Enough Fuel?

With Congress and the President locked in an epic election season battle over a Supreme Court appointment, one has to wonder if there will be another round of fiscal stimulus.

Let’s assume there is not and the U.S. Consumer and economy has to fend for itself. Looking at some basic data might help shape the picture. Remember, our economic model is predominately based upon consumer spending.

Functionally, the U.S. Consumer is still sitting on significant savings even though they have been spending down those reserves over the past few months. In fact, if they spent back down to pre-COVID levels, it could potentially add an additional $1.97 trillion―or 9.1% of GDP―back into the economy. [i]

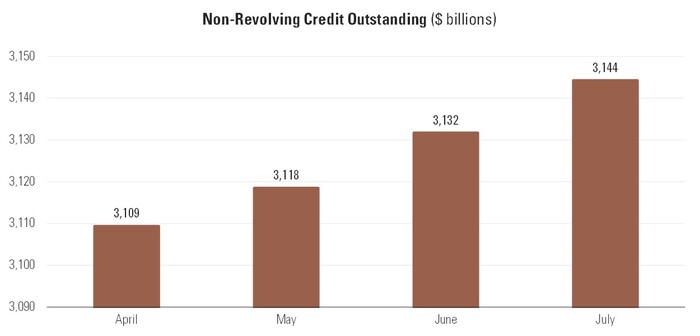

Looking at the U.S. Consumer’s willingness to use credit to make purchases sheds more light on their ability to spend. Non-revolving credit (like mortgages) has been expanding during the COVID-19 pandemic. [ii]

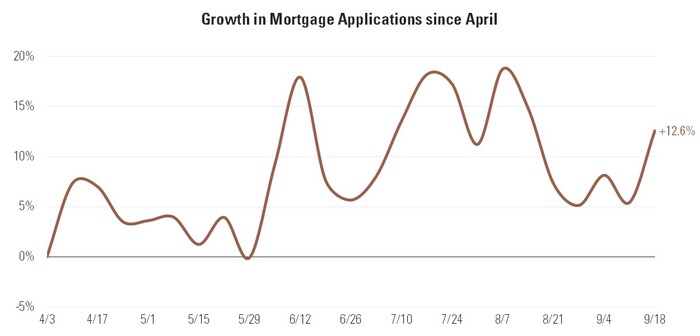

In fact, new mortgage applications have risen 12.6% since April. [iii]

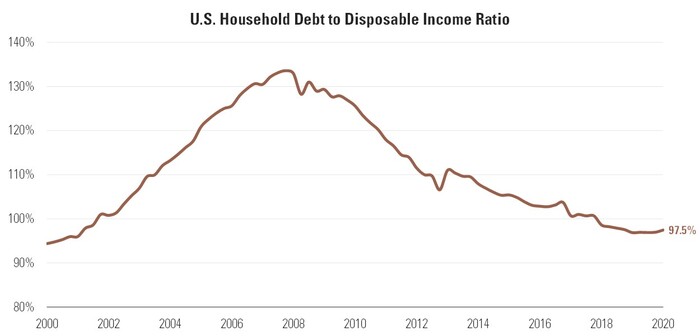

While some economists look at overall debt to income—and that paints one picture—you could surmise the consumer might be tapped out with the current high level of debt to income. [iii]

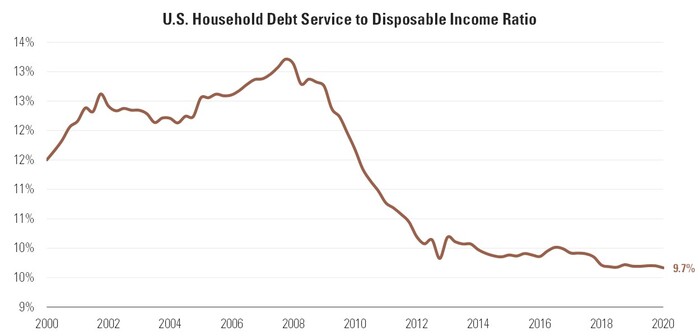

However, when looking at what the consumer pays to service their debt compared to disposable personal income you get an entirely different picture. In my estimation, it’s really about what they pay to service the debt that matters most. [iv]

You can see we are currently at historic lows and well off the Great Financial Crisis (GFC) highs. If consumers spent back to GFC highs that could add a whopping $6.4 trillion to consumption and about 33.1% of GDP that could be added over the coming years.

All that being said, consumers still need to spend and for them to do that on any sustained basis they need to have two things: jobs and confidence.

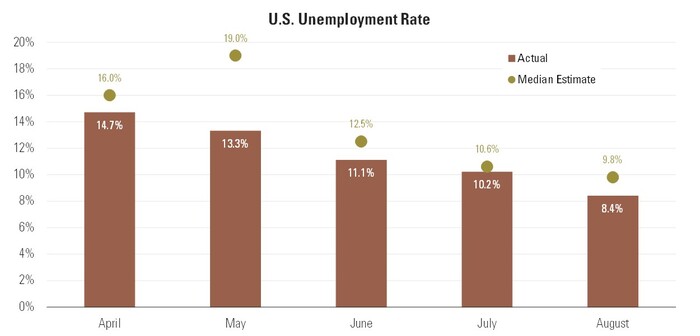

Jobs have been recovering at a faster rate than anticipated and that is certainly good news. [v]

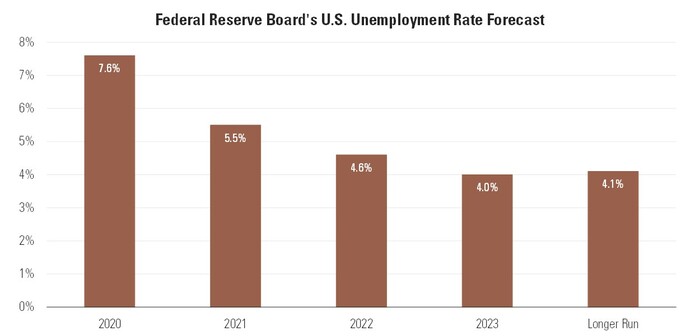

In fact, expectations for the unemployment rate to drop to as low as 6.6% by year-end are starting to be baked into estimates. The Fed has also lowered their unemployment forecast, now projecting a 7.6% rate at year-end compared to their June forecast of 9.3%. [vi]

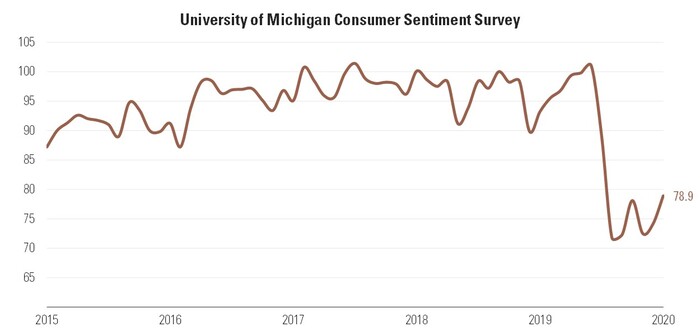

As for confidence, the University of Michigan Consumer Confidence index surprisingly rose in September. With increases in infection rates, political instability, and social unrest, the consumer seems to be more optimistic than expected. [vii]

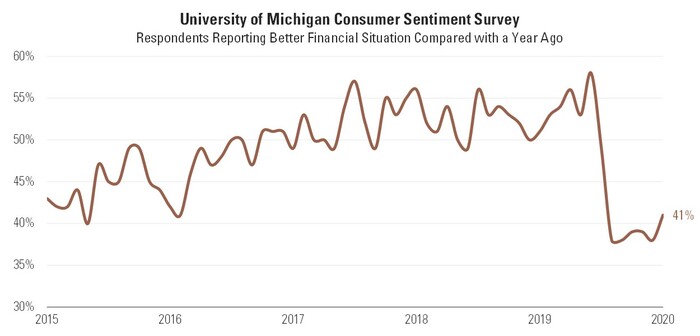

Further, the share of respondents reporting their finances improved over the last year reached 41%―the highest reading since March―but remains below the all-time peak of 58% in February. [vii]

In my estimation, there might just be enough fuel in the consumer’s tank to pull us through this medically-induced economic coma. We still need jobs and if we are going to be near 6% unemployment by the election, we might just make it out of this without our dysfunctional government needing to come to the aid of their country.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/PSAVERT

ii. https://fred.stlouisfed.org/series/NONREVSL

iii. https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/weekly-applications-survey

iv. https://fred.stlouisfed.org/series/TDSP

v. https://fred.stlouisfed.org/series/UNRATE

vi. https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20200916.htm

vii. http://www.sca.isr.umich.edu/