Growth Cycle Detour – Q3 2022 Look Ahead

Our Q3 2022 Look Ahead is available for review. The video link is here and the PDF version is here. In this post, we highlight some key themes we see in the coming quarter.

We think we are in the midst of a growth cycle detour. 1

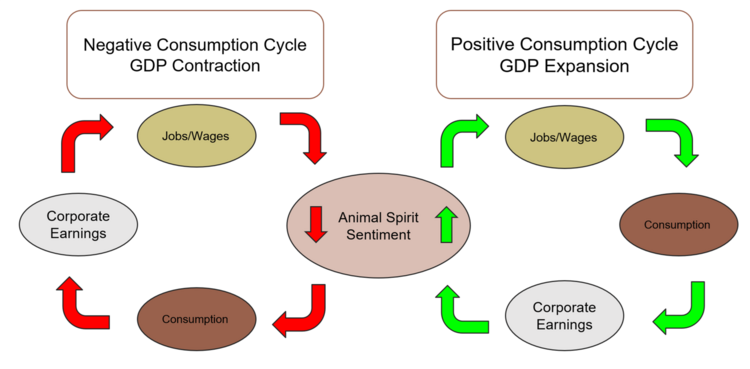

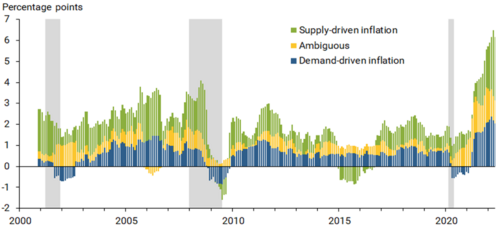

We believe we will have a period of suppressed consumer animal spirts, but that won’t be a permanent trend. This will mostly be driven by the simple fact that interest rates will moderate sooner than most anticipate. Why? Because inflation is largely being driven by supply side issues rather than pure demand. 1

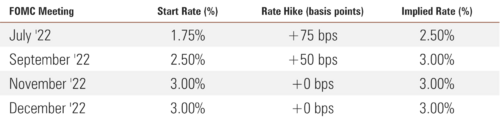

We recognize the Federal Reserve’s interest rate setting policy will have little to no impact on supply side inflation. Combine that with the real threat that we are close to a mild recession; and we believe interest rate hikes will come in the form of a series of brief bursts then perhaps pause later in the year.

Take a look at our Q3 2022 Look Ahead here

Watch our narrated version here

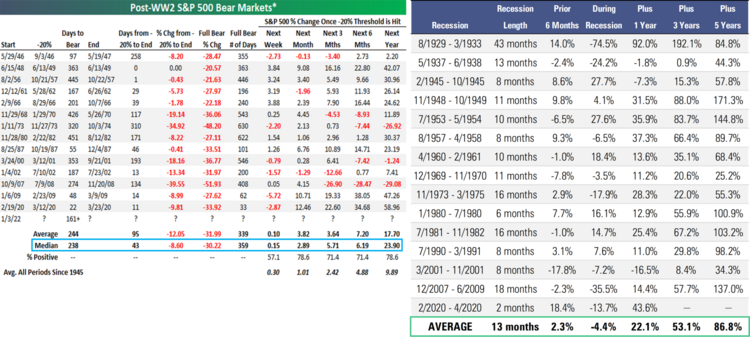

The first order question investors should be asking is how long will this market malaise last? When looking at recessions, the periods are relatively brief. 3

Take a quick look at other historical data points on how long bear markets last here. After working through 6 prior cycles (1987, 1991, 2001, 2004, 2008, 2020) I’ve learned one thing; growth is hard to permanently kill. We are in a growth detour.

Take a look at our Q3 2022 Look Ahead here

Watch our narrated version here

Review our latest video with best-selling author of Psychology of Money, Morgan Housel. See what’s more important that investment returns.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: