How is This Possible?

Higher Tariffs, More Jobs, Lower Prices!

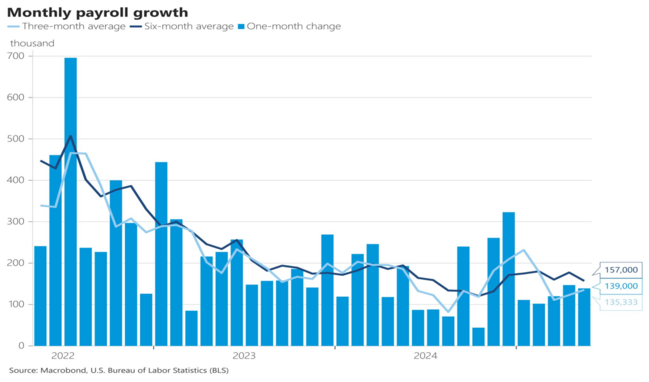

The recent jobs report reflects continuing strength in the overall economy. The US added 139,000 jobs in May. While cooling is still relatively strong, with a 6-month average of 157,000 jobs that’s more than enough to absorb new entrants to the jobs market. There is still no sign of any recessionary tendencies in the data.1

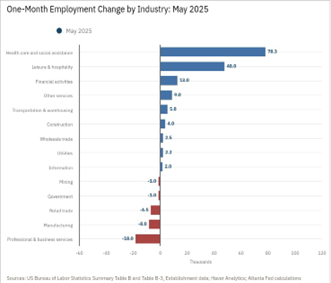

The largest gains continue to come from Health Care with average hourly wages at $35.5 per hour — much higher wages than the $22 per hour for Leisure and Hospitality.2

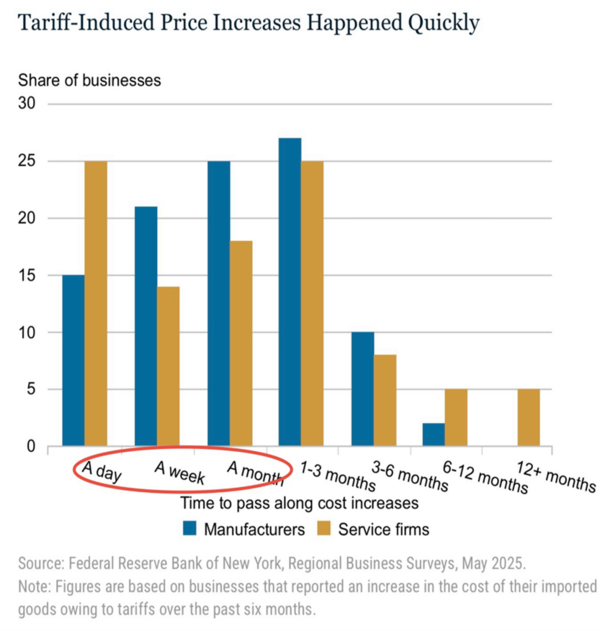

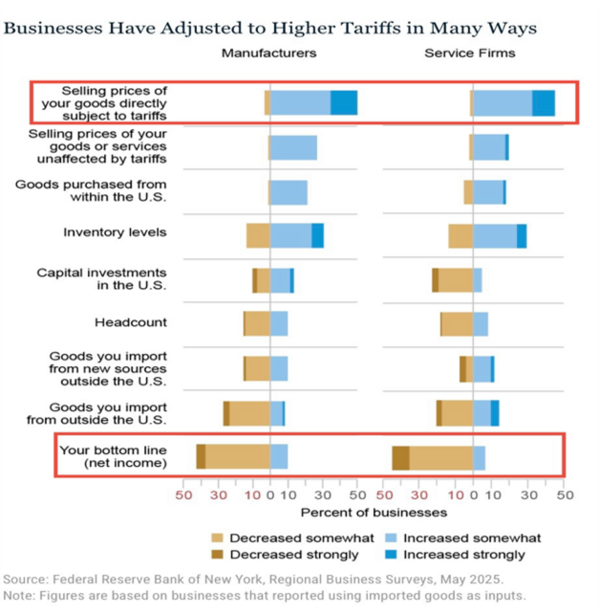

The tariffs have clearly not impacted the jobs market in a meaningful way. But what about inflation? In a recent Federal Reserve survey, 75% of businesses say they have already raised prices due to the tariffs.3

Critically, companies raised prices almost immediately. Over 50% addressed tariff challenges within 30 days.4

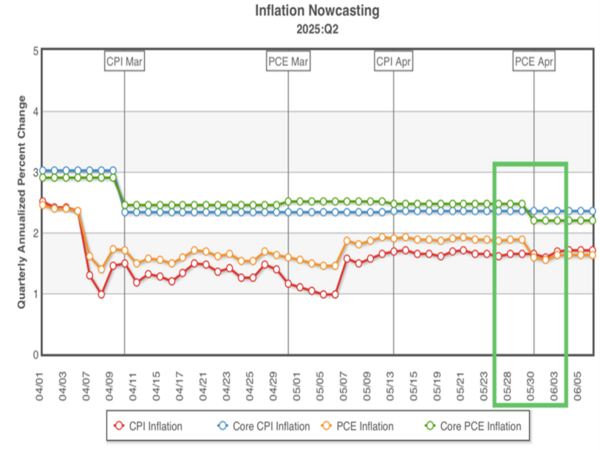

The survey was conducted between May 2nd and May 9th — before the reduction in the Chinese tariff rates. Yet recent forecasts show overall inflation continuing to moderate in May.5

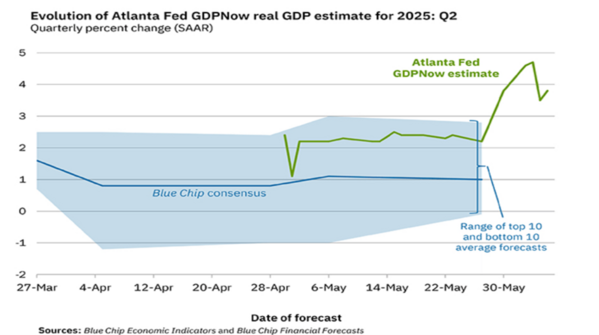

Add to this the fact that Q2 economic growth outlook for the US economy could come in at nearly 4%, according to the Fed’s GDPNowcast.6

So how can you have tariff-induced price increases that get passed along to the consumer almost immediately, combined with strong macro-economic growth, and moderating inflation?

- Tariffs, like the 2025 ones on Chinese goods and EVs, raise prices selectively — e.g., on appliances, electronics, or specific industrial inputs.

- These are not widespread categories in the CPI basket, and so the overall CPI/PCE effect is small.

- Shelter inflation, a major CPI driver, is easing as rents cool — offsetting other cost pressures.

According to the same Fed Survey it appears businesses are adjusting in several ways to the tariffs, including passing some price increases along to the consumer and absorbing others by making less profit.7

It’s hard to imagine the world’s largest economy with the greatest consumers deftly navigating these complex pressures, yet it’s happening. Six weeks from now we will see if corporate earnings will indeed hold up. So far so good.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

1.) https://x.com/NickTimiraos/status/1918283292991693176

3.) https://x.com/MikeZaccardi/status/1931316022490915132

4.) https://x.com/FedGuy12/status/1930273728820138372

7.) https://x.com/dailychartbook/status/1930542610881606013

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.