Greece Again - Volatility and the Benefits of Diversification

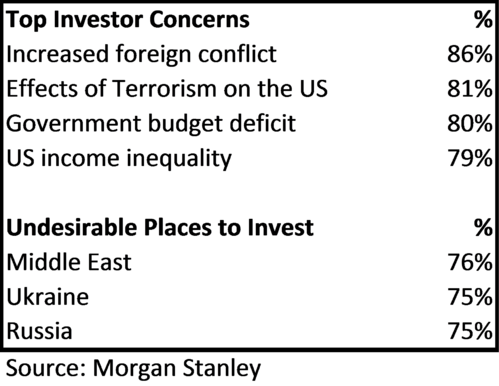

On the face of it, most investors don't really care about what happens to Greece. Foreign conflicts and domestic issues were the top concerns in a recent survey of what concerns US high net worth investors.[i]

However, most of our allocated portfolios contain some form of global equity diversification. You most likely have some money invested in US stocks, International Developed stocks, and Emerging Markets stocks.

Conventional investment and allocation wisdom suggests a diversified basket of equity holdings can reduce risk (volatility) without reducing expected returns.[ii]

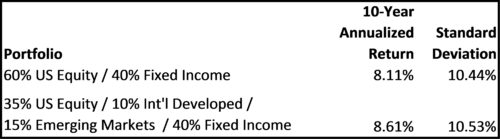

You can see from the table below a traditional 60% equity/40% fixed income portfolio that is solely focused on US equities had a 10-year annualized return of 8.11% with 10.44% risk (standard deviation).[iii]

You can see from the data above, the returns are enhanced at a comparable risk level through the addition of actively managed International Developed and Emerging Market funds.

This is why you see us work to diversify across the globe.

Now back to Greece. While there may be only a very small sliver of Greek equity exposure in the hypothetical portfolios above and 0% actual exposure in our current portfolios, the Greeks may have something to say about your International Developed returns.[iv]

Some definitions may be in order:[v]

- International Developed equities are stocks from countries in Western Europe, as well as Canada, Australia, Japan, Israel, South Korea, Singapore, and Hong Kong.

- International Emerging equities are stocks from countries in Central and South America, Asia, Africa, the Middle East, and Eastern Europe. This includes countries such as Brazil, Russia, India, China, Mexico, Thailand, Turkey, and Egypt.

I'll focus on the Developed countries and specifically Greece for this post, which was downgraded from Developed to Emerging Market status in 2013.[vi]

The European Union has integrated European countries together financially in a manner unlike any other in Europe’s history. Regrettably, Greece is a member of this union.

Greece is a serial defaulter on debt. It has defaulted on external sovereign debt obligations five times in the modern era (1826, 1843, 1860, 1894, and 1932).[vii]

Unlike other countries in the EU, Greece has some issues: [viii,ix,x]

- High unemployment

- High budget deficits

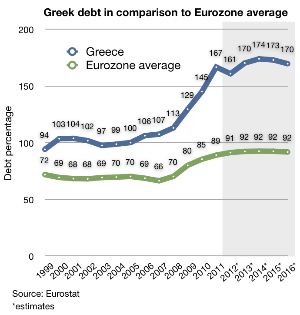

- High debt level, nearly double the Eurozone average

- High levels of tax evasion, up to 30 billion Euros per year in uncollected taxes

- Social services (health care, pension) equal 31.9% of all state expenses (2012).

On top of those fiscal issues, Greece is running a total debt to GDP ratio of 174.9%. Compare that to the United States’ ratio of 101.5% and you get the picture.[xi]

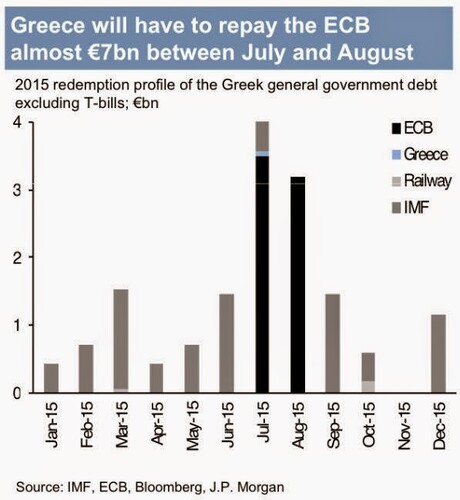

Oh, one more small detail. That debt is due any month now and the lenders want to get paid. July looks particularly painful as Greece will owe its EU brethren lots of money as opposed to the IMF, which is located a few blocks from the White House.

As there is no method to exit the EU for member countries, the rules are being made up on the fly.

- Perhaps the Greeks will default and exit, converting their EU debt and currency back to their old drachmas?

- Perhaps they will renegotiate the interest rates they are paying now (about 3% to 4% average for the IMF loans and 11% on Greek government bonds).[xii,xiii]

- Perhaps they will simply extend the debt out buying themselves more time to address their fiscal challenges at home.

No one knows what to make of Greece’s negotiating stance, but certainly we can expect some pretty rocky times ahead for developed market equities unless the Greeks come to terms with their reality.

The last time the Greeks faced such dire consequences (2011), we saw developed market equities drop by 25% only to rally by 60% in the subsequent 32 months after they negotiated terms.[xiv,xv]

I suspect we can expect the same this time. That's why we have been considering lowering our Developed Markets exposure and preparing to hold through the volatility. The long-term diversification benefits outweigh the risks in the short run.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Morgan Stanley. (Jan 26, 2015). High Net Worth Investors Optimistic About 2015.

[ii] Saletta, C. (Aug 13, 2014). Why Portfolio Diversification Is Vital to Investing Success. Motley Fool.

[iii] Morningstar Direct.

[iv] Artisan Funds and Vontobel Asset Management. (Dec 31, 2014). Fund holdings.

[v] Wikipedia. Developed Markets and Emerging Markets.

[vi] Stoukas, T. and El Madany, S. (Jun 12, 2013). Greece First Developed Market Cut to Emerging at MSCI. Bloomberg Business.

[vii] Fox, E. (Sep 19, 2011). The History of Greek Sovereign Debt Defaults. Investopedia.

[viii] O’Brien, M. (Nov 14, 2014). Greece’s recession is over, but its depression will be the worst in history. The Washington Post.

[ix] Wikipedia. Economy of Greece.

[x] Wikipedia. Tax evasion and corruption in Greece.

[xi] TradingEconomics. (Feb 17, 2015). Greece and US Government Debt to GDP.

[xii] Chrysoloras, N. (Feb 2, 2015). Greece Seeks Third Debt Restructuring: Who’s on the Hook? Bloomberg Business.

[xiii] Ip, G. (Feb 11, 2015). Benefit of ECB’s Bond Buying: Fiscal Breathing Room. The Wall Street Journal.

[xiv] Morningstar Direct. 4/30/2011 to 9/23/2011 and 9/24/2011 to 6/6/2014.

[xv] Google Finance. EFA Index, price return only.