Hope Is Not A Policy Tool!

Last week the Federal Reserve raised interest rates by another 25 basis points. This is the third interest rate increase in the last eighteen months. [i]

The Fed uses interest rates to promote full employment and control inflation; currently, the Fed has an annual inflation target of 2%. [i]

However, inflation has not hit the Fed’s target level for several years. [ii]

In fact, in her most recent press conference, Chairwoman Janet Yellen admitted to this long-running failure to achieve their target saying, “…especially with roughly five years of inflation running under our 2 percent objective that is a goal to which the committee is strongly committed.” [i]

She is quick to cite her growing concern over full employment as the Fed’s rationale for raising interest rates. Certainly, the unemployment rate is a cause for both celebration and concern as it hovers at near-historic lows. [iii]

Low unemployment, according to the famous Phillips Curve (no relation), should lead to higher wages, which should, in turn, increase the price of goods, as well as inflation. [iv]

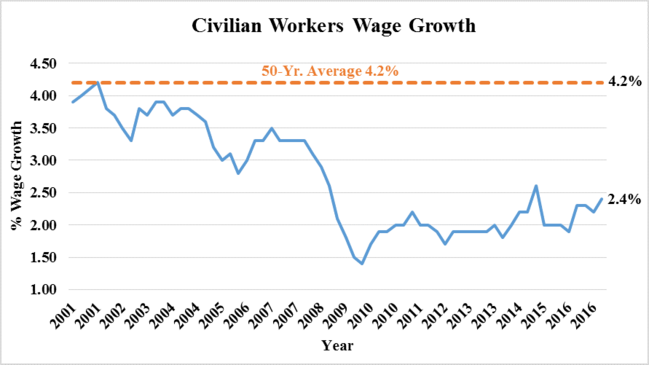

However, as we have opined in prior posts, wage growth remains at anemic levels. [v]

Certainly, wage growth is another of the many factors that lead to low inflation at times. Coincidentally, it can also be a driver of stagflation.

So, why is it that the Fed is continuing to raise rates when we have such low inflation and wage growth?

Given what we have observed in the Fed’s behavior thus far, it appears that their hope or faith that the Phillips Curve remains a relevant tool somehow trumps reality.

Citing another of Yellen’s comments, she stated in her most recent press conference, “… we continue to feel that with a strong labor market and a labor market that’s continuing to strengthen, the conditions are in place for inflation to move up.” [i]

Note the use of the word “feel” in the above statement.

Yellen does cite some reasons for low inflation, like the decrease in cell phone bills and prescription drug prices, but let’s get real. [i] Honestly, you can’t expect that five years of low inflation, including about a 1% inflation rate last year, is because of a decline in your cell phone bill.

We “hope” the Fed values data over feelings and wishful thinking before they choke off economic growth and inflation before we actually see some real growth.

If you have questions or comments, please let us know. We always appreciate your feedback. You can contact us via Twitter and Facebook, or you can e-mail me directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://phillipsandco.com/files/8814/9788/9317/FOMCpresconf20170614.pdf

ii. https://fred.stlouisfed.org/series/CPIAUCSL#0

iii. https://fred.stlouisfed.org/series/UNRATE

iv. http://www.economicsonline.co.uk/Global_economics/Phillips_curve.html

v. https://data.bls.gov/pdq/SurveyOutputServlet