From Bear to Boom - The Fastest Recovery in 75 Years

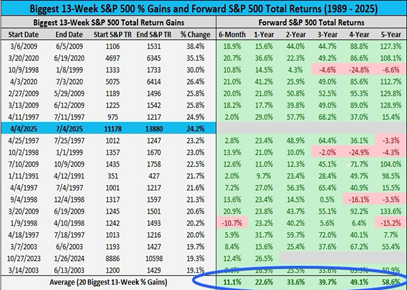

We wrapped up one of the most consequential periods for U.S. equities. The S&P 500 recovered all its losses in the quarter and then some, rising 30% from the April 7th lows.1

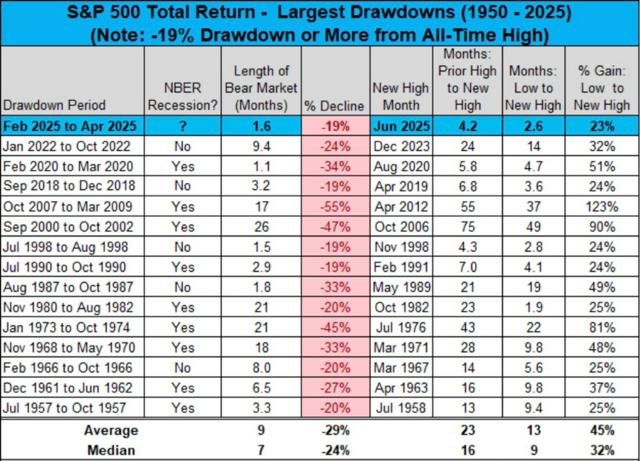

In fact, it’s one of the most rapid recoveries since 1950, with a 1.6 month bear market, no recession, and only 2.6 months to a new all-time high. When we say, “markets move in brief bursts, and if you miss just a few days you lose all the advantages,” we weren’t kidding.2

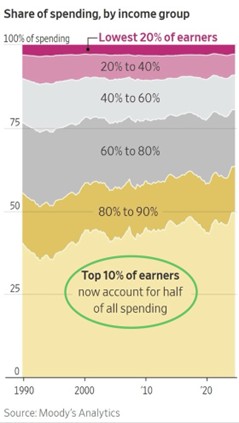

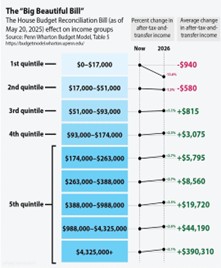

With the passage of the “Big Beautiful Bill” (BBB) over the weekend, another major economic uncertainty lifted. The bill should add some short run fiscal firepower to the overall economy, boosting consumption and corporate earnings.3 While the benefits of the BBB aren’t distributed equally across all income cohorts, the bulk of the tax cuts will help the top 60% of earners, who drive over 80% of consumption.4

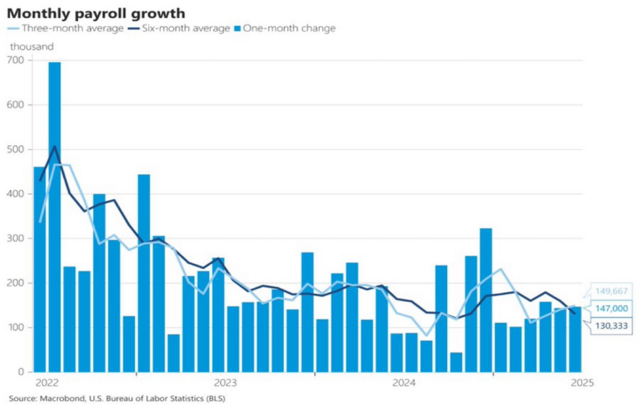

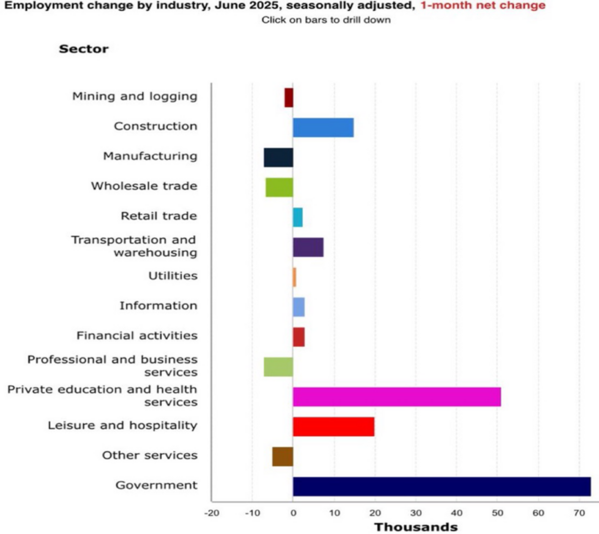

The bill’s passage is just in time, in my estimation. While the headline jobs number last week was very favorable for the US economy, adding 147,000 jobs in June, below the headlines was a different story.5

The bulk of the jobs continues to come from government employment, healthcare, and leisure/hospitality. If you combine all the other sectors and eliminate government, you have almost no job gains. The private sector needs the confidence to hire again.6

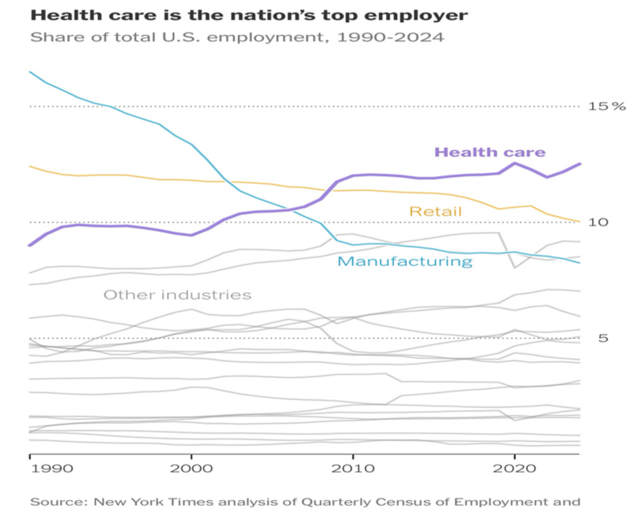

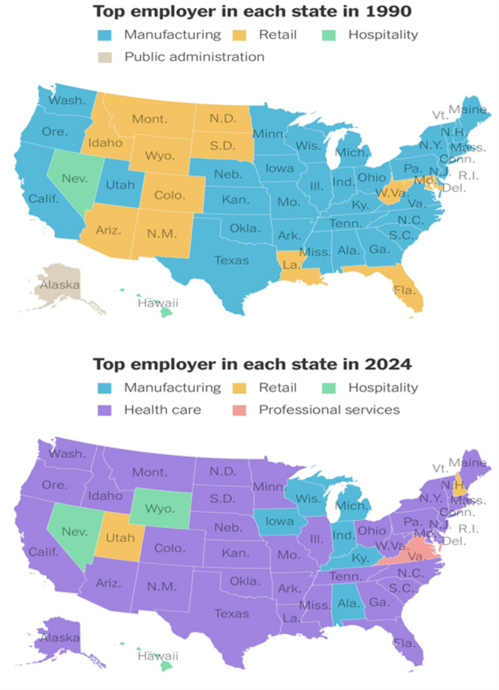

Speaking of healthcare, it’s become the largest employer in the nation.7

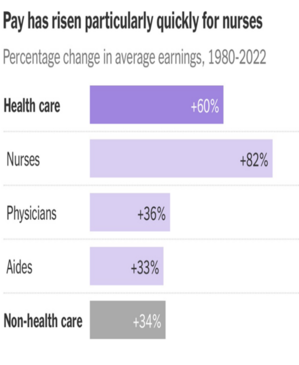

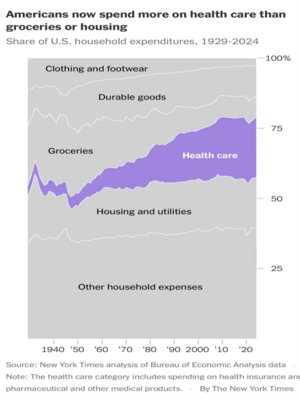

It has the largest wage growth compared to non-healthcare,8 and Americans now spend more on health care than we do on groceries and housing.9

Healthcare has become the top employer in just about every state in the Union.10

This is particularly relevant, as the BBB does have changes to federal health care support. Those changes will put pressure on some states to increase their spending, or recipients will face cuts to support and access. This will merit close attention.

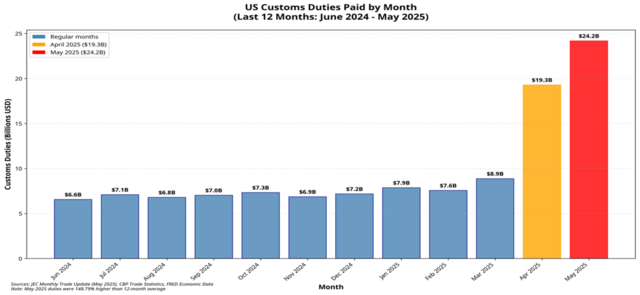

We should have more economic uncertainty lifted this week (or month) as another tariff deadline looms. So far, tariffs are being collected, and at the current rates, that’s nearly 300 billion a year being collected by the US Government.11

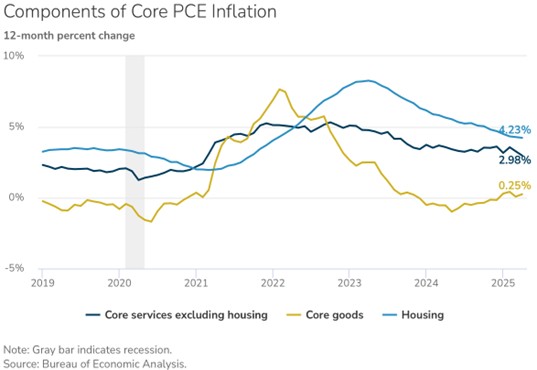

All the while, we still do not see any meaningful price inflation from tariffs collected on imported goods.12

And for those concerned about market tops and rapid price appreciation, historically equity prices can rise even further. Especially if we see more tariff certainty and rate cuts to follow. It doesn’t mean corrections are not in the offering, as they always are.13

Yet the bear to boom cycle is alive and well. You can learn more from our Q3 Look Ahead by clicking the link here.

You can also see my summary of the BBB by clicking here.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- At The Peak, Yet This Signal Points Higher (SP500) | Seeking Alpha

- https://x.com/charliebilello/status/1941546847065022907

- https://x.com/SueRomulus/status/1939571713018065146

- "The US economy Depends More Than Ever on Rich People"

- https://x.com/NickTimiraos/status/1918283292991693176

- https://x.com/TheMaineWonk/status/1940759978547003784

- https://x.com/avatans/status/1940770566442832000

- https://x.com/TruueDiscipline/status/1940766246720753981

- https://x.com/_Eric_Reinhart/status/1940792050749984920

- https://x.com/DrBruggeman/status/1940894594511651220

- the-2025-joint-economic-report-119th-congress-.pdf

- Fed Eagle Ace Pigeon! Kashkari supported last week's interest rate decision, estimating another two yards of rate cuts this year Giant.com - US stock radar

- How Savvy Investors Are Profiting From This $1 Trillion Market Sell-Off | Seeking Alpha

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.