Earnings Still Matter

It is hard to imagine the S&P 500 is only 7.8% off its high when you consider the various factors working against investors. 1

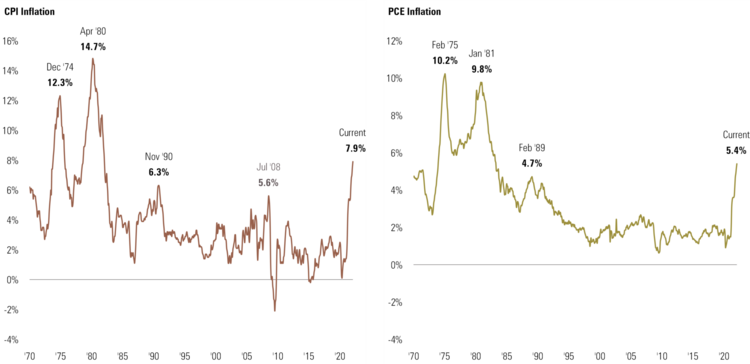

Inflation is sitting at near-record highs on both CPI and PCE. 23

Last week, the Fed signaled a very aggressive approach to fighting inflation in their recent statement. 4

“Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.”

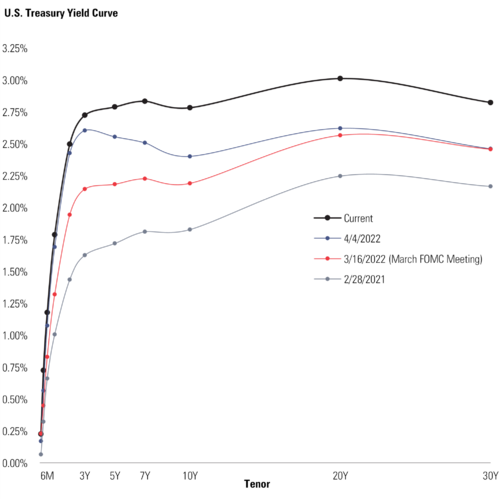

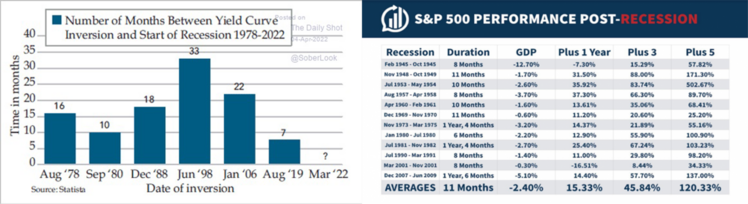

Almost immediately, interest rates shot up—inverting the yield curve again on the short-end and signaling a recession in our future. 5

Just a quick side note on inverted yield curves that have predicted recessions: the time frames for when recessions start and how long they last are inconsistent. 67 Yet, 11 months is tolerable when you consider the S&P 500 rallies off recessions by an average of 15.33% one year later.

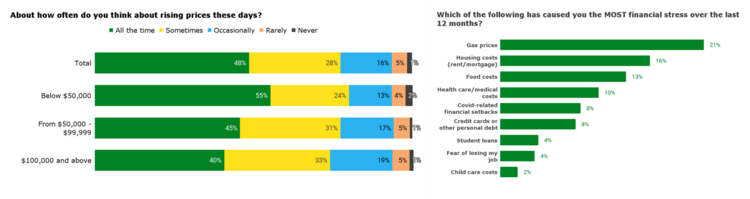

Inflation has been top of mind for many of us. According to a recent survey, almost half of people asked reported that they think about inflation “all the time”. 8

Basic needs like gas, housing, and food prices are causing the most stress amongst Americans.

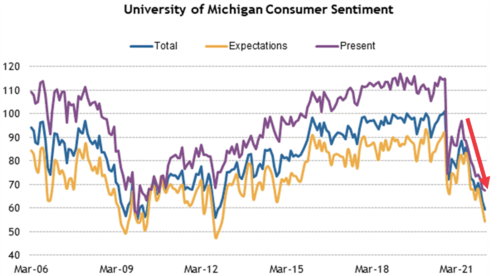

It’s not surprising when you see consumer sentiment is hitting very bearish levels, as noted by the University of Michigan Consumer Sentiment index. 9

Compounding these challenges with inflation are the actual blunt tools (i.e. raising interest rates) the Fed is using to fight inflation. They have limited tools when it comes to fighting inflation, especially when so much of it is driven by supply side issues, like supply chain bottlenecks, and now, the war in Ukraine.

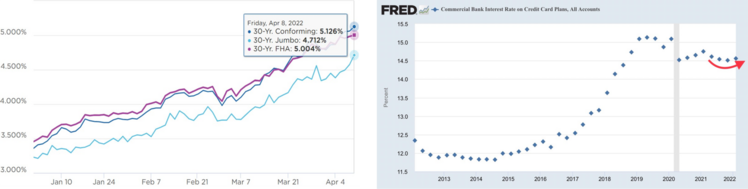

With the aforementioned Fed messaging last week, interest rates in the real economy are skyrocketing. Mortgage rates on the 30-year fixed mortgage crossed over 5% last week. Mortgage rates are up 39.8% over the last few weeks. Interest rates on credit cards have also spiked. 10 11

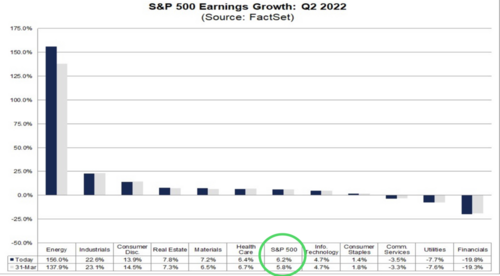

With all this negativity, why is the S&P 500 hovering near all-time high? As we have said in our Q2 2022 Look Ahead (link here), earnings season starts in earnest this week and, on that front, company earnings are looking more resilient.

Full year 2022 corporate earnings revisions have been trending since the beginning of the year. 12

Further, Q2 EPS growth prospects have improved also since the start of the month. 13

Perhaps S&P 500 earnings growth does matter.

The Federal Reserve is poised to make policy errors and crush consumer demand with their current projected rate increases. You will likely hear a drumbeat of recession calls from the media and Wall Street in the coming weeks. We, too, think it is entirely possible the U.S. slips into a recession sometime this year or early next year. However, we also believe the Fed will moderate interest rate expectations when better inflation data trickles in over the next few months.

In the meantime, we are taking these concrete steps to defend portfolios:

- We continue to position health care into portfolios as a hedge against inflation. We added the Health Care ETF in late January.

- We are going to continue to add industrial metals to portfolios—not just as a hedge against inflation but, more importantly, to take advantage of the commodities super cycle. (See our interview with Jeff Currie from Goldman Sachs link). We initially added this about 1 year ago and continue to strengthen our position.

- With rapidly rising rates, we are going to position some fixed income into the shorter-end of the curve and capture some excellent yields. This will be done on an individual credit basis to facilitate holding to maturity.

It’s still our view the Fed has done a lot of doomsaying and the markets have overestimated the number of rate increases. The consumer brakes will soon be tapped and inflation should moderate in the coming months, either through some supply adjustments or demand destruction. Let’s hope it is more on supply fixes than demand destruction.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://schrts.co/AVJDcbxQ

- https://www.bls.gov/cpi/

- https://www.bea.gov/data/personal-consumption-expenditures-price-index

- https://www.federalreserve.gov/monetarypolicy/fomcminutes20220316.htm

- https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

- https://dailyshotbrief.com/

- https://awealthofcommonsense.com/

- https://www.momentive.ai/en/blog/cnbc-financial-literacy-2022/

- http://www.sca.isr.umich.edu/

- https://www2.optimalblue.com/obmmi/

- https://fred.stlouisfed.org/series/TERMCBCCALLNS

- https://www.bloomberg.com/opinion/articles/2022-04-10/inflation-earnings-season-will-be-awkward-for-the-federal-reserve

- https://insight.factset.com/topic/earnings