Fake News!

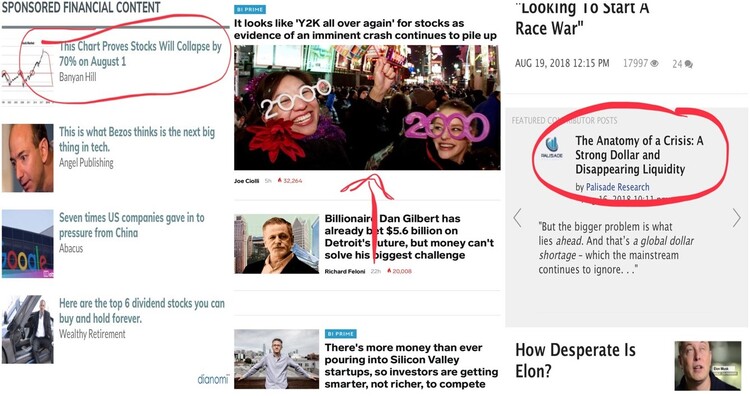

Fear sells! There is no question about it, especially when it comes to the uncertainties associated with investment performance. To the untrained eye, or simply to regular investors managing their own portfolios, it’s extremely difficult to differentiate between what’s real and what’s fake.

Just look at some of the content I had to wade through when taking in the news from three websites: Zero Hedge, The Daily Beast, and Business Insider.

Frankly, I’m surprised anyone would be an investor at all after being inundated with so much click bait.

From my experience, most investors don’t have the tools necessary to evaluate competing claims. Generally, investors tend to lack an appreciation of what works when investing, and without that appreciation, anything can creep into their mindset— and far more easily, I may add, with the help of plenty of fake news, such as the kinds shown above.

With volatility increasing over the past ten days, both politically and in the markets, allow me to review some key principles I’ve picked up along the way. [i]

First, your investments should be the output of your plan; it’s that simple. As an investor, you should have a plan that helps you target a rate of return that meets your objectives. Put another way, careful planning should be the primary driver of your asset allocation. [ii]

As obvious as that sounds, few investors engage in basic planning. Instead, they end up with an asset allocation that likely meets someone else’s goals (brokers’, promoters’, investment sponsors’, investment managers’), but not their own.

A recent survey by Charles Schwab has shown, “…three in five Americans live paycheck to paycheck and that only one in four [has] a written financial plan, but those who do exhibit positive investing and saving behavior.” [iii]

Schwab’s survey also shows that only 25% of Americans have a written plan that outlines their investment objectives. The survey points out the differences between planners and non-planners when it comes to investing. [iii]

The second key principle is how time shapes risk when it comes to investing, especially when investing in equities. [iv]

Financial plans should carefully evaluate the time investors have to allow their assets to “soak” and absorb the risk associated with the returns those assets can provide. If investors lack the necessary time to allow for the potential reductions in risk, perhaps they need to accept less return (and less risk) or choose a different goal altogether.

The third key principle to understand is that equity markets correct all the time. I know that may seem strange to say considering the last ten years, but history shows it’s true. In fact, markets often pull back. [v]

Again, it’s all about time. As you can see from the table below, markets can correct quickly, but it takes them longer to recover. Investors need to have time in their plans to absorb those normal gyrations in order to capitalize on the benefits of having equity exposure. [vi]

And the final key principle is the concept of market timing. Any thought of “timing the market” versus “time in the market” is a fool’s errand. The average investor who tries to time the market ends up with dismal returns and, in most cases, will fail to meet any objective at all. Just look at how the average investor stacks up against various asset classes and blended portfolios. [iv]

Fake news, click-bait, political volatility, and market volatility are all factors that influence and change investor behavior. The key to avoiding that danger is having a strategic plan that drives investment decision making and, more importantly, investor behavior.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can email Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://stockcharts.com/h-sc/ui

ii. Phillips & Co.

iii. https://pressroom.aboutschwab.com/press-release/schwab-investor-services-news/most-americans-dont-have-financial-plan-and-many-think-t

iv. https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_3Q18_linked.pdf?segment=AMERICAS_US_ADV&locale=en_US

v. https://PHILLIPSANDCO.COM/blog/a-brief-word-from-our-sponsor-risk/

vi. https://PHILLIPSANDCO.COM/files/9615/1519/3009/Look_Ahead_2018Q1_-_Final.pdf