Enough Fire Power

The Federal Reserve held their seminal meeting last week and came to the conclusion that the economy was nearing a point where a rate increase is likely. Fed Chairwomen Yellen said:

"Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal fund’s rate has strengthened in recent months.” [i]

With a little over 70% of our economy driven by consumption, and much of that being fueled by consumer debt, interest rates matter, a lot.

If you think about debt as a tool consumers can constructively use to pay for things they need in the present, while utilizing their future earnings, you can begin to grasp the importance of debt in our economy.

A simple example is a buying a house. Buying a house requires you to allocate future earnings, while paying interest, so that you can have the home in the present. This is what’s commonly referred to as a mortgage. This also applies to a car loan, or using credit to purchase the equipment a business needs to expand; it applies to anything you can't pay cash for at that present moment.

With rates rising in the future, the question becomes how much debt service (interest payments) can consumers withstand before we see a credit crisis? And we all know what happened during the last one.

Here are a few observations about our current use of debt:

First, the American worker is making more money now (adjusted for inflation) since the start of the financial crisis, on a weekly basis. [ii]

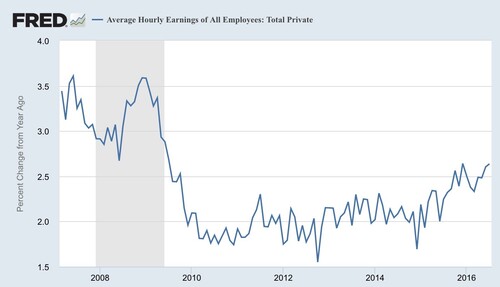

Second, consumer’s average hourly earnings have been increasing at a growing rate since the end of the financial crisis, topping out at the current rate of 2.7%. [iii]

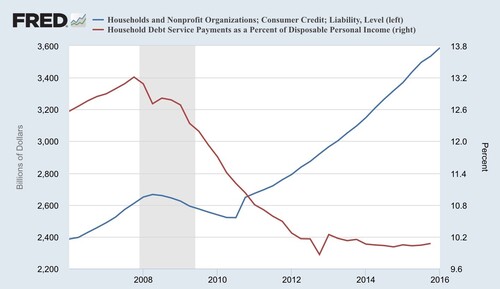

Third, while total debt levels have been growing (blue line, $3.6T) the amount of debt service (red line, interest payments) consumers have been making relative to their disposable income is at a long-term low of 10.1%. [iv]

There are a lot of reasons why consumers may be leveraging up. Perhaps with their incomes growing at a paltry 2.7%, and not at the pre-financial crisis levels of 3.5% per year, consumers feel the need to leverage up. Perhaps, they are more confident about their jobs and instead of utilizing debt, they want to pull forward their current income to buy what they want. Perhaps they have no choice but to leverage up in order to pay for what they need.

In any case, as a percentage of their income, they are certainly in better shape to afford to service the debt now than they have been in quite a while.

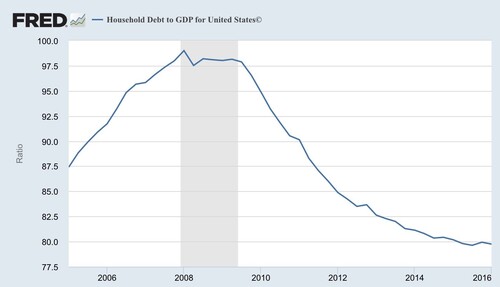

Fourth, while absolute debt levels have been escalating, the amount of household debt to our total economy is at very low levels. [v]

If the Fed does decide to raise rates, odds are currently at a 57.2% chance for a December hike. It seems like the consumer can continue to pull forward future earnings to pay for the items they currently need. Market participants are only currently seeing a 30% chance that the Federal Open Market Committee will increase rates when it meets September 20th through 21st, according to CME FedWatch Tool.

You can see in the below tables the probability of a rate increase from our current range of 25-50 bps, based on what market participants have assigned to upcoming Fed meetings: [vi]

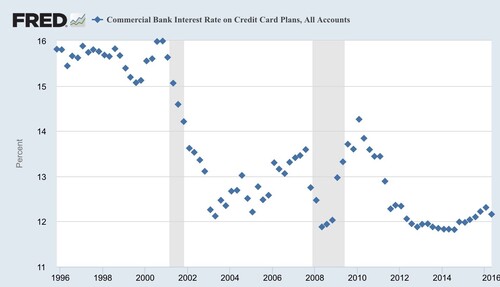

Surprisingly, the consumer has been a net beneficiary of relatively low credit card interest payments which has certainly been helping to keep debt service levels very low. [vii]

Interest payments in the low 12% range are significantly different than the elevated 16%-19% range we experienced in the late 90's. [viii]

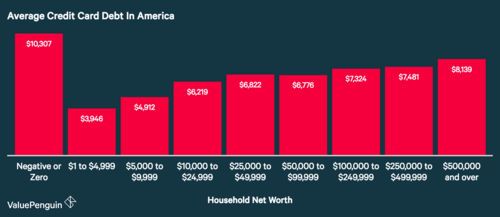

The level of credit card debt that households of a certain net worth are carrying is also very telling. The poorest amongst us are carrying the most debt, and that certainly could be a troubling sign if the economy gets rocky and debt service levels climb.

For now, it appears the economy and consumer can absorb a modest rate increase, while continuing to fuel the macro economy with their consumption. Stable consumer consumption after a rate increase should fuel better earnings growth, even in spite of rising rates.

While it can be hard to hold equities during times when valuations are elevated, the strength of the consumer and their ability to continue spending after a modest interest rate increase, should add some support to current values.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.federalreserve.gov/newsevents/speech/yellen20160826a.htm

[ii] https://fred.stlouisfed.org/categories/24

[iii] https://fred.stlouisfed.org/categories/24

[iv] https://fred.stlouisfed.org/categories/24

[v] https://fred.stlouisfed.org/categories/24

[vi] http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

[vii] https://fred.stlouisfed.org/categories/24

[viii] http://www.valuepenguin.com/average-credit-card-debt