Gut Check Time

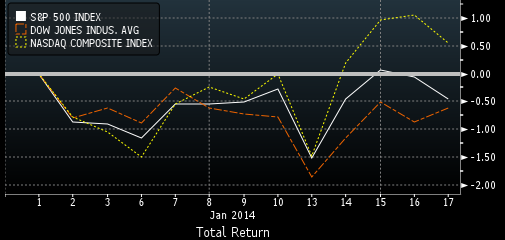

As this calendar year unfolds it looks quite apparent market participants are in a bit of a tug-o-war. Markets have barely budged from the start of the year. [i]

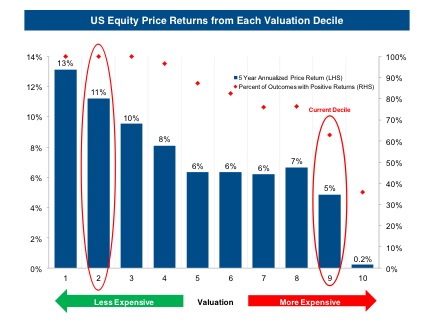

Equity investors are dealing with an interesting equilibrium point as it relates to valuations. According to Goldman Sachs, there is still some room for US equity valuations to rise. This chart provided by Goldman Sachs suggests US Equity prices are in the 9th decile of most expensive. [ii]

Yet, the average 5 year annualized return is around 5%. While that's certainly a nice return, average returns clump together once your cross over the 4th decile and the 9th decile is literally at the edge of the cliff.

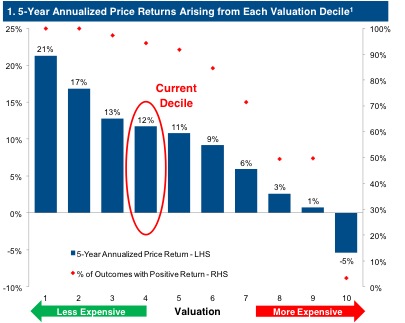

By contrast you can see Europe offers much more opportunity from a valuation perspective. [iii]

It's one of the reasons why we are adding more tilts toward international developed markets. At current valuations 5-year historic annualized returns are around 12% with a cliff coming in the 6th decile. It's still very possible Europe can fall into a deflationary spiral, especially with Greece at a staggering 27.8% unemployment rate. [iv]

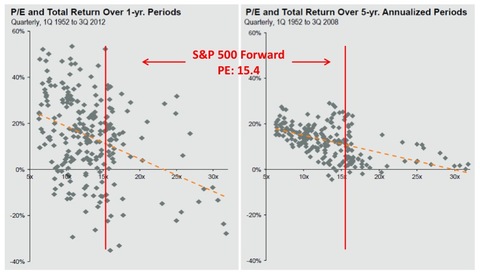

From another perspective, you can see from the data below why US investors are in a classic equilibrium showdown. In my opinion, without substantial corporate earnings growth, P/E ratios are destined to expand, thus pushing them into a much more volatile territory that is not matched with appropriate returns. [v]

The red lines represent current valuations. The left chart shows 1-year returns following certain valuations, and the right chart shows 5-year returns. At current valuations, returns begin to scatter. To the left of the line shows much more clustering in the positive quadrant. To the right of the line reflects much more variability in returns, both positive and negative. From a 5 year perspective, returns suck toward the zero line.

The bottom line for the path forward in US equity prices will likely be filled with much more volatility, uncertainty and variability all the while returns being muted. The risk to return tradeoff is under serious debate. Either earnings will reaccelerate and change the debate or we will continue to inch closer to a cliff.

Be prepared to check your gut and examine your time frames for US equity investing. It's no time to be uncertain about what you’re doing, why you’re doing it and for how long.

Gut check time is upon us.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] Bloomberg LP

[ii] “2014 Outlook: Within Sight of the Summit”, p. 8, Goldman Sachs Investment Management Division, January 15, 2014

[iii] Ibid., p. 18

[iv] “Greek unemployment rises slightly in October to new record 27.8 pct”, Reuters, January 9, 2014

[v] “1Q 2014 Guide to the Markets”, JP Morgan, p. 14