Exhausting

By now you might be developing some investor fatigue as market volatility adds more difficulty to the already complex art of investing. After all, we have experienced 16 days of triple digit moves in the last 30 trading days. [I]

Perhaps, you might be thinking, "When will this ever end"? Or, "How much more of this volatility can I take"? The volatility roller coaster can be a cruel ride.

That's why it's around this time in market cycles I dust off a few key lessons I've learned from 30 years as a professional investor.

Much of this I have written about in prior posts, but it's worth repeating.

1.) Earnings growth matters, not speculation-

As much as investors get lost in charts, technical patterns, volatility, and talking heads on TV trying to explain away the latest gyrations in the markets; the true measure of market and stock performance is earnings growth and dividends. Not simply earnings, but the growth rate of a company's dividends. After all, when you buy a stock, you've already paid for the existing earnings. What matters is the future growth in earnings and the dividends you are trying to buy. You can see over the last 100 years, earnings growth accounted for 5% of the 9.6% of total return. Dividends made up 4.5% points and speculation (as measured in P/E change) made up only 0.1%. Now, considering we have had zero earnings growth in Q3 and don't expect that to change until Q4, we should expect extreme volatility to persist through the rest of this month. [II]

2.) Markets move in brief bursts-

Corrections happen quickly and recover quickly. Just look at the timing of this correction from peak in May to 10% down (correction) and then recovery. [III]

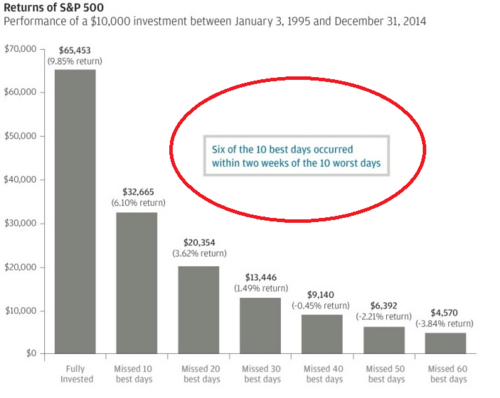

It's virtually impossible to consistently time exits and entries when markets move this quickly. Further, and this is probably more relevant than speed of the market, missing the best up days in the market impacts your returns significantly. Take special note on when the best up days occur relative to the down days. [IV]

3.) Extreme market declines push correlations of most asset classes to 1-

When markets drop significantly, the theory of some asset classes providing pure protection tends to fail. For example, bond holdings tend to get sold along with stocks when investors are desperate to raise cash and hide. This pushes asset classes that are not well correlated, like stocks and bonds, closer to acting in unison. Asset classes moving closer to "1" generally happens during times of extreme market events. The good news is the percent of time we experience extreme events is very rare. In fact, 95.56% of the time we experience normal market behavior of 1 standard deviation (sigma event). [V]

4.) Financial crises are different-

My rules of thumb all work but one cautionary notes is when we are facing a financial crisis. Returns and behavior tend to get extended and exaggerated for much longer when we face a financial crisis vs. a routine correction. The good news is a financial crisis is easier to spot than one would think. Most financial crises are debt induced similar to our housing crisis in 2008. We currently do face one looming debt crisis and that's with China. However, their banking system is in much better shape than we were in 2008. Here's what Nicholas Lardy said in his book, Markets over Mao as it relates to China debt.....

"China’s national saving rate, reflecting the combined savings of households, corporations, and the government, approaches 50% of GDP, significantly higher than any other economy in recorded history. Like households, countries that save more can sustain higher debt burdens. Second, the vast majority of this debt is in domestic rather than in foreign currency…Thus, its debt does not involve any significant currency mismatch, a major contributor to many financial crises. Third, the majority of this debt has been extended by banks, and China’s systemically important banks are financed entirely by deposits rather than through the wholesale market…Finally, the government has enormous scope to further increase bank liquidity should that become necessary. Other factors, too numerous to list here, also suggest that a banking crisis is far from certain in China."

5.) Time matters most-

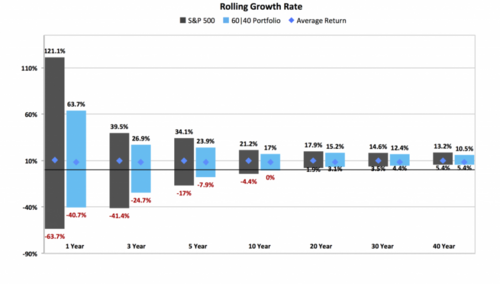

Of all the lessons I've learned, time in the markets matters most (not timing the markets). While you can't exactly control the risk of a portfolio, you can control the time you hold that portfolio. When you allow yourself enough time, you can shape some of the risk out of the asset. Simply take a look at the chart below. Intuitively, shorter time frames add significant risk compared to holding assets for longer periods of time. [VI]

As exhausting as this current bout of volatility might appear, it's not unexpected. Due to weak year-over-year earnings, market participants will react to anything and perhaps everything. Our job is to put the odds in your favor and we fight investor fatigue by staying true to lessons learned over the last three decades.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

References

[i] Dow Jones Index, 100+ bps moves Aug 10, 2015 - Sept 8, 2015

[ii] http://www.mymoneyblog.com/total-stock-returns-fundamental-speculative-returns.html

[iii] http://www.advisorperspectives.com/dshort/updates/Current-Market-Snapshot.php

[iv] J.P. Morgan Guide to Retirement, 2015

[v] https://blogs.cfainstitute.org/investor/2012/08/27/fact-file-sp-500s-sigma-events/

[vi] http://gestaltu.com/2013/09/planning-adverse-scenarios.html