Handcuffed on Interest Rates

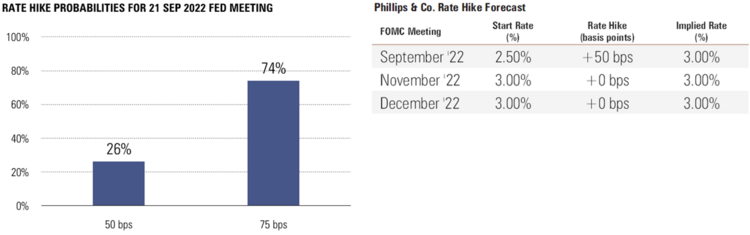

Within just a couple of weeks (September 20-21), the Fed will reconvene to determine the amplitude of the Fed Funds rate. Most market participants are expecting a ¾ point rate increase, while we believe a ½ point increase is still in the cards. 1

I’ve focused on interest rates above other issues (Ukraine, China, Energy, Food) as I believe they are the key determinant to putting this growth detour cycle behind us.

In a way, I feel handcuffed to the interest rate narrative; perhaps the Fed feels the same way.

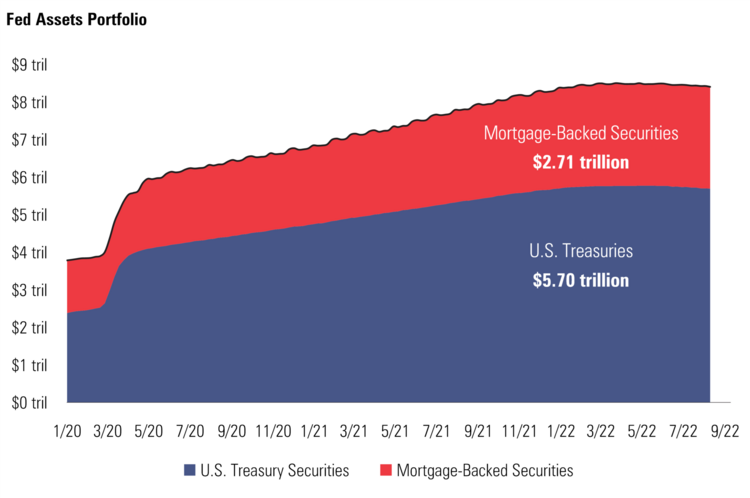

The Fed has to sell treasuries from their $8.4 trillion portfolio of assets. 2

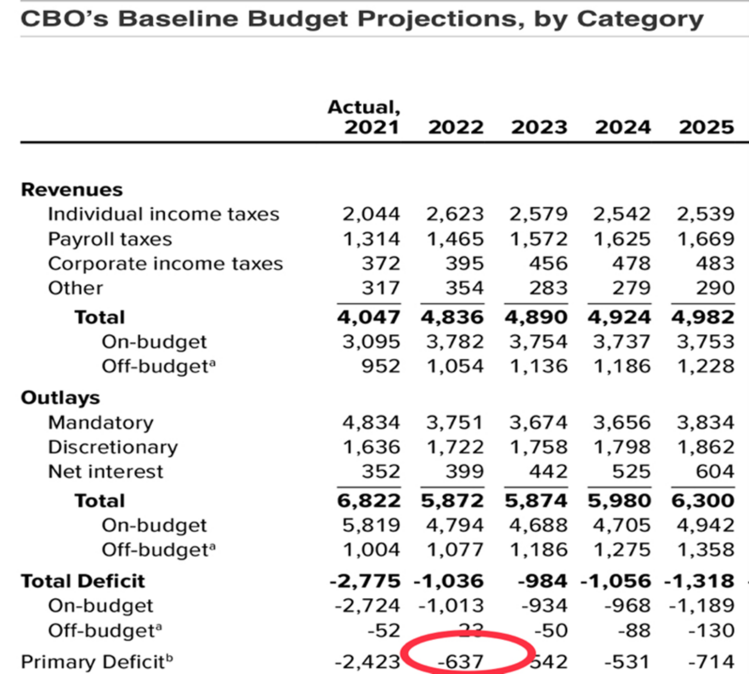

Simultaneously, the Federal Government also must sell treasuries to fund our budget deficit – to the tune of $637 billion according to the Congressional Budget Office (CBO). 3

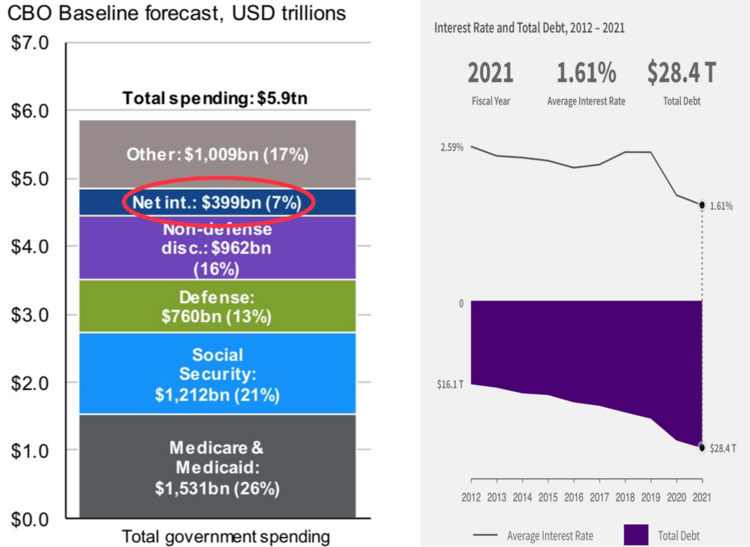

Currently the U.S. taxpayer spends about $400 billion per year on interest expense (7% of taxes) to pay for the accumulated debt of $28 trillion. 4 5

Remarkably, we have financed that massive debt at an average interest rate of 1.61%. Not bad!!!

While the Fed raises short term interest rates to put a brake on inflation, the U.S. Government is going to have to go out and sell longer duration treasuries to fund our budget deficit. Clearly, they are going to finance and refinance our debt at much higher rates; maybe as much as 2-times as high as the current average.

We all know that will lead to more debt service in the coming years and the impending interest on interest charges associated with running large deficits.

The real-world buyers of our fiscal deficit will determine interest rates like home mortgages, credit cards, and auto loans. Perhaps much more than the Fed will determine real world interest rates.

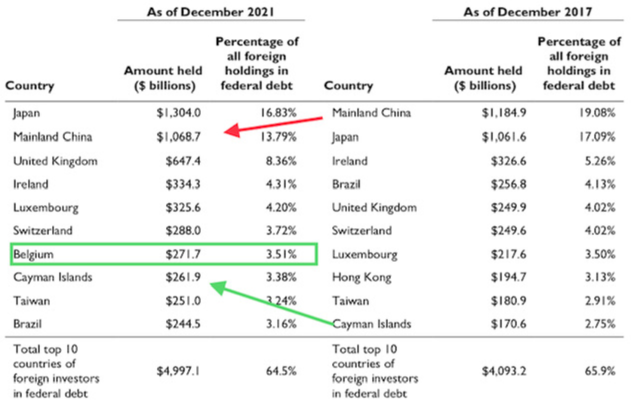

So who will finance our deficits in the future? Just look who owns our debt. 6

Notice who’s been selling our debt and who’s been buying our debt. No surprise China is a seller. Belgium and the Cayman Islands are buyers. What’s that about?

According to several reports, both China and Russia along with some other oil rich countries use Belgium as a custodian for buying U.S. debt. It’s no surprise since the U.S. Government cut off Russia from the SWIFT international banking system.

It’s not rocket science to figure out that the largest owners of our debt outside of the United States will welcome, and even demand, higher rates.

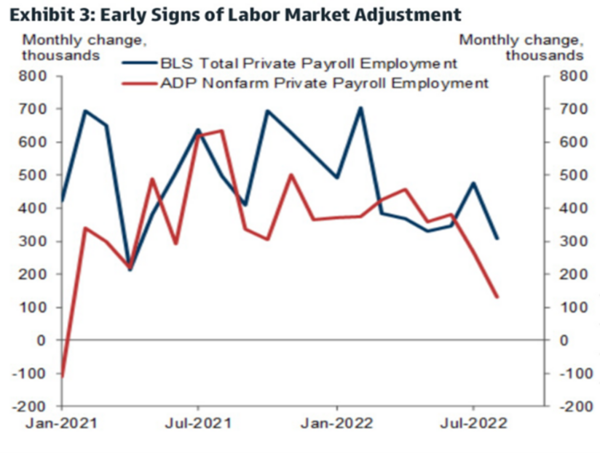

As a side note, the jobs picture is starting to deteriorate a little. That should also put handcuffs on the Federal Reserve rate hiking cycle. 7

The consequences in the coming months could be a spike in rates and that’s why we think the Fed will tap the brakes on their rate hike cycle because our deficits will do the rate hiking for them.

We are all handcuffed to the interest rate narrative right now.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

- https://www.federalreserve.gov/releases/h41/current/h41.htm

- https://www.cbo.gov/data/budget-economic-data

- https://fiscaldata.treasury.gov/national-debt/

- https://fiscaldata.treasury.gov/national-debt/

- https://sgp.fas.org/crs/misc/RS22331.pdf

- https://research.gs.com/