Getting Closer to Breaking

At Phillips & Company we interact with thousands of clients each year. The data points we gather by listening are incredibly powerful.

It’s not infrequent at this stage in an economic cycle, especially with the massive drawdown in portfolios, that clients ask why we don’t move to cash and get out of the way? It’s a fair question; albeit much easier to ask when looking backward compared to looking forward. 1

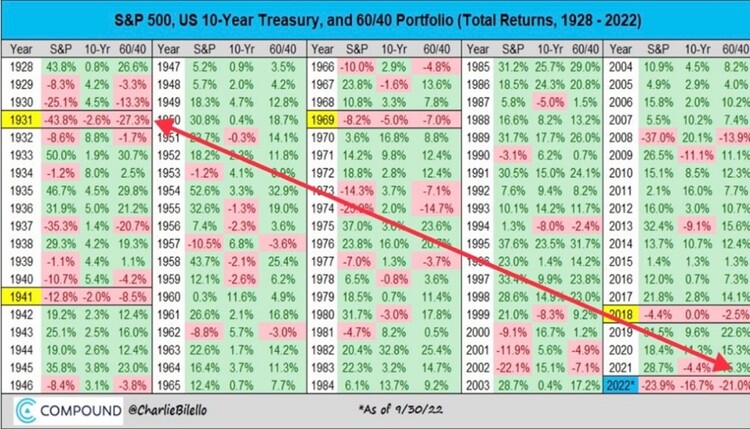

Who didn’t know interest rates were going to rise at the onset of 2022? Here’s what’s hard to know. At that time, the Fed was just starting to taper, not raise rates. Russia was not expected to invade Ukraine and create systemic inflationary pressures. Supply side inflationary impacts were expected to abate by mid-year. Looking back is so much easier than trying to anticipate unexpected future events.

Managing portfolios across full market cycles requires some adjustments but moving in and out of cash is pure market timing.

For me, managing portfolios comes down to principals first.

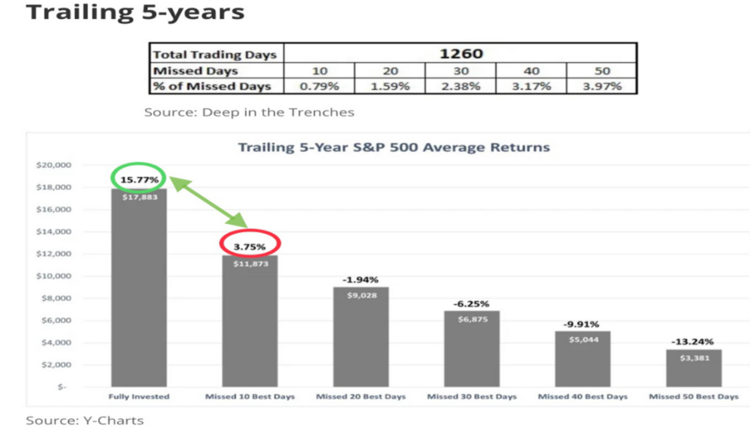

Equity markets move in brief bursts and if you miss just a few days of those moves you can lose all the advantages of investing in equities. 2

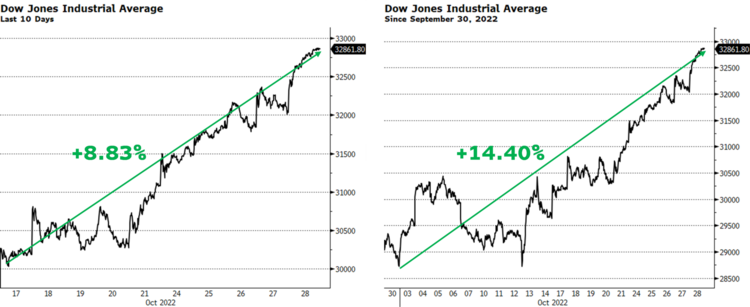

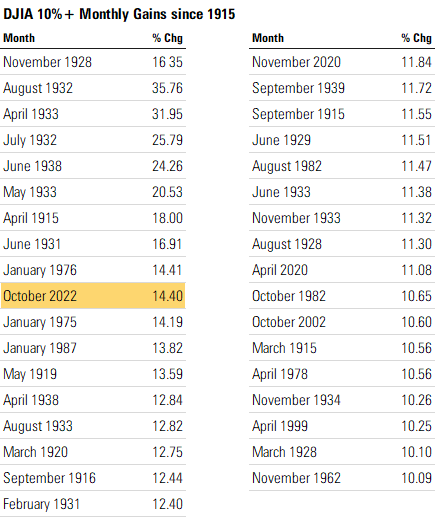

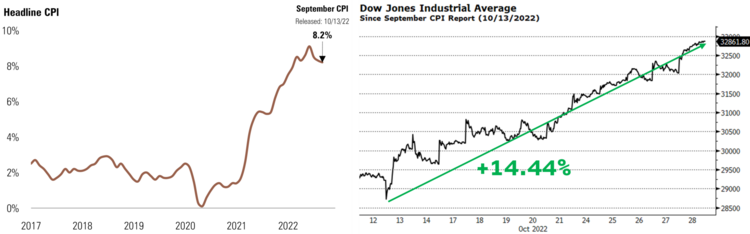

Think about the last 10 days. The Dow Jones rallied 8.83% in just those 10 days and since the end of September it’s rallied 14.40%. 3

In fact, October is set to be the best month for the Dow since 1976. 3

It’s hard to imagine this incredible brief burst was preceded by a terrible print on the CPI (inflation).

The last reading on consumer price inflation was on October 13th, showing an 8.2% increase year-over-year. Clearly this was terrible and signaled the Fed is going to continue to raise rates higher than most had anticipated at that time. That was the exact same date the Dow took off on its historic rally. 3

How could anyone sitting in cash know this was the trigger to get back into equities?

Enough said about timing the markets. We all know it’s not possible. While it’s within all of us to question a long-term strategy, it’s simply not knowable how investors will react to any set of data.

Consider the plethora of economic data released last week.

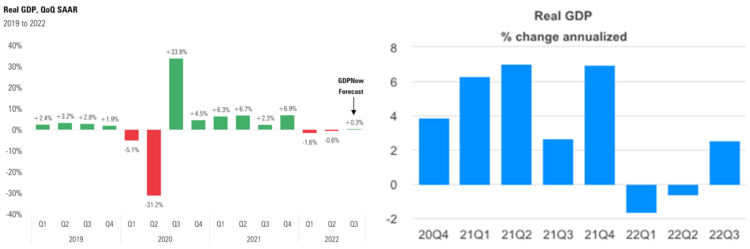

Most investors expected a pretty dour GDP report for Q3 at the onset of the quarter. Some even suggested we were in a recession. It wasn’t a far stretch to believe that, especially after the first two quarters of negative GDP growth. 4

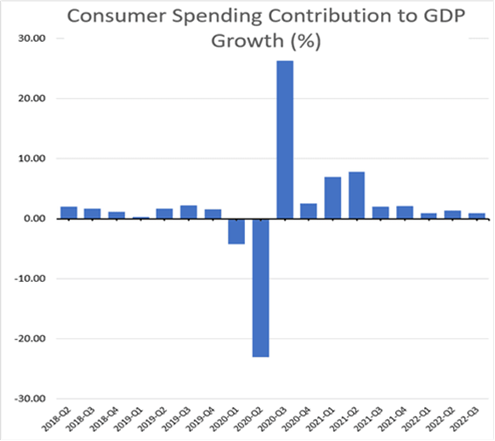

Instead, we had a strong report that overwhelmingly suggests we are not in a recession yet. However, a slowing consumer is certainly not going to be a surprise to anyone with the massive dose of rising rates. Contributions by the consumer to GDP growth will continue to be a challenge until the Fed pauses their aggressive rate hiking cycle. 4

Accompanying a slowing consumer should be an association with slowing inflationary trends.

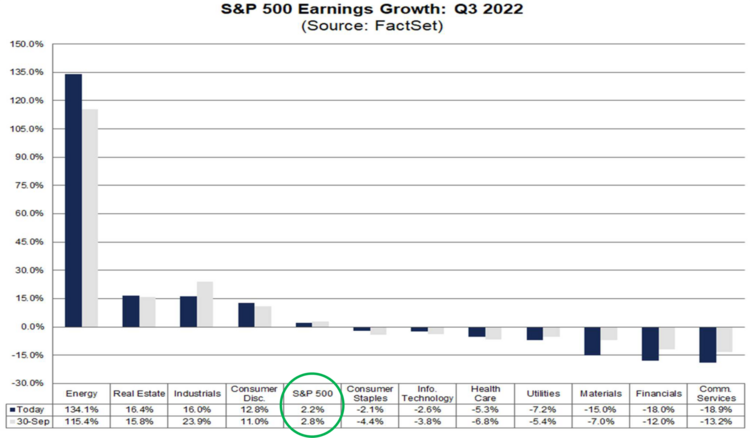

A softening of consumption should be reflected in corporate earnings, and that too seems to be apparent. According to FactSet, “For Q3 2022, the blended earnings growth rate for the S&P 500 is 2.2%. On September 30, the estimated earnings growth rate for Q3 2022 was 2.8%.” Earnings are coming in below expectations and will be the lowest they have been since the pandemic. 6

Again, who can possibly anticipate if markets will rally in light of a bad trend in earnings?

It’s only with hindsight can we hypothesize investors are anticipating an end to the Fed rate hike cycle and moving the mountains of cash they are sitting on back into equities. 7

It’s possible we are getting closer to a collision between the Federal Reserve’s interest rate policy and the real economy. While we are getting closer to breaking the economy, that might just be what investors are wanting to see. But who knew this would be the trigger point? It’s just too hard to time any of this.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://compoundadvisors.com/blog

- https://deepinthetrenches.com/missing-the-best-days-in-the-market/

- Bloomberg

- https://www.bea.gov/data/gdp/gross-domestic-product

- https://www.bea.gov/data/personal-consumption-expenditures-price-index

- https://insight.factset.com/topic/earnings

- https://www.pantheonmacro.com/