Growth Worries & Volatility

We are finally getting to the long-anticipated stage where the economy is showing signs of weakness, but not excessively so. Equity markets will reflect that uncertainty with increased volatility. That is to be expected. What will be unexpected is the behavior of those that speculate using leverage.

However, the Fed should be on alert and on the way. Last Wednesday Fed Chair Powell suggested September could be the time for rate cuts to begin: 1

"A reduction in our policy rate could be on the table as soon as the next meeting in September."

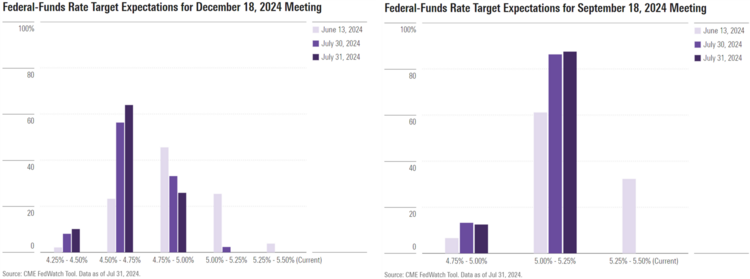

In fact, markets are now projecting three cuts in 2024, taking the federal-funds rate down to 4.50%-4.75% by December, with an 84% chance of a 50 bp rate cut in September. 2

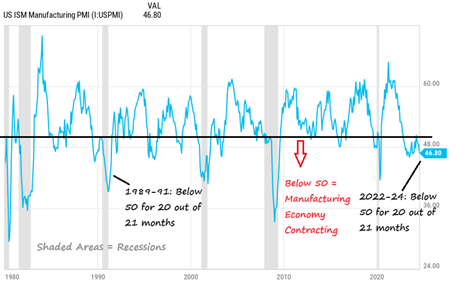

Just after that speech, U.S. manufacturing data showed a contraction for the 20th time in 21 months. We have been in a goods recession for a long time. 3

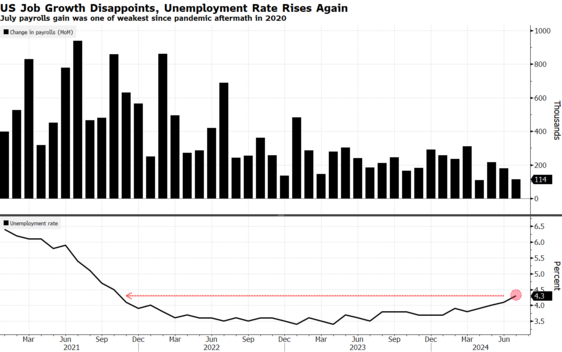

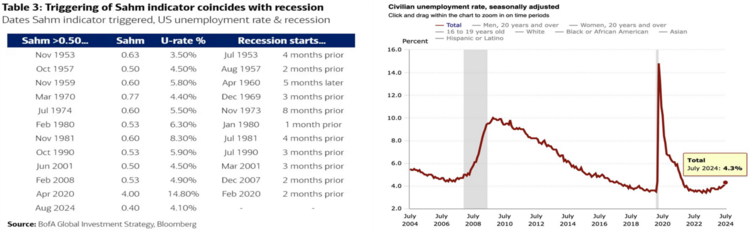

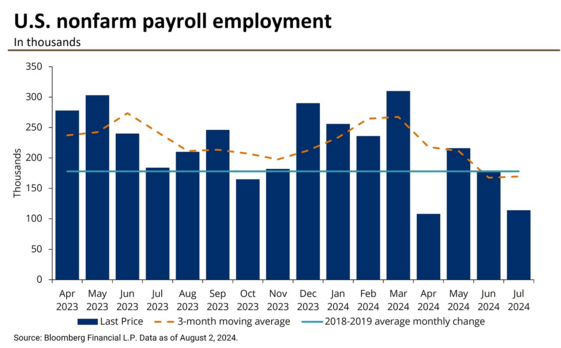

Then on Friday, the long-awaited July Jobs report showed some meaningful slackening in the labor market. The U.S. economy only added 114,000 jobs and the unemployment rate jumped to 4.3%. 4

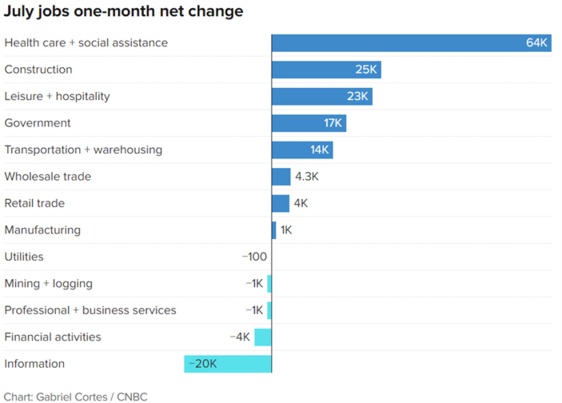

Most sectors showed weakness other than the typical health care, government and hospitality and leisure sectors. 5

According to one indicator (the Sahm Rule) the U.S. economy should already be in a recession. I discussed this rule last week, and it’s important to know the rule is a lagging indicator. 6 7

The equity markets took all this data poorly and sold off for fear the U.S. economy would slip into a recession. Simultaneously, U.S. Treasury rates took a tumble, signaling interest rates cuts are on the way. 8

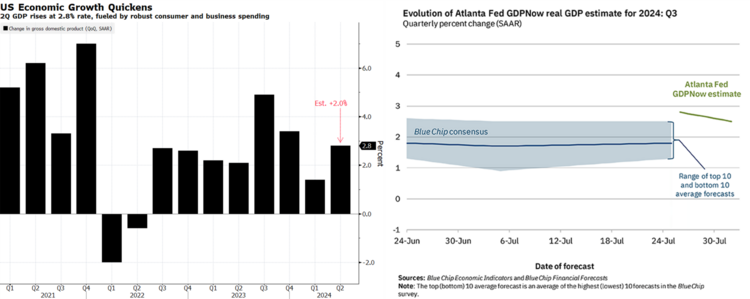

Let’s clear one thing up first. I don't believe we're on the brink of a recession at this time. Q2 GDP reflected strong overall growth and Q3 estimates by the Atlanta Fed suggest GDP growth in the current quarter. 9 10

While the headline jobs report was weaker than expected, the three-month average is still suggesting an expanding economy, albeit softening. 11

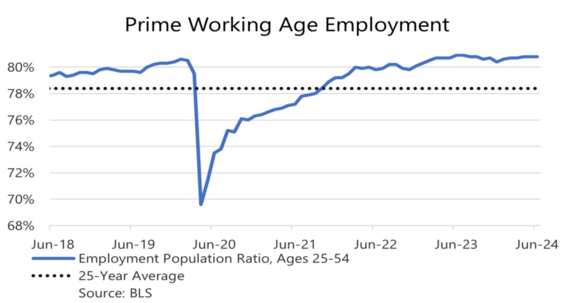

Further, prime age employment (25-54 years old) is expanding. 12

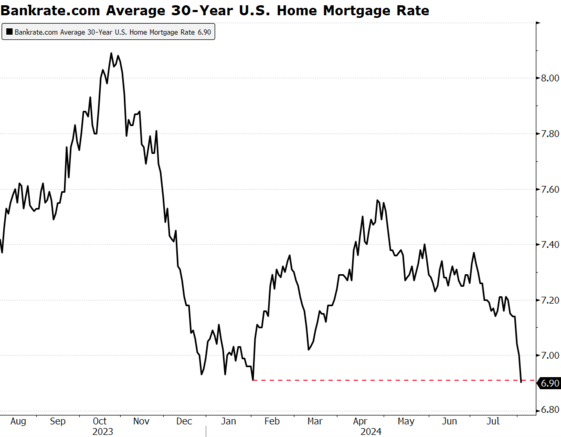

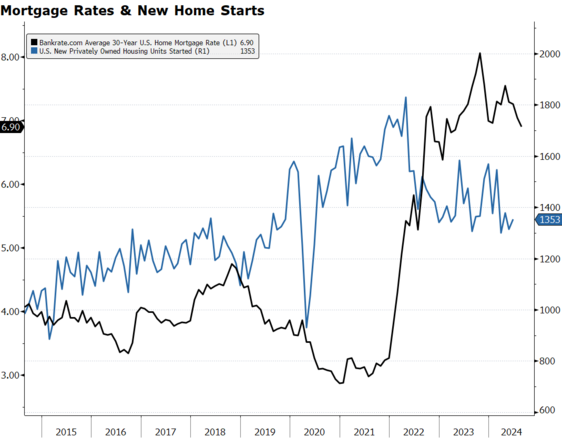

In addition, mortgage rates should be coming down to levels not seen since last year. 7

This alone has the opportunity to lift construction and home-related economic activity which is no small part of our economy. 7

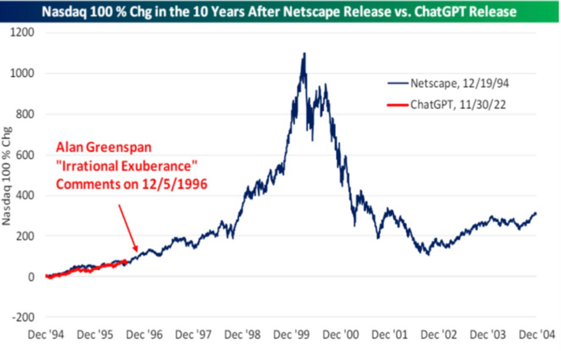

Consider this chart from our friends at Bespoke, just in case you felt we were getting to the “irrational exuberance” territory of the Dot-com era. There is a long way to go if investors behave as they have in the past. 13

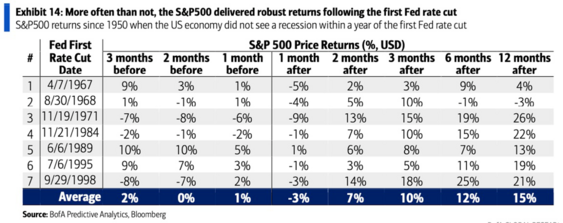

When there have been rate cuts not associated with a recession the outcomes for equity investors are typically quite good, but you must absorb the volatility. 14

Let’s get ready to absorb the volatility and use it to our advantage. Dollar-cost average into high-conviction positions and rebalance back to your portfolio targets.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/mediacenter/files/fomcpresconf20240731.pdf

- https://www.morningstar.com/economy/september-fed-rate-cut-looks-likely-then-what

- https://x.com/charliebilello/status/1819038054314561559

- https://www.bloomberg.com/news/articles/2024-08-02/us-hiring-slows-by-more-than-forecast-while-unemployment-rises

- https://www.cnbc.com/2024/08/02/heres-where-the-jobs-are-for-july-in-one-chart.html

- https://www.marketwatch.com/story/a-closely-tracked-recession-indicator-the-sahm-rule-has-now-been-triggered-heres-what-that-means-7d689d07

- https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

- Bloomberg

- https://www.bloomberg.com/news/articles/2024-07-25/us-economy-accelerated-by-more-than-forecast-last-quarter

- https://www.atlantafed.org/cqer/research/gdpnow

- https://www.jpmorgan.com/insights/outlook/economic-outlook/jobs-report-july-2024

- https://fred.stlouisfed.org/graph/?g=1reEM

- https://www.bespokepremium.com/login/

- https://x.com/MikeZaccardi/status/1818971601674654027