Getting Close to Flatlining

The U.S. economy added another small notch to its macroeconomic growth narrative last week with sufficient growth from retailers. Not surprisingly, traditional brick-and-mortar stores posted a small year over year (YOY) decline of 4 percent, while online retailers posted a strong YOY increase of 18 percent. [i] These results are why it can be difficult to talk about possible early warning signs we see developing in the economy.

Last week we discussed frailty in auto loans. This week we are seeing a reliable indicator, flatlining, move closer to forecasting a recession.

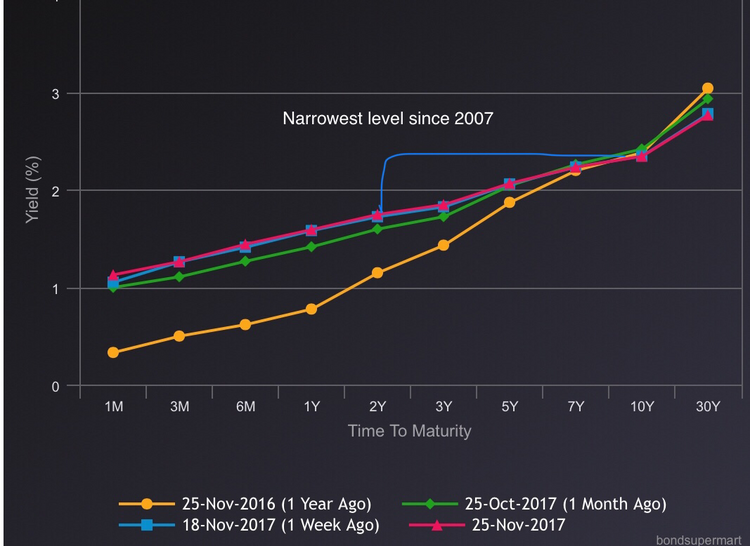

The yield curve, which is a measurement of the yield on treasuries for a period of one month to thirty years, flattened significantly. [ii]

In simple terms, this means investors in fixed income investments are not being rewarded for the extended holding period. In the chart above, the difference between 2-year Treasuries and 10-year Treasuries is 58 basis points. We have not seen this type of flatlining since 2007. [iii]

Why would an investor take on eight years of holding period risk for something as small as half a percentage point of additional interest per year?

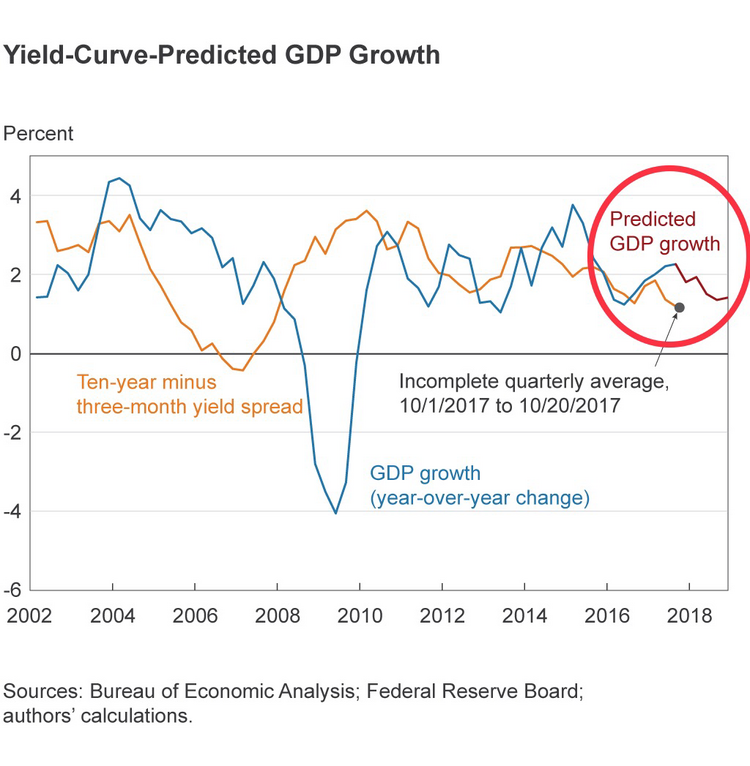

The flattening or narrowing of the yield curve suggests bond investors are not confident in the long-term growth prospects of the economy. Although it does not yet signal a recession, it certainly may signal that a slowdown is in the works. In fact, according to the Cleveland Federal Reserve Bank, a downshift is being forecasted. [iv]

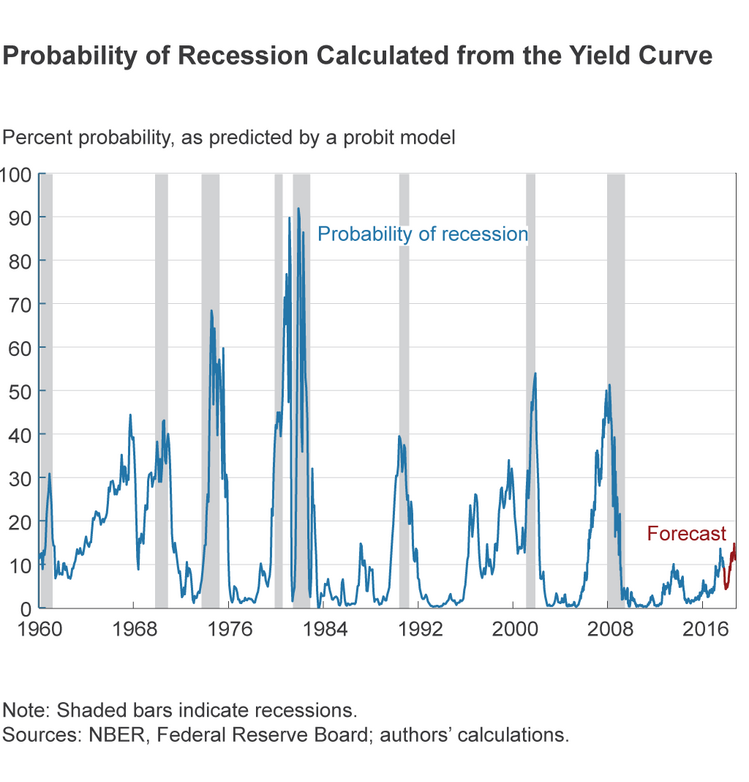

The good news is that even with a flatter yield curve, the Cleveland Fed is not predicting a recession in the next eighteen months; putting the odds of a recession at about twelve percent by October 2018. [iv]

However, the odds of a slowing economy are growing, as credit investors are pessimistic about the future growth of the long-term economy, notwithstanding any tax measures passing Congress.

For the past several years, we have used managers to hold shorter-term bonds. However, from a practical standpoint, investors holding fixed income need to consider the risk/reward of holding longer duration fixed income. When you factor in expenses, cash may be a reasonable alternative at this point.

We continue to expect U.S. stocks to trade in a range until we get to next quarters earnings report. Fixed income becomes a bit trickier to navigate, as this large asset class gets closer to the flat line.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

i. https://www.wsj.com/article_email/inside-the-wal-mart-vs-amazon-battle-over-black-friday-1511733478-lMyQjAxMTE3MDIzNzgyMzc2Wj/

ii. https://www.bondsupermart.com/main/market-info/yield-curves-chart

iii. https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

iv. https://www.clevelandfed.org/our-research/indicators-and-data/yield-curve-and-gdp-growth.aspx