Earnings, Inflation, and Recessions – Better Outcomes

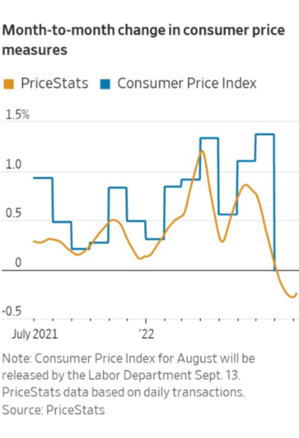

Tomorrow we will get a critical update on inflation festering in the U.S. economy. Expectations are pointing to a lower reading, which could create a fear that the Fed will overreact by raising rates much higher than needed to moderate inflation. 1

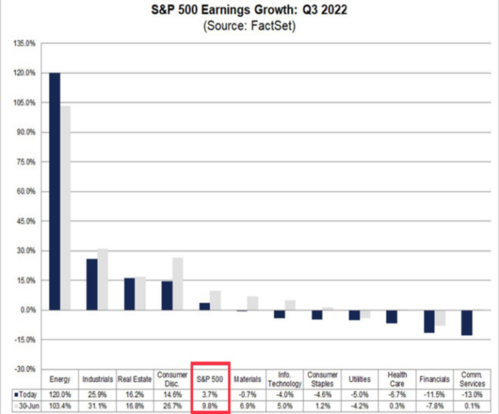

It’s hardly a surprise to see a significant downshift in earnings expectations for Q3 considering the extreme rhetoric out of the Federal Reserve. What was once a respectable growth expectation for S&P 500 earnings at the end of June (9.8%) turned into anemic growth of 3.7%. Clearly equity analysts’ expectations have gone sour. 2

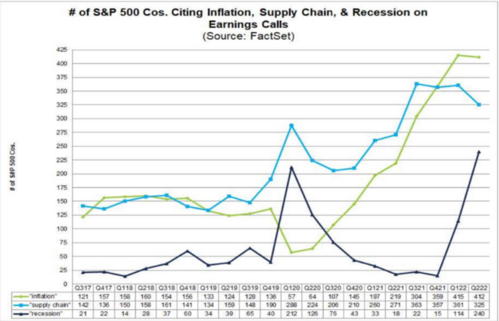

When FactSet analyzed earnings conference calls, they also noted some pessimistic themes (inflation, supply chain, and recessions) being mentioned. 2

It’s interesting to note supply chain fears are abating along with some moderation of inflation while recession fears are accelerating. It’s no wonder when you review the harsh rhetoric out of the Fed. You can review those comments here.

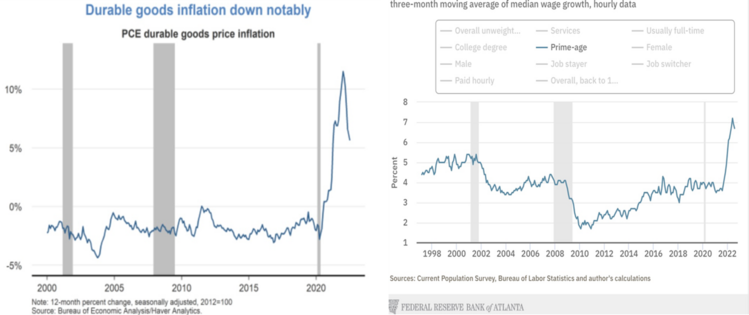

Durable goods inflation is moderating along with wages for prime-age workers. 3 4

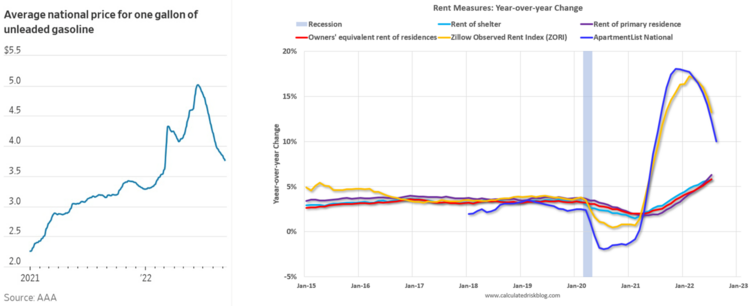

Gasoline prices have been dropping for the last two months and we are finally seeing some cooling in rents, which is the largest component of core inflation. (Note: I don’t expect softer rent growth to immediately help the inflation picture as rents are sticky). 5 6

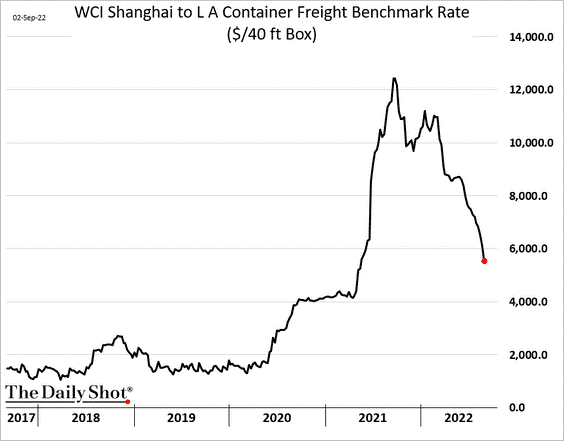

Relative to supply chains, we are seeing some dramatic reductions in freight costs, which are down nearly 50% from peak. 7

It would appear the moderation in supply chain and inflation data are being felt by corporations as reflected in earnings calls.

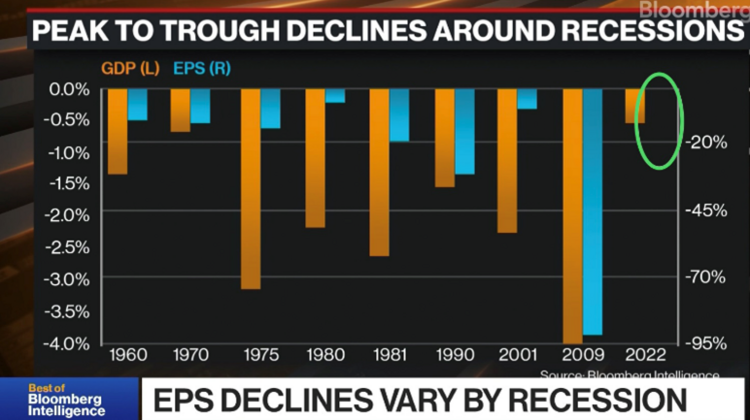

Recession concerns certainly trump all other comments, but historically, economic recessions are accompanied by earnings recessions, and we simply don’t see earnings slipping into negative territory in Q3. 8

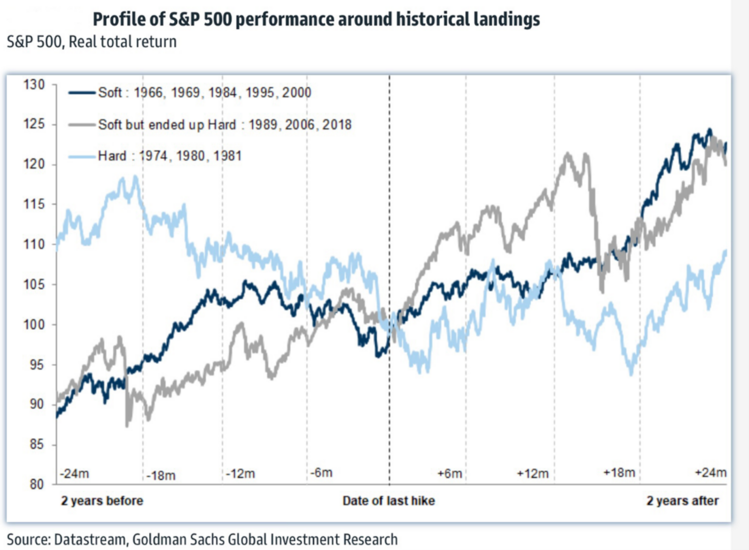

I’m not suggesting the worst is over, but I also don’t believe under current circumstances we are on the precipice of a hard landing recession. If, in fact, we are approaching a softer landing, we could be closer to the end of the rate increases period by year-end and perhaps better equity returns sooner. 9

It’s simply too hard to forecast. Although, you can see that’s exactly what Wall Street attempts to do. Most forecasts are based on the past while we have to live in the present and generate returns predicated on the future. 10

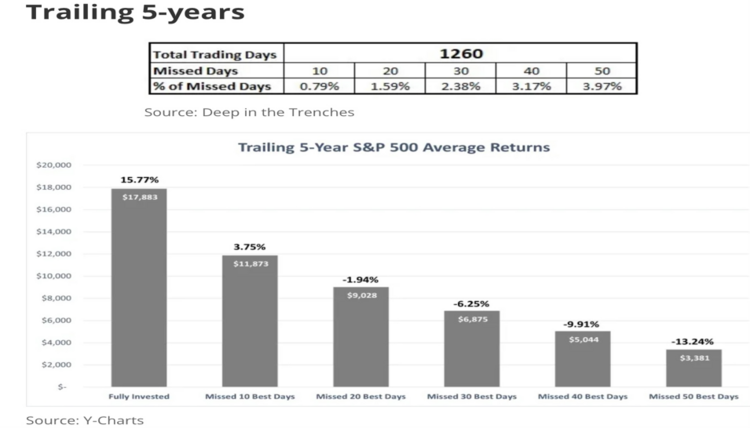

Living through growth cycles is painful for investors and instincts might suggest trying to time these events. However, following first principals generally leads to better outcomes.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.wsj.com/articles/inflation-showed-signs-of-easing-in-several-industries-in-august-11662888602

- https://go.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_090922.pdf

- https://www.bea.gov/data/consumer-spending/main

- https://www.atlantafed.org/chcs/wage-growth-tracker

- https://gasprices.aaa.com/

- https://www.calculatedriskblog.com/

- https://dailyshotbrief.com/

- https://youtu.be/omtKNullJ3g?t=49

- https://research.gs.com/

- https://deepinthetrenches.com/missing-the-best-days-in-the-market/