Earnings Recessions – When Will it End?

Ultimately, earnings growth matters. After all, investors only own the future. When you buy a stock, you’re purchasing a fractional share of future cash flow streams that the company generates from earnings and dividends. You’ve bought it at its current earnings, but have likely paid a higher valuation in anticipation of future growth in those earnings and dividends.

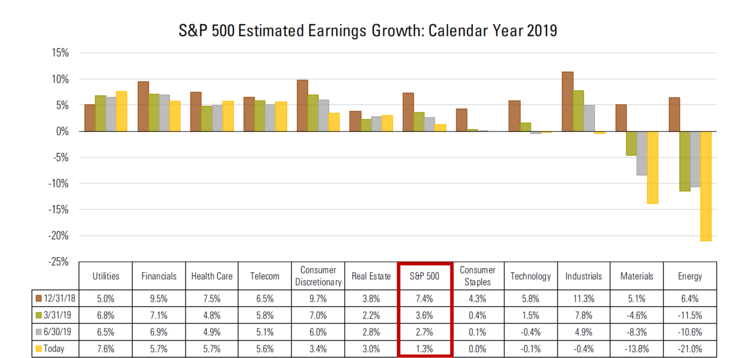

Unfortunately, there has been an absence of meaningful earnings growth for two consecutive quarters. We’ve been discussing the earnings recession for quite some time and estimates have been trending down since the beginning of the year. [i]

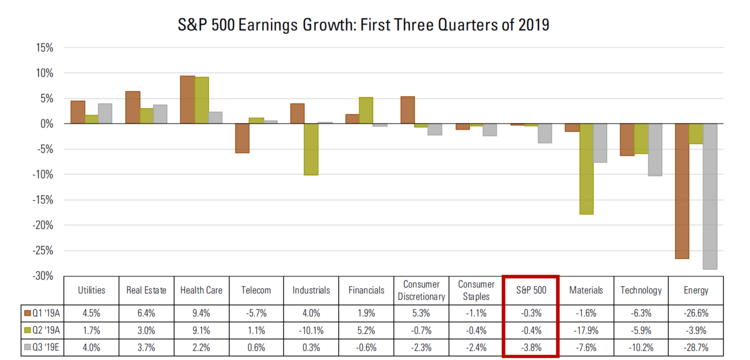

Throughout 2019, we have gone from one quarter to two-quarters of little to no earnings growth, the latter indicating the official start of an earnings recession. Now, we’re looking at a continuing trend for a third quarter. [ii]

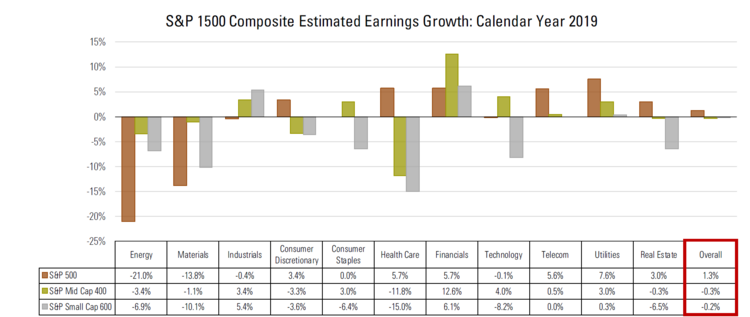

As shown below, if you drill down beyond the S&P 500 to pull in mid- and small-cap companies, the recession in earnings has been consistent across all market-cap sizes, pointing to broad-based weakness. [iii] [iv]

When companies struggle to produce meaningful earnings growth, it often leads to a decrease in hiring and an increase in layoffs. This is due to labor making up 20% - 30% of all costs to a company. Higher unemployment has a direct impact on consumer spending, laying the groundwork for a bona fide economic recession.

Not to mention a prolonged period of earnings contraction can impact the price of stocks, souring investor sentiment and leading to a pullback in consumption.

In our estimation, it’s getting to be crunch time for earnings growth. While we are anticipating a stagnant third-quarter of earnings growth across the S&P 500, my view is that investors are bidding up stock prices in hopes of the recession ending in Q4, which is just a few days away.

It’s a normal cycle, but the cycle will need to end soon.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_092019A.pdf

ii. https://insight.factset.com/

iii. http://lipperalpha.refinitiv.com/2019/07/sp-400-mid-cap-index-earnings-dashboard/

iv. http://lipperalpha.refinitiv.com/2019/07/sp-600-small-cap-index-earnings-dashboard/