Flying Blind in Neutral

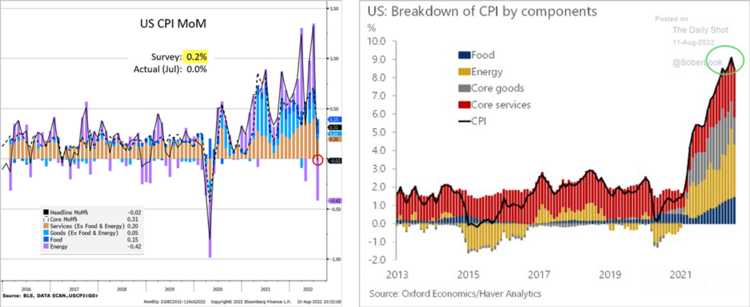

Last week’s report on consumer prices finally gave a little respite to the onslaught of inflation news. The month-over-month change in consumer prices was zero, with a moderation in the year-over-year rate. 1

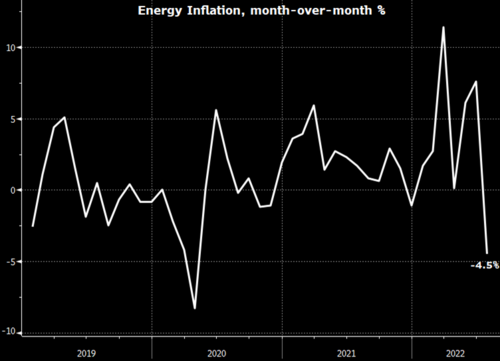

Energy prices were the main contributor to the easing of inflationary pressures. 2

Further, prices for hotels, airfares, wholesale gasoline, and producer prices all suggest further declines in inflation for the month of August. 2

While one month does not make a trend, two months starts to suggest something is happening with the macro picture. That’s my expectation – that we are at peak inflation and should see declines over the next 12 months. The amount and velocity are certainly in question.

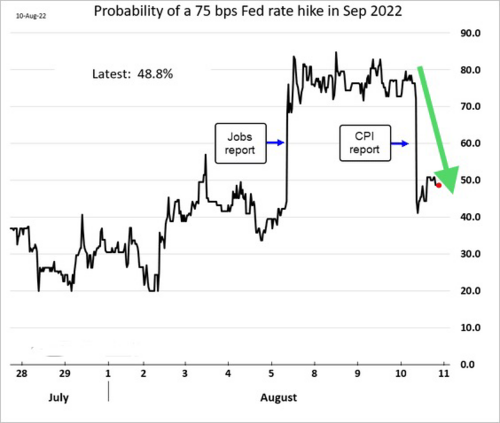

It’s interesting to note that futures markets are now falling in line with our expectation for a 50 basis point rate increase in September as opposed to 75 basis points. 1

Buried in the comments Fed Chair Powell made in July just after raising rates 75 basis points were a couple of important tidbits:

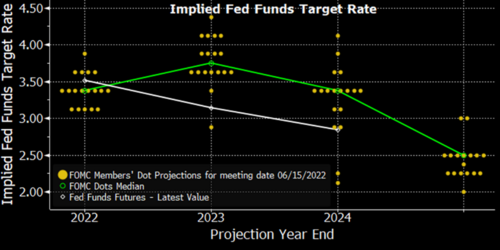

One, he suggested in two different comments during one press conference we are now at a neutral rate on the Fed Funds: 3

“So I guess I’d start by saying we’ve been saying we would move expeditiously to get to the range of neutral. And I think we’ve done that now. We’re at—we’re at 2.25 to 2.5 [percent], and that’s right in the range of what we think is neutral.”

“And I also mentioned that, as this process—now that we’re at neutral—as the process goes on, at some point, it will be appropriate to, to slow down.”

What does a neutral rate mean? Put simply, it is the federal funds rate that neither stimulates nor restrains economic growth.

That certainly supports our narrative that we are closer to the end of the rate increase cycle than the beginning. 2

This should support equity returns as we work our way through a better Q3 earnings season.

Two, he stated they would not be putting out forward guidance on interest rates: 3

“And we’re going to be making decisions meeting by meeting. We think it’s—we think it’s time to just go to a meeting-by-meeting basis and not provide, you know, the kind of clear guidance that we had provided on the way to neutral.”

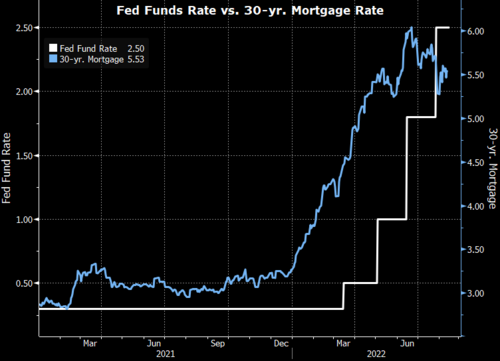

Forward guidance has worked so well in squashing demand, even before Fed Funds rate was lifted. Just look at an overlay of the 30-year mortgage rate compared to the Fed Funds rate. Mortgage rates lifted off well before the Fed lifted interest rates. 2

Why end something so effective? Perhaps the Fed wants to allow the consumer to find their own equilibrium without the jawboning of the Fed? Perhaps the Fed wants to have as much optionality to pause rate increases in the future without being tied to any statements?

In any case we are going to be flying blind on future rate increases beyond neutral. Let’s get ready for more volatility, but perhaps an upward trend in equity prices.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: