Elections Have Consequences — So Do Earnings

With the upcoming Presidential Debate taking place this week and party conventions around the corner, election season is kicking off.

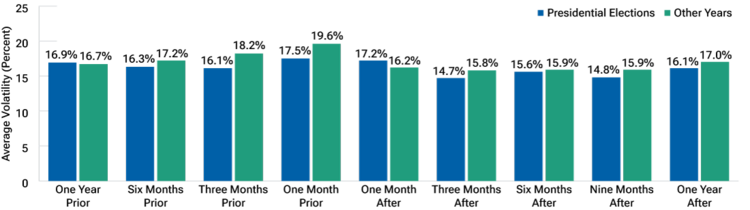

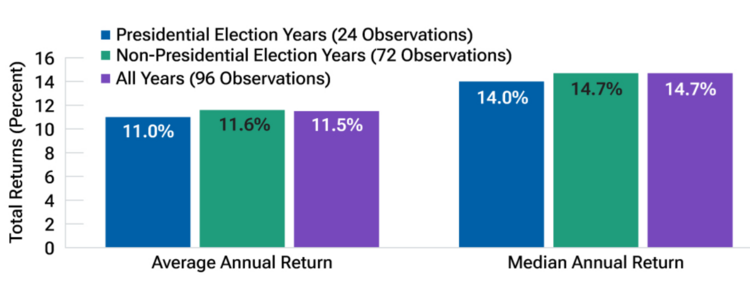

The amount of anxiety around the outcome will be increasing as November approaches. Policy and personality differences will take the forefront and drive headlines. Volatility will likely increase consistent with historical trends, although it’s interesting to note that Presidential election years are less volatile than other years. 1

However anxious Americans are, the investment thesis still suggests strong market returns during Presidential election years. While the risk (volatility)/reward is not as beneficial, the historic returns are still solid. 1

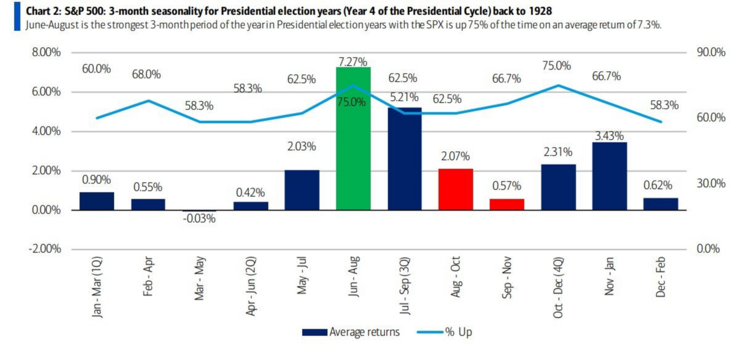

On a 3-month average, we are entering the best period of time for equities during a Presidential cycle. 2

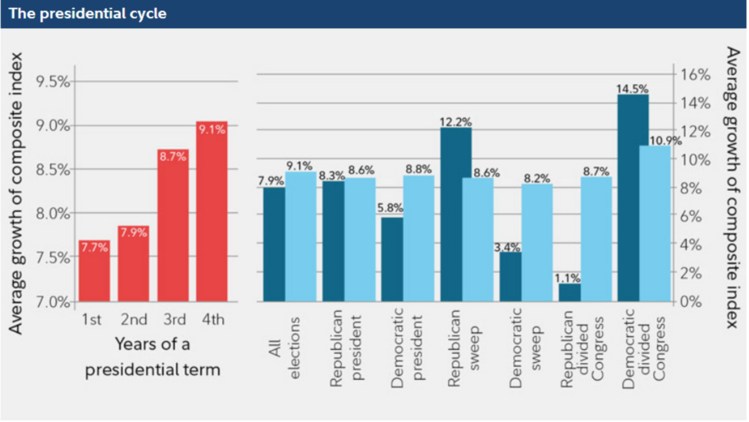

Based upon a study completed by Fidelity, the first two years of a Presidential cycle have modest returns while the last two years show much better returns. Division in congress is also very supportive of equity investing – especially in the last two years (light blue in the chart below). 3

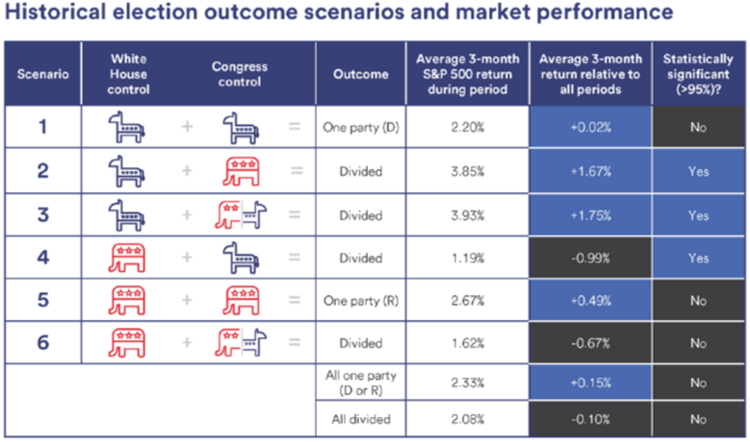

Looking at periods just following the election, the outcome also supports reasonable returns, with divided government scenarios often yielding particularly positive results. 4

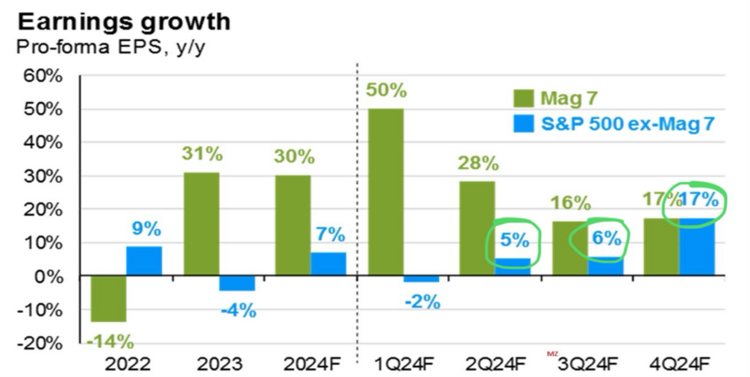

U.S. elections have consequences for taxes, spending, and geopolitics. So do earnings. The second half of 2024 looks to be very strong for corporate earnings growth rates (ex-Magnificent 7) and that’s likely driving the current equity rally. 5

Counterintuitively, as big as the personality and policy differences are going to be between the parties, it’s a good thing earnings still matter.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.troweprice.com/financial-intermediary/us/en/insights/articles/2024/q2/how-do-us-elections-affect-stock-market-performance.html

- https://x.com/Barchart/status/1787964682717810835

- https://hbkswealth.com/2020/08/presidential-elections-and-stock-market-performance/

- https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?slideId=equities/gtm-mag7perfomance