Energy Growth Returns

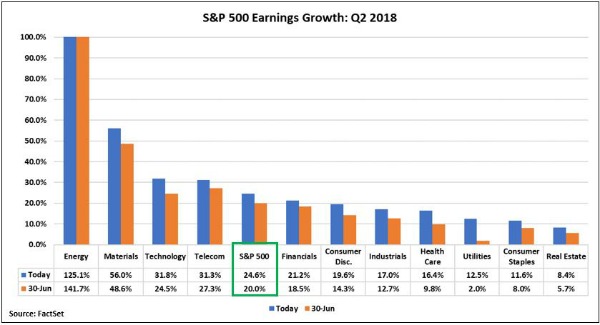

Second quarter earnings reports are approximately 91 percent complete; needless to say, it’s hard to be disappointed. So far, according to FactSet, S&P 500 companies have reported earnings-per-share growth of 24.6 percent, exceeding the expectations of 20 percent growth. [i]

One surprise has been the impact of a strengthening U.S. dollar on corporate earnings. When the dollar is strong relative to other currencies, it makes U.S. goods and services more expensive overseas, and, in theory, it should influence corporate earnings. [ii]

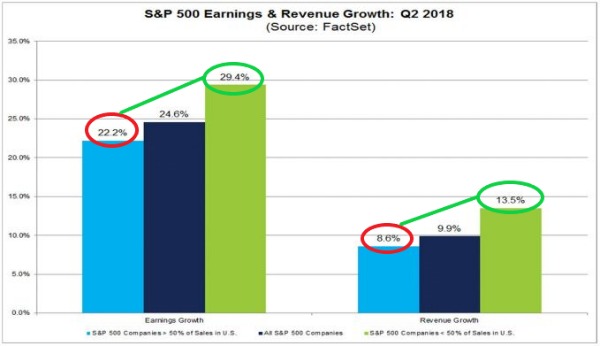

As you can see, over the last twelve- and three-month periods, the U.S. dollar has continued its strong run. However, astonishingly, large exporters have not suffered at all. In fact, they have thrived compared with those that are less dependent on exports.

S&P 500 companies that have less than 50 percent of their revenues coming from within the U.S. grew earnings by 29.4 percent, while those with more than 50 percent of their revenues coming from within the U.S. grew earnings by 22.2 percent. Although it wasn't just earnings growth, the same breakdown of companies grew revenues by 13.5 percent and 8.6 percent, respectively. [i]

One of the biggest factors that drove these earnings was the strong rally in the price of crude oil; the United States is now the largest oil producer in the world. [iii]

In fact, over the past twelve months, the price of crude oil has risen 36.13 percent, and it increased 14.15 percent just during the second quarter. [iv] [v]

Now one thing I would like to point out is that expectations for earnings growth next year become extremely muted compared with what we have experienced in 2018. Analysts are expecting Q1 2019 earnings-per-share growth of 7.3 percent and Q2 2019 earnings-per-share growth of 7.8 percent. [i]

However, if we continue to experience rising oil prices, we could see these expectations for the first and second quarters of 2019 far exceeded. After all, both Iran and Russia are facing increased sanctions that may affect the price of oil given that these countries are among the top ten oil exporters in the world. Additionally, these two combined, make up 15.9 percent of global oil exports. [vi]

Keep an eye on oil prices because Energy just may be a large driver of any earnings growth surprises in 2019.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

ii. https://fred.stlouisfed.org/series/TWEXB

iii. https://www.investopedia.com/investing/worlds-top-oil-producers/

iv. Bloomberg, L.P.

v. https://fred.stlouisfed.org/series/DCOILWTICO

vi. http://www.worldstopexports.com/worlds-top-oil-exports-country/