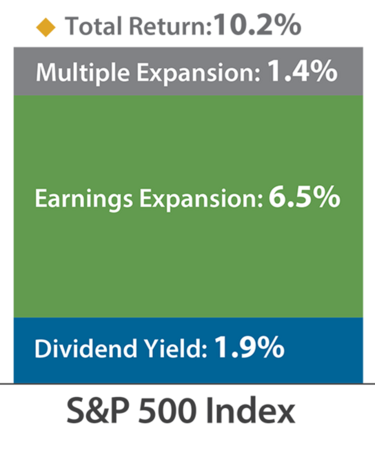

As we pause from politics, the one thing that matters most is earnings. Future corporate earnings drive valuations and that is what keeps equity prices moving upward. 3

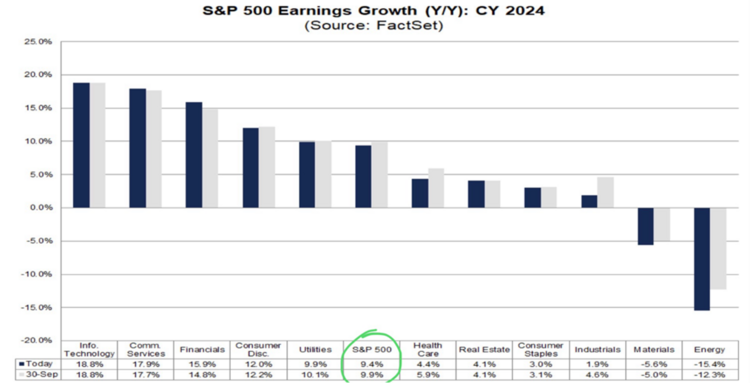

As this relates to current earnings, we are just getting into the best part of the year. Full-year 2024 S&P 500 earnings growth expectations are around 9% growth. 4

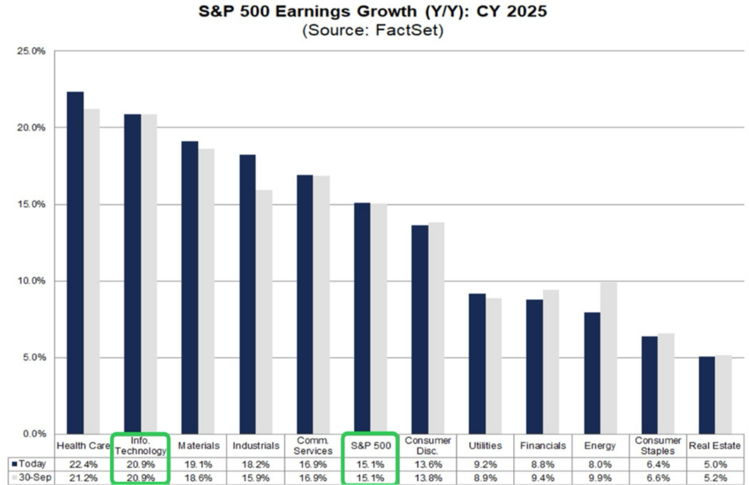

Looking further ahead, 2025 S&P 500 earnings expectations are even higher at around 15% growth, with the Tech sector projected at 20%+. 4

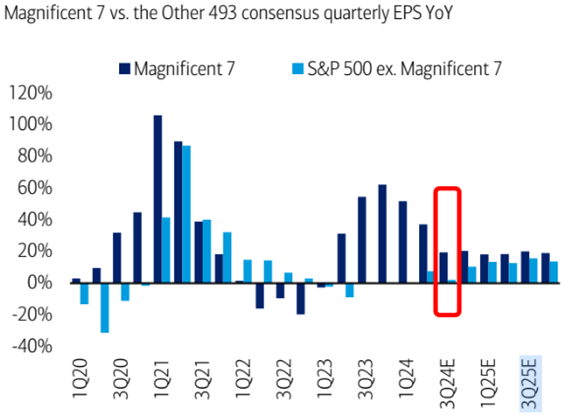

When you consider the Tech sector driving earnings growth compared to the rest of the S&P 500, one can come away with even more hope for equity returns next year. 5

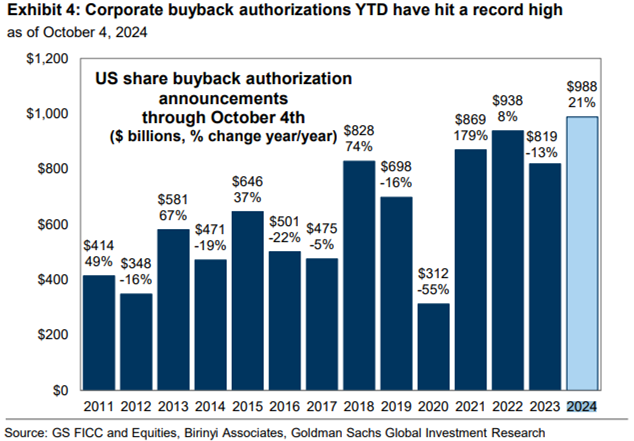

When you layer in the nearly $1 trillion in stock buybacks (reducing share supply and boosting earnings per share), you get the sense that everything earnings-related is lining up nicely. 6

Earnings are like gravity; you can’t run from it and in the long run you can’t escape its powerful pull. The good news is that earnings are poised to expand in the coming months and into next year, which bodes well for equity markets in spite of the political noise.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.crfb.org/papers/fiscal-impact-harris-and-trump-campaign-plans

- https://publishing.gs.com/

- https://www.mhinvest.com/blog/depend-on-dividends-and-earnings-growth-not-multiple-expansion

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_101824.pdf

- https://business.bofa.com/en-us/content/market-strategies-insights.html

- https://x.com/MikeZaccardi/status/1844849218017714307

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.