Have We Changed or Will “Big G” Come Through for Us?

In the current highly charged political environment, it is not safe to even dip your toe into the fray of electoral politics. I certainly don’t want to incite any wrath. However, it is fair to consider a critical question that must be on our minds: Have we changed?

Have we changed as Americans this year and over the past few years? The famed political and cultural commentator David Brooks wrote a recent op-ed in the New York Times framing that discussion. Here is a link to the piece.

He cites several surveys and studies that can be summarized as follows: [i]

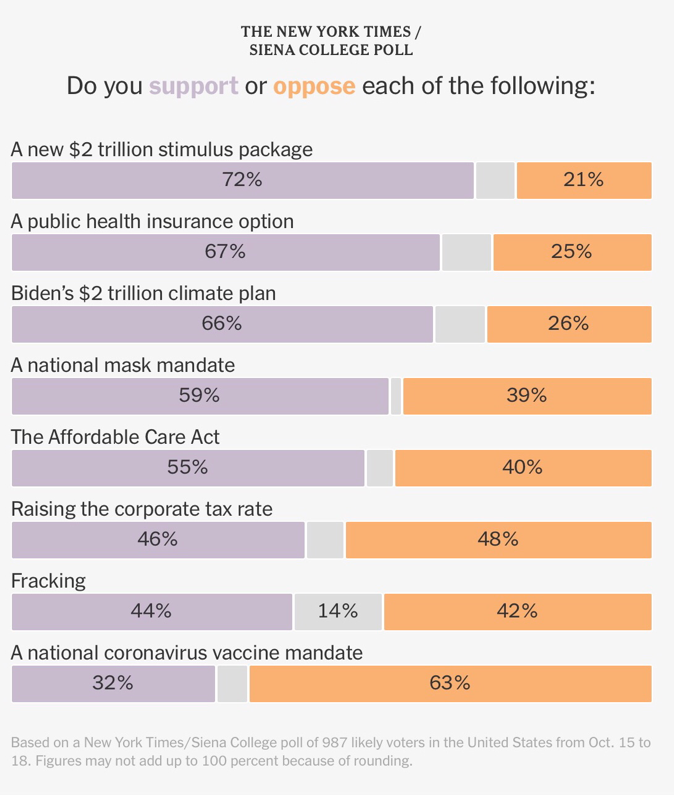

Americans, including Republicans, are favoring a bigger role for government. More deficit-funded stimulus, public health insurance options, climate change policy, etc. (To be sure, with the New York Times accused of being left leaning, I took the time to view the cross tabulations to verify the weightings were representative of both major political parties and independents).

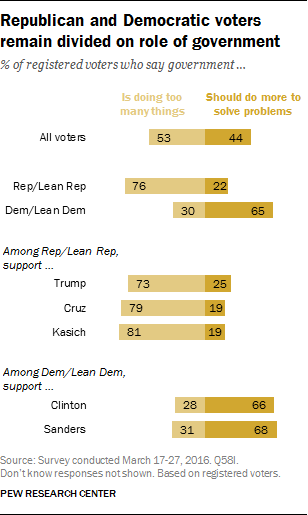

Brooks goes on to cite this interesting survey done in 2016 that suggests people have indeed changed―and perhaps Republicans most of all―compared to today. [ii]

The government doing too much then and not doing enough now seems to be at the crux of this election. While Brooks’ op-ed is titled “How Democrats have Won the War of Ideas,” I am taking a 10,000-foot view and suggesting we look deeper at the American consumer’s behavior.

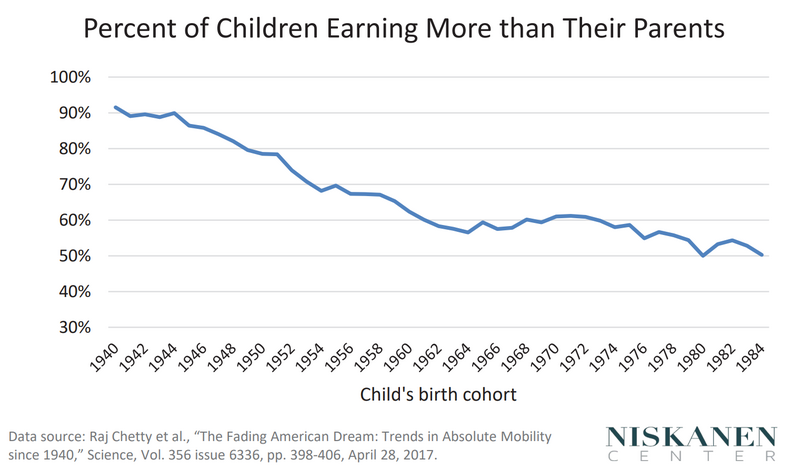

Brooks cites from this study and it notes a troubling trend: It is harder for kids today to earn more than their parents did and the natural reaction is for that cohort of workers to want more support from the government. While this dataset ends in 1984, I can assure you the downward trend has not changed and is getting worse. [iii]

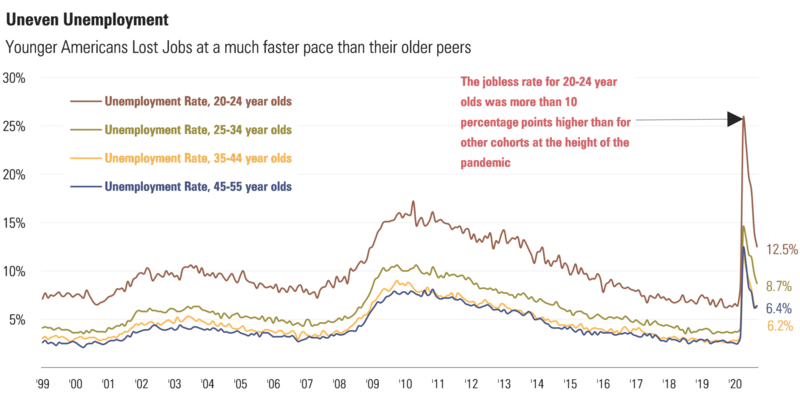

Further, young adults have faced the brunt of the pandemic-induced recession, losing jobs at a faster rate and recovering slower than other age groups. [iv] [v] [vi] [vii]

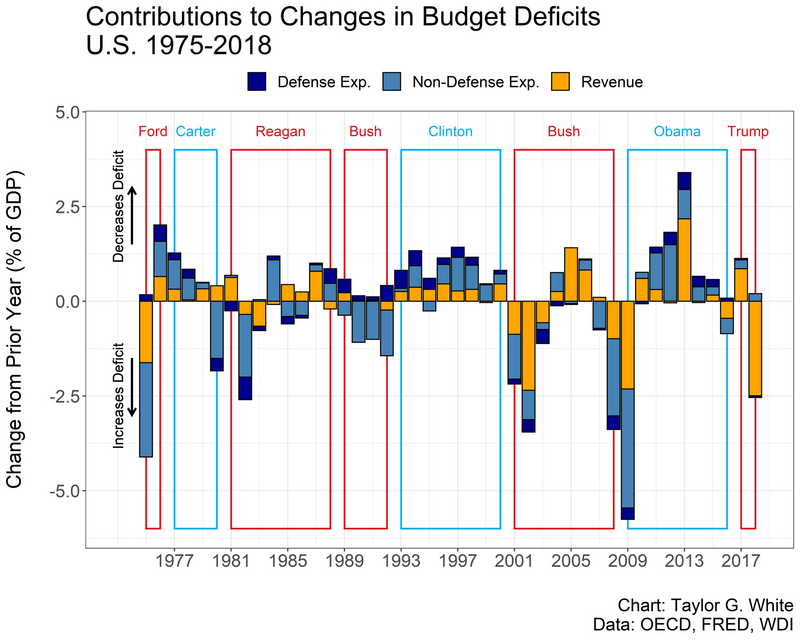

Intuitively, we know we have shifted a little leftward just by the sheer size and strength of policy decisions. Deficit spending was almost taboo for Republicans in the past but look at the levels they have added to overall debt. [viii]

This is not your parents’ fiscally conservative Republican Party anymore.

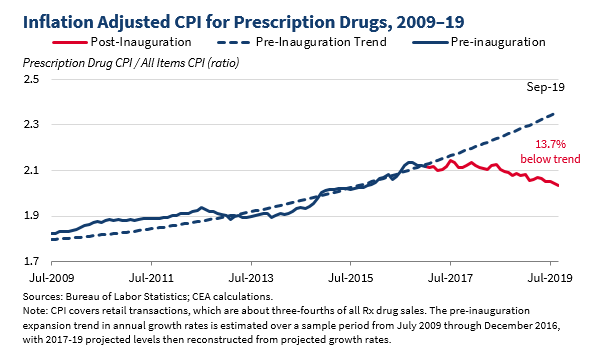

Trump interceded in prescription drug pricing. [ix]

Again, not necessarily free markets, but free enterprise policies.

In these times when we are all inclined to think the two tribes in American politics (Republicans and Democrats) are far apart, this should give us all pause. Perhaps the center of political gravity in American has shifted.

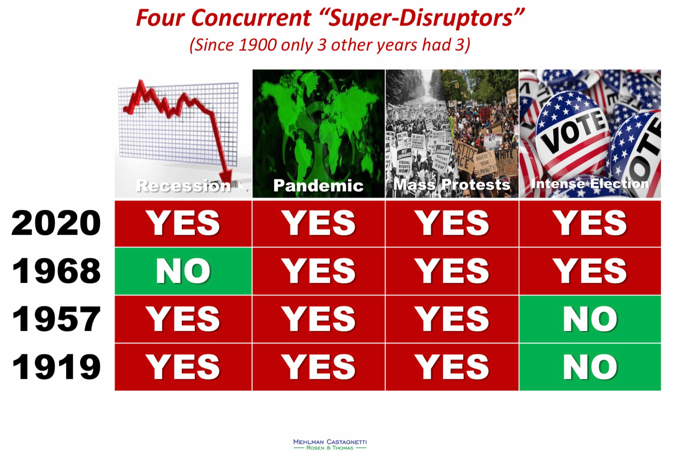

I don’t discount the effects of the pandemic on any of us. This from a recent public policy and opinion shop: [x]

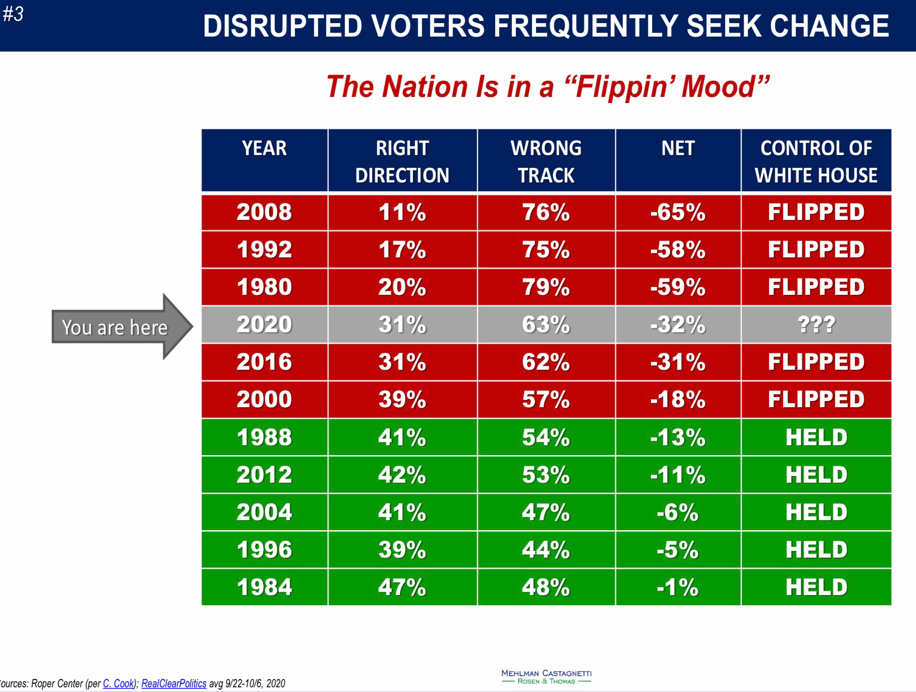

Disruptive events drive disruptive voters. Again, from the same policy shop. You can see the full report here. It’s quite fascinating. [x]

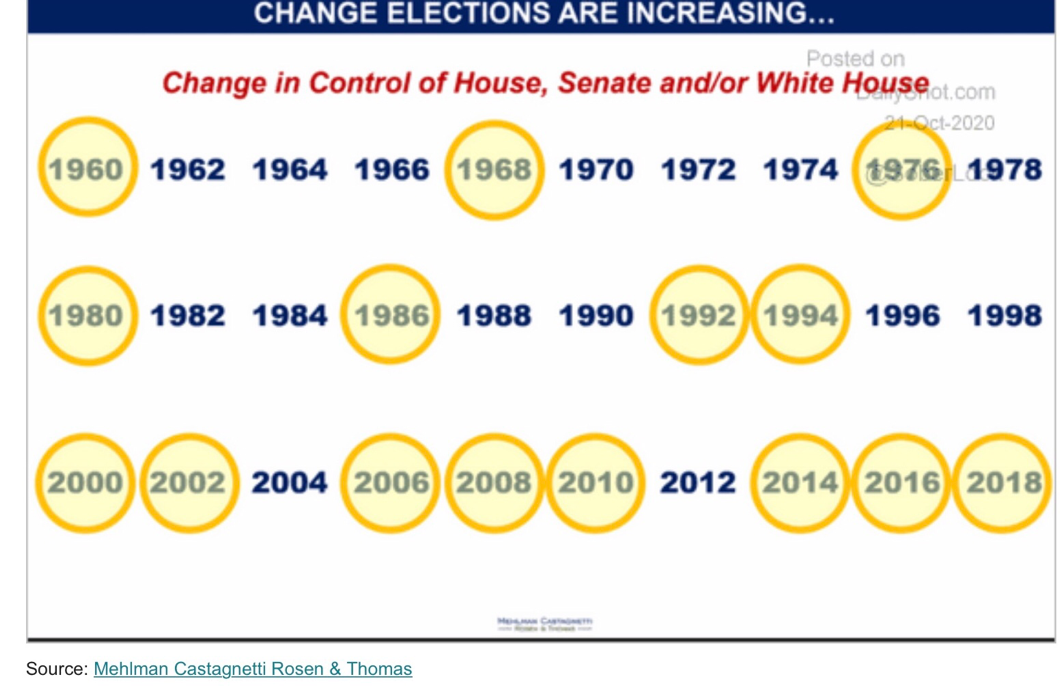

Change is not so unusual anymore when it comes to our politics. We are in a constant state of some political change of late. Is that because we just don’t know what we want as a collective citizenry?

Do we want bigger government to help us smooth out inequity and supply larger safety nets while at the same time staying out of our business? It’s hard to tell, but we certainly want something different all the time―at least in the last 20 years according to the chart below. [x]

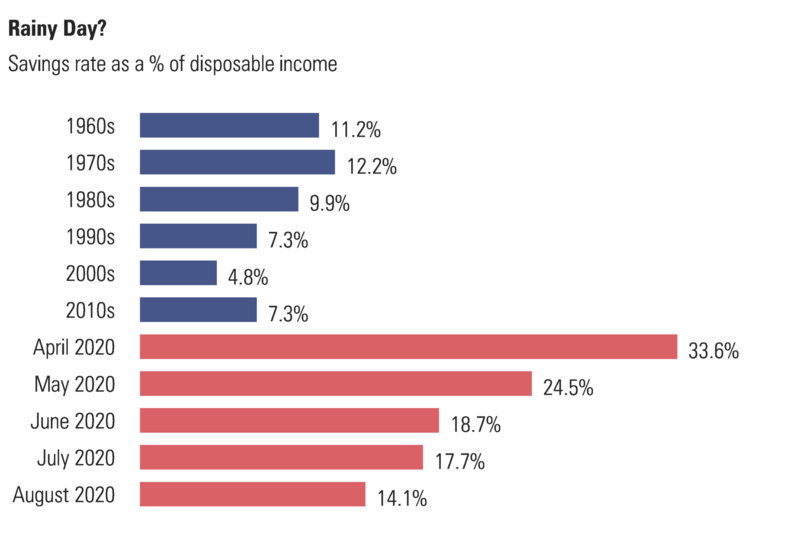

It appears to me the predominant economic trend of our current time is not tax policy, nor environmental politics, nor is it trade wars—The trend that could have the most profound impact on our base economic system of consumption is precautionary savings.

Just look at current savings rates: [xi]

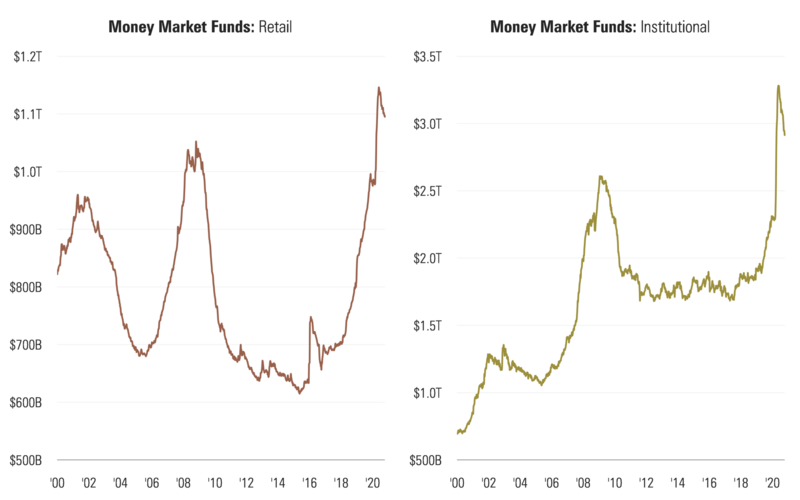

Personal savings, although declining, might not return to normal and retail and institutional cash might just stay at elevated levels. [xii] [xiii]

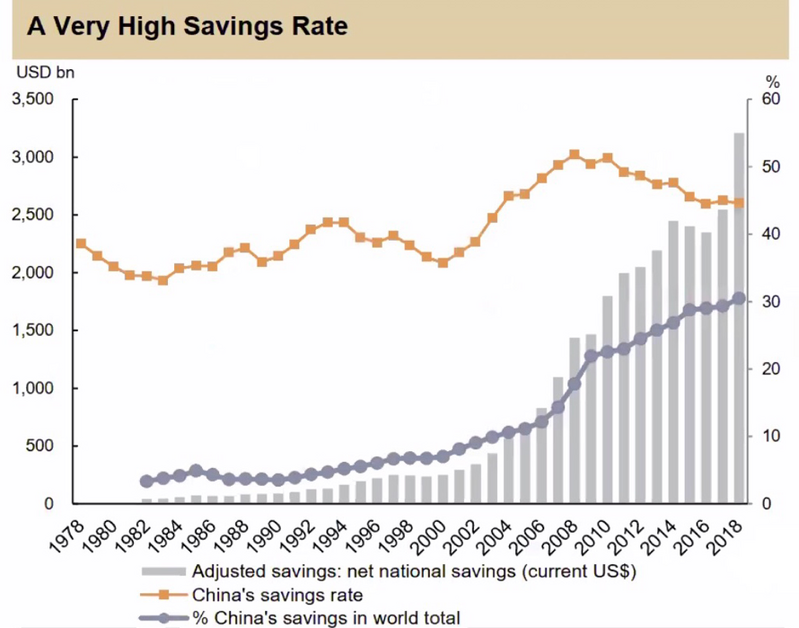

People save when they don’t trust the systems and institutions they’ve grown to depend on. Just look at China’s savings rates as they have always been cautious of their government support. [xiv]

I can assure you with our growing experience in China, the CCP is very concerned about unlocking precautionary savings levels so that their citizens consume more versus saving.

Are we going to be on the same precautionary savings trajectory if we grow more reliant on government and they do not deliver?

Do we become permanent precautionary savers?

Will our liberal republic form of government be able to successfully allocate our assets to help us gain confidence to consume to a point of low to no savings again?

Can the obvious inequities in our capital systems be resolved with more, and bigger government? This is not a partisan comment, as both parties adopted the “Big G” in our GDP model.

“Big G” might save the day and win elections, but does our political class have the maturity we can all depend on and trust to consume at will?

That’s the question we will need answers to if we all want to return to “normal.”

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.nytimes.com/2020/10/20/us/politics/biden-trump-times-poll.html

ii. https://www.pewresearch.org/politics/2016/03/31/3-views-on-economy-government-services-trade/

iii. https://www.niskanencenter.org/faster_fairer/a_new_policy_synthesis.html

iv. https://fred.stlouisfed.org/series/LNS14000036

v. https://fred.stlouisfed.org/series/LNS14000089

vi. https://fred.stlouisfed.org/series/LNS14000091

vii. https://fred.stlouisfed.org/series/LNS14000093

viii. https://miro.medium.com/max/12000/1*pqIXolEpzpTNktAgIclA-A.png

ix. https://www.whitehouse.gov/articles/prescription-drug-prices-falling-historic-levels-thanks-trump-administration-policies/

x. https://mehlmancastagnetti.com/

xi. https://fred.stlouisfed.org/series/PSAVERT

xii. https://fred.stlouisfed.org/series/WRMFSL

xiii. https://fred.stlouisfed.org/series/WIMFNS

xiv. https://www.imf.org/~/media/Files/Publications/WP/2018/wp18277.ashx#:~:text=After%20the%20Global%20Financial%20Crisis,15%20percent%20for%20emerging%20economies