Emerging Markets

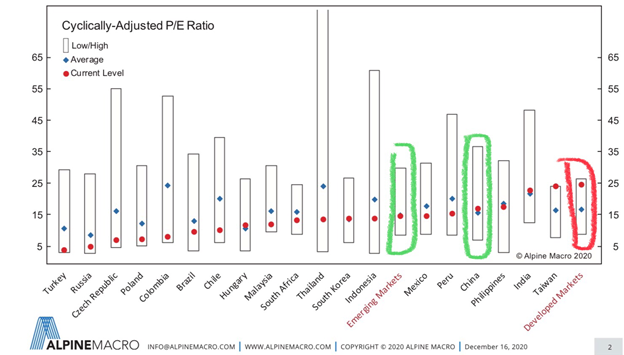

As we swiftly approach 2021, it is becoming abundantly clear where some of the greatest opportunity might exist within the broad spectrum of equity investing. Emerging markets appear to be the clear favorite from a valuation perspective. [i]

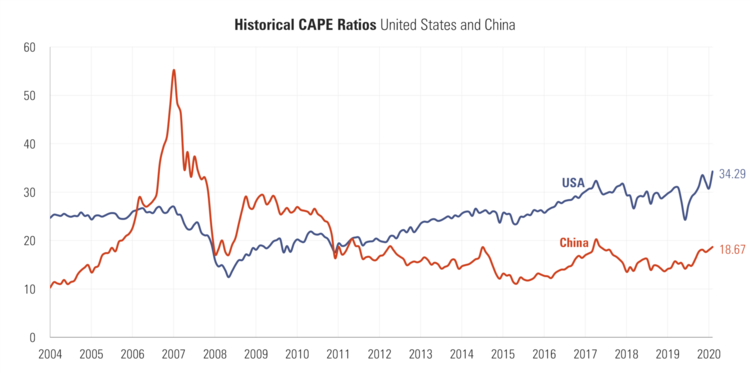

Relative to Developed Markets, Emerging Markets look particularly inviting. Using the cyclically-adjusted P/E ratio and drilling down on the two largest markets in the world– China and the United States– the valuation disparity becomes even more pronounced. [ii]

Drilling a bit deeper into China and you might think, after a great year of equity returns, valuations could be elevated similar to the United States. [iii]

However, China is far from a bubble when it comes to valuations– largely driven by stout corporate earnings growth. [iv]

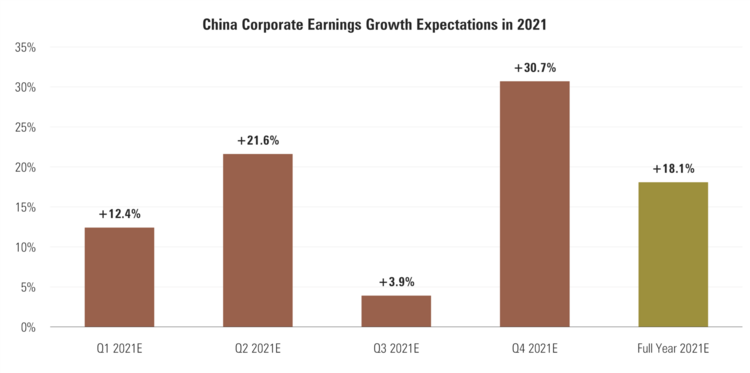

Considering 2021 EPS growth expectations of 18.1%, Chinese valuations still look very favorable compared to prior bubbles. [v]

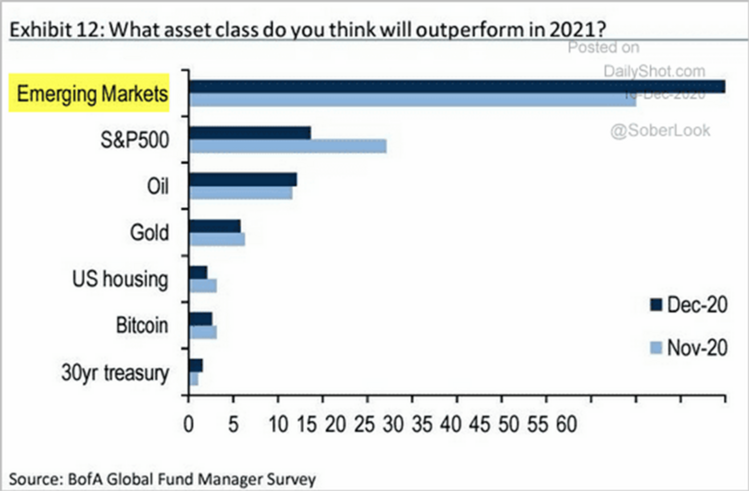

No wonder a recent fund manager survey by Bank of America shows an ever-growing drumbeat for emerging markets outperformance in 2021. [v]

In addition, a recent Bloomberg survey of 63 investors and traders showed Emerging Markets and China as the overwhelming favorites across multiple asset classes in 2021. [vi]

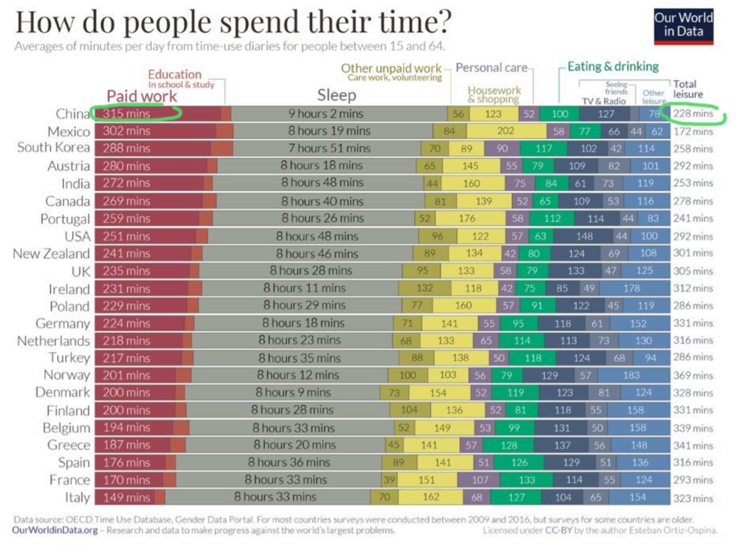

While there are many reasons why emerging markets (and specifically China) are garnering more attention, it might be a matter of work. The Chinese have an anecdotal saying about their work schedule called “996” (work from 9am-9pm, 6 days a week).

Looking broadly across various economies, those that live in emerging markets generally work longer hours and spend less time on leisure. It is pretty clear they should have better growth rates. [vii]

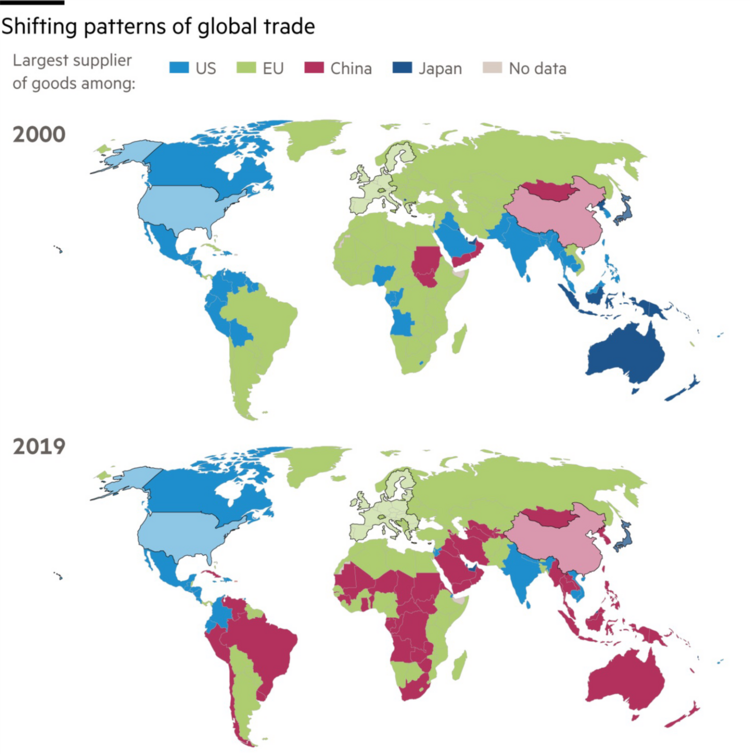

It is no wonder China has become a globally dominant trading player in just over 9 years. I suspect in the coming Biden years, it is going to be hard to convince China to yield their hard-earned economic advantage back to the United States. [viii]

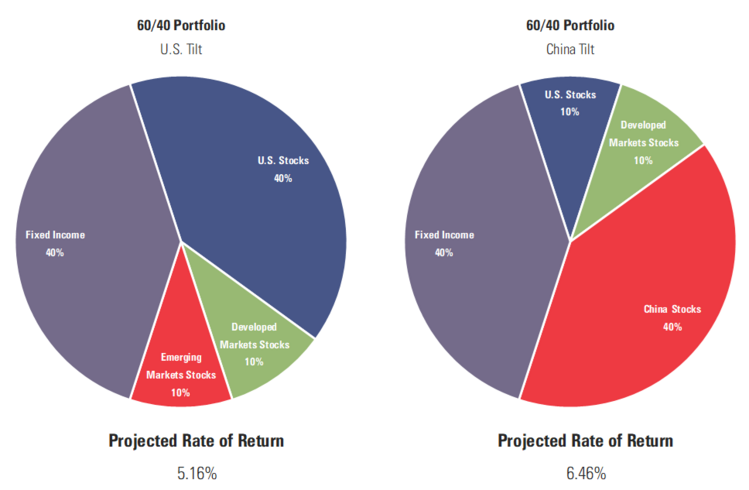

What would it look like if we flipped the allocation, overweighting from the United States to Emerging Markets? It is almost hard to digest since we have spent most of our lives as the dominant player in the world. [ix]

I’m not suggesting this is the portfolio for 2021, but it might be worth taking a hard look at what the future looks like if China becomes the dominant global player in the coming years.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://alpinemacro.com/

ii. https://indices.barclays/IM/21/en/indices/static/historic-cape.app

iii. https://www.bloomberg.com/quote/SHSZ300:IND

iv. https://www.msci.com/msci-china-all-shares

v. https://thedailyshot.com/

vi. https://www.bloomberg.com/news/articles/2020-12-08/2021-emerging-market-rally-on-track-with-vaccine-biggest-caveat

vii. https://ourworldindata.org/

viii. https://www.ft.com/content/af4631f3-fed3-476c-b9c0-bd460a930a48

ix. Phillips & Co. estimates