Expectations VS. Reality-"Triple Not So Fast"

We have now entered the third quarter 2015 earnings reporting period. While speculation creates short term excitement, earnings generally drive long-term results. [i]

It's clear to me, speculation is driving the current recovery in the market. These last three weeks we have seen the S&P 500 rally 3.35%. [ii]

Much of this, in my opinion, is driven by hopes of a delay in the Fed raising rates. In fact, futures markets are not expecting rates to increase this coming month and only a 29% chance of a rate increase in December. [iii]

Certainly market participants, including us, welcome this relief rally. Unfortunately, some facts are hard to run from. Most important is the confirmation we are in an earnings recession.

When reviewing the most recent earnings summary (provided by Factset), we can see how expectations are trumping reality. [iv]

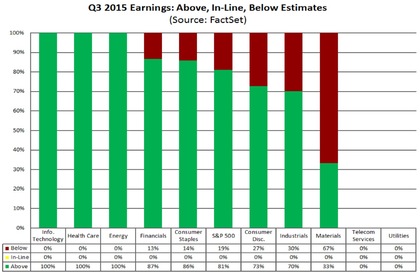

Of the mere 58 S&P 500 companies to report earnings, 81% have beat earnings expectations. Certainly a reason to celebrate. "Triple Not So Fast" as famed football coach and commentator Lee Coros is known to say. When we look at the reality of earnings versus expectations, we get an entirely different picture. [v]

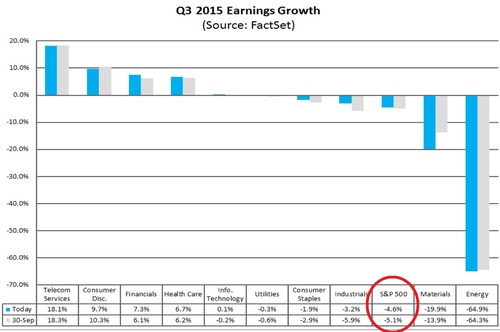

When looking at the same 58 companies to report, the average earnings decline is -4.6%. This would put us in an earnings recession as we discussed in our quarterly look ahead.

As you review in detail the data above you can see some positive trends in sectors we currently favor: Healthcare, Financials and Consumer Discretion. Our bias is expressed in our tilt toward growth vs. value.

By moving from value to growth, we are capturing 280 bps more exposure in Healthcare and 710 bps more exposure in Consumer Discretionary. [vi]

We went on record in our blog post on August 31st, 2015 that we expected a relief rally to start at the end of Q3. However, our expectation was based upon investors trading on Q1 2016 earnings (which should return to growth), as opposed to a delay in a rate increase.

Expectations might be trading ahead of reality and in the nearly three decades of investing, this is not uncommon. Perhaps, reality will catch up to expectations before we feel another challenging pull back.

"Triple Not So Fast" could catch up with fantasy land.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.mymoneyblog.com/total-stock-returns-fundamental-speculative-returns.html

[ii] https://finance.yahoo.com/echarts?s=%5EGSPC+Interactive#{"range":"1d","allowChartStacking":true}

[iii] http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

[iv] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.16.15

[v] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_10.16.15

[vi] Morningstar Direct, Russell 1000 vs. Russell 1000 Growth