Grinding Upward

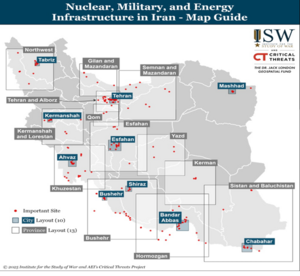

The recent conflict in the Middle East between Israel and Iran has been on the radar for a long time but until now was always a low probability event. No longer. The missile strikes bring a host of new geopolitical risks beyond tariffs.1 Israel struck key Iranian infrastructure that will certainly damage the country’s energy capacity.2

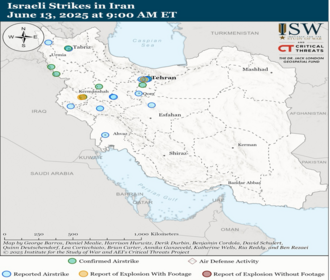

The initial strike was followed by the historic pattern of a sharp spike in oil prices.3

The initial strike was followed by the historic pattern of a sharp spike in oil prices.3

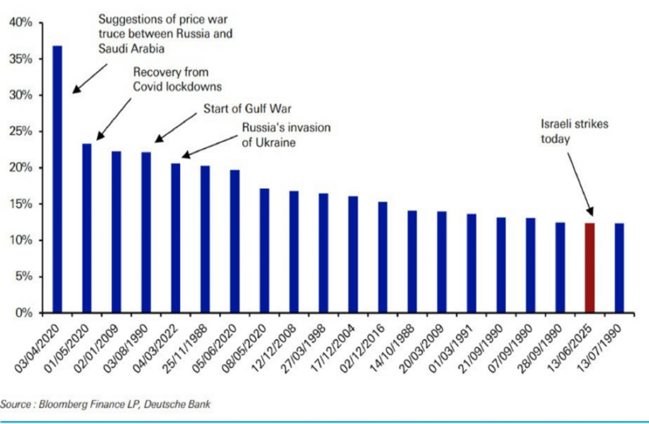

In response, Iran has threatened to block the Strait of Hormuz. Between 20% - 30% of all energy flows through that critical choke point.4

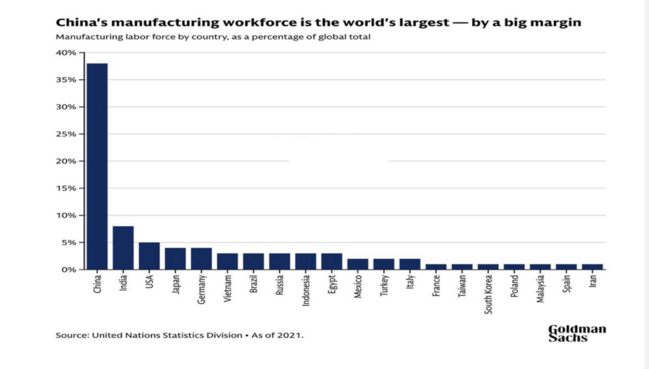

The biggest loser in any significant energy disruption from a closure of the Strait would be China, as they by far import the most Iranian energy products.5

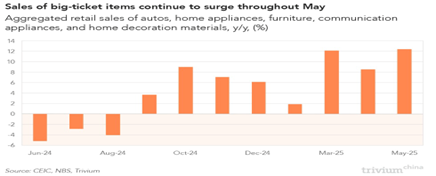

As China is the global leader in manufacturing that requires significant energy, they could see as much as a 5% jump to China’s manufacturing costs. This would be a very bad outcome for them, especially when their consumer is just trying to get back on their feet.6

That could have a destabilizing impact on their jobs picture.7

That could have a destabilizing impact on their jobs picture.7

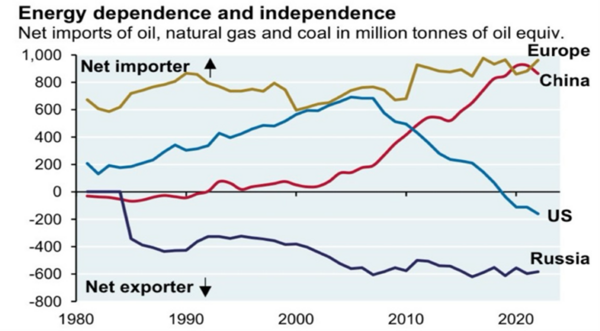

The shifting of energy dependency and independence has some specific geopolitical ramifications.

The shifting of energy dependency and independence has some specific geopolitical ramifications.

- China has become the largest net importer of fossil fuels, surpassing Europe around 2023.

- Europe remains highly dependent on imports, despite some volatility and recent attempts to diversify away from Russian gas.

- The U.S. flipped from being a large net importer to a net energy exporter by the late 2010s.

- Russia is consistently a net exporter—its geopolitical leverage has historically rested on this position.

China: High Vulnerability to Middle East Shocks

- With over 70% of its oil imports sourced via sea lanes—much of it through the Strait of Hormuz—China is strategically exposed to disruptions stemming from Iran-Israel conflict.8

- Any actual closure or disruption at Hormuz could create energy security concerns and spike manufacturing costs in China (as discussed earlier).

- This will likely accelerate China’s push for:

- Long-term strategic petroleum reserves (SPR),

- Yuan-settled oil contracts (to reduce USD risk),

- Closer ties with energy exporters like Russia, Venezuela, and the Gulf.

U.S.: Strategic Advantage & Energy Buffer

- As a net exporter, the U.S. is insulated from external supply shocks.

- Rising global oil prices from Middle East conflict benefit U.S. producers and strengthen its geopolitical influence (especially over allies' dependent on imported oil).

- Washington can selectively release or withhold LNG and oil exports to shape regional outcomes, especially in Europe and East Asia.

- Only a temporary bump in energy prices

Europe: Energy Security Still Fragile

- Europe has reduced dependence on Russian gas post-Ukraine, but still remains a large net importer, particularly of LNG and refined oil.

- Any Hormuz-related supply shock would reignite inflation risks and pressure EU leaders to revisit energy rationing plans or subsidize costs.

Russia: The Beneficiary on the Sidelines

- Russia could financially benefit from any disruption in Iranian exports, as global prices rise and customers like China are forced to lean more on Russian supply.

- This dynamic may deepen the China–Russia energy axis, undermining Western sanctions and fragmenting the global energy order further.

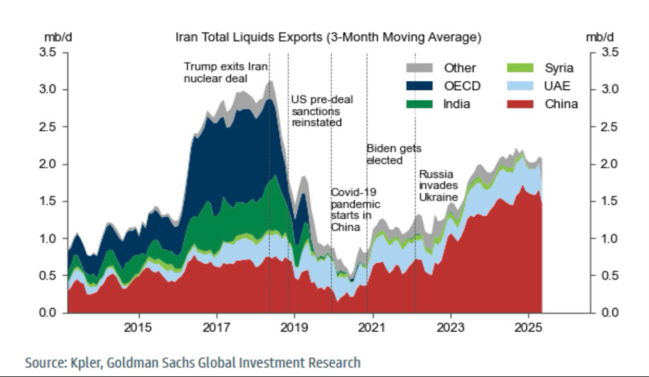

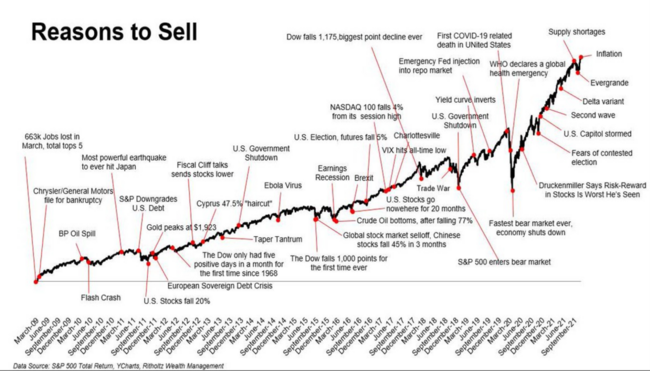

It’s hard to anticipate how this will play out other than increasing the level of uncertainty. There are always reasons to sell. Yet equity markets have historically gridded higher.9

I look at this event as another chance to stay invested and rebalance if needed. This is most likely just another small blip on the grind upward.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1.) Iran Update Special Edition: Israeli Strikes On Iran, June 13, 2025, 8:00am Et | Critical Threats

2.) https://bsky.app/profile/thestudyofwar.bsky.social/post/3lrlj6ri6tz2a

3.) In the Money: 5 Things to Know - by Amber Kanwar

5.) Virtually all of Iran's oil exports go to China : r/climateskeptics

7.) Rewiring Global Trade: Tariffs Rewrite the Map

8.) https://www.linkedin.com/posts/justinpfortier_us-continues-to-grow-as-energy-exporter-and-activity-7305309849972592641Dewsutm_source=li_share&utm_content=feedcontent&utm_medium=g_dt_web&utm_campaign=copy

9.) How Can You Overcome the 3 Cognitive Biases that Hurt Your Returns - Steady Compounding

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.