Feeling Anxious?

This past week I’ve heard from several of our clients. Realize we serve over 18,000 employees in 401(k) plans and thousands of individuals. Our data set is pretty broad, and I get a good feel for what they are thinking.

There seems to be an anxious mood of late. Their businesses and jobs are going well, the economy is in reasonably good shape and yet they are not happy. Call it an unspecified anxiety.

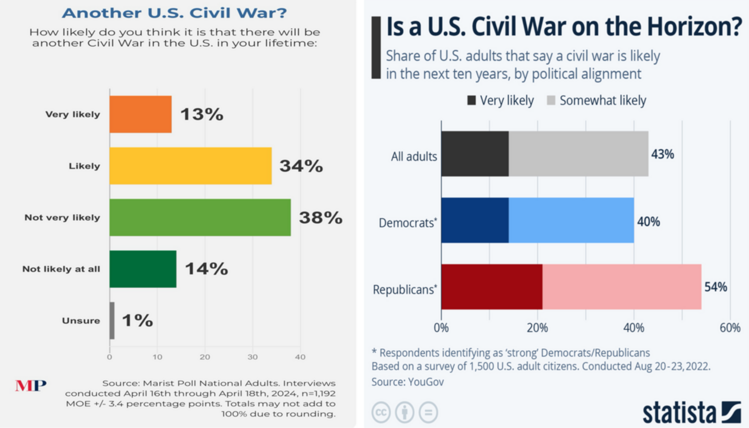

The data on consumer sentiment and mood perhaps confirms this vague anxiety. In the most extreme, the number of Americans who think there will be some kind of civil war in their lifetime is fairly high. 47% think it’s likely or very likely according to a recent survey by Marist. However, we have felt this way since 2022. Feelings of instability have been around for quite some time. 1 2

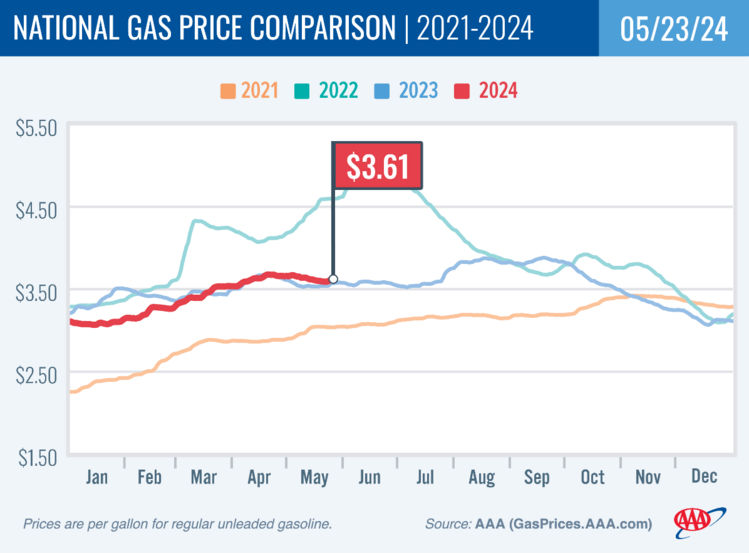

The despair is not really about the divisions in America specifically. The foul mood continues to be about the economy and inflation. First, gasoline prices are still stuck at 2023 levels and while they are below peak, Americans want cheaper gas! 3

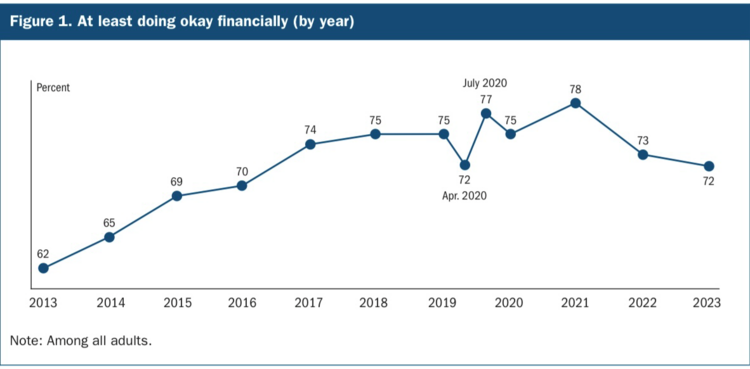

The Federal Reserve just released their Economic Well-Being of U.S. Households for 2023. The findings were not very good for the current political administration and reflect a pretty dour mood for the American consumer. Here are a few quick highlights:

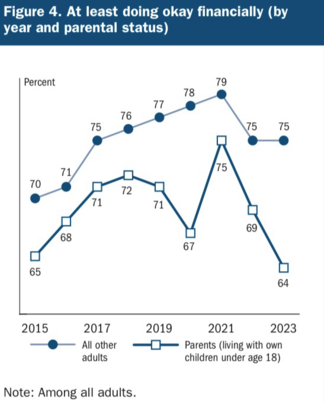

Americans are still not feeling as good about their financial picture post the influx of cash provided by the Federal Government during the Covid pandemic in 2020-2021. 4

If you are a parent, you are feeling much less “okay” than you did at the time of the Covid cash drop. That’s a lot of folks feeling relatively worse off, likely driven by the high cost of childcare. 4

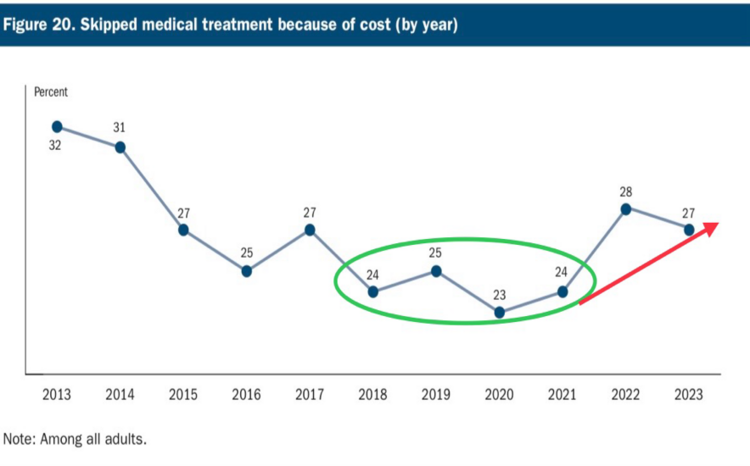

Here’s an interesting statistic – more people skipped medical treatments in 2023 and the trend has been gathering momentum for a couple of years. Neglecting your health because of high costs can have a dramatic effect on your mood and mental health. 4

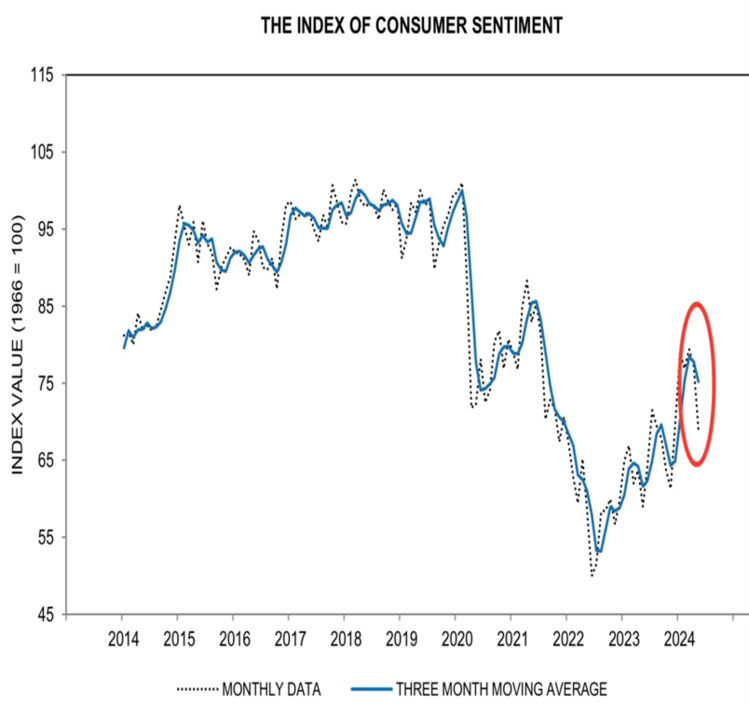

Overall consumer sentiment also ticked down last month according to the University of Michigan Consumer Sentiment Survey. 5

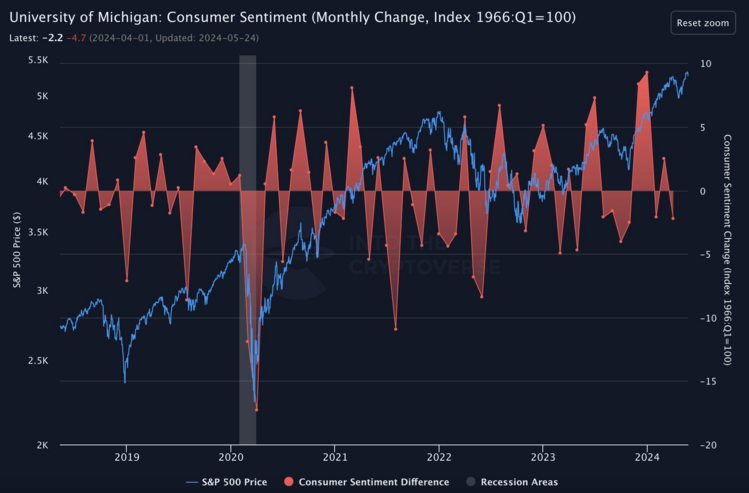

Realize consumer sentiment is very volatile, as are people’s moods. You catch me at the wrong time, and I could fill out a survey that would seem desperate. However, when you overlay the S&P 500 on the Consumer Sentiment chart you can get a feel for the long-term equity trend notwithstanding some modest connection between sentiment and the S&P 500. Moods can swing but equity returns tend to churn higher. Declining moods can provide the Fed with the room they need to cut rates. 6

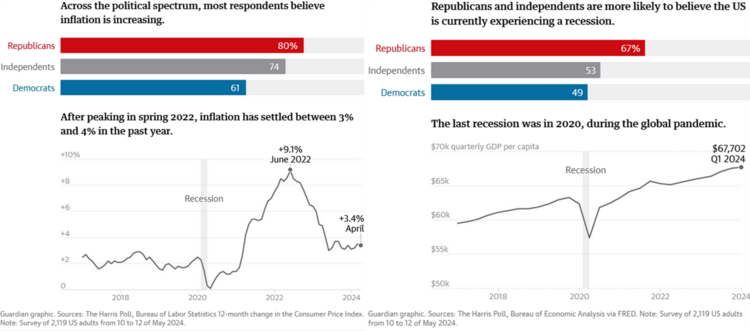

Another recent survey by Harris suggests Americans across the political spectrum still find inflation strong although the rate of change is moderating. Even worse is the fact that those same Americans find the U.S. in a recession right now. 7

When I start to feel that uncertain, hard-to-identify, anxious mood; I remind myself of two things:

Underspend to oversleep. Nothing puts me in a better mood than making sure I am not overspending and saving more. Sleeping well at night without financial concerns is a great cure for some anxiety.

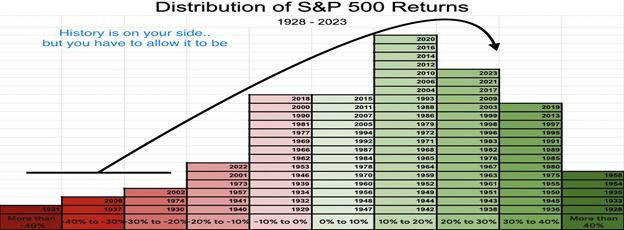

I also review this chart. 8

When you think about the worst that has happened over the last nearly 100 years, the odds of positive returns in the long run are well in our favor. The times being down between negative 20% to over 40% compared to being up 20% to over 40% are so few. I just have to remember to keep those odds in my favor.

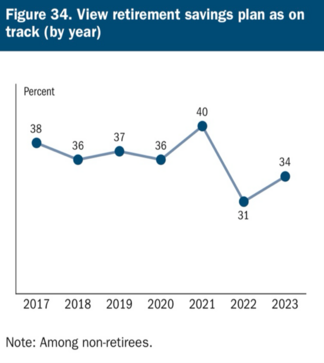

One final thing that you can do when you feel generally anxious about the economy and your financial well-being: Get a better plan – only 34% of Americans feel confident in their retirement plan. 4

Moods and sentiments can indeed feel incredibly real, and it's natural for us to react based on how we feel. It’s also what makes equity investing so challenging. Sometimes the best thing to do is to do nothing. If you have to do something, connect with us and we can help walk you through your plan and how it will likely do in most circumstances.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://maristpoll.marist.edu/polls/a-nation-divided/

- https://www.statista.com/chart/28200/is-a-us-civil-war-likely/

- https://gasprices.aaa.com/pump-prices-hit-the-rest-stop-ahead-of-long-holiday-weekend/

- https://www.federalreserve.gov/publications/files/2023-report-economic-well-being-us-households-202405.pdf

- http://www.sca.isr.umich.edu/charts.html

- https://x.com/ITC_Macro/status/1794073581086732742

- https://theharrispoll.com/

- https://x.com/StockMKTNewz/status/1741226233709334533