Hunting for Returns

When it comes to investments, most everything is expensive these days. You name the asset class, and it’s likely trading at or near an all-time high:

• U.S. Equities

• Home prices

• Commodities

• U.S. Treasuries

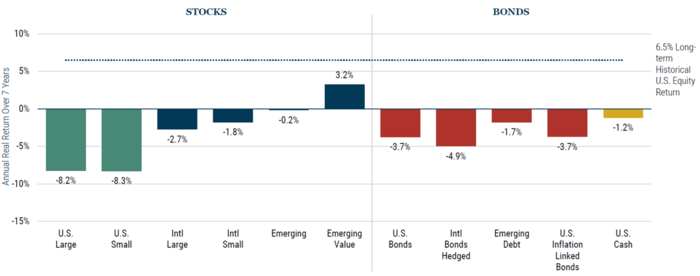

With valuations at extreme highs, forward-looking returns look gloomy. Famed investment house GMO, exemplifies this point in their forward-looking real return forecasts (after adjusting for inflation). [i]

To be fair, GMO tends to have a pretty gloomy outlook and often misses some terrific market moves. That is the nature of value investing.

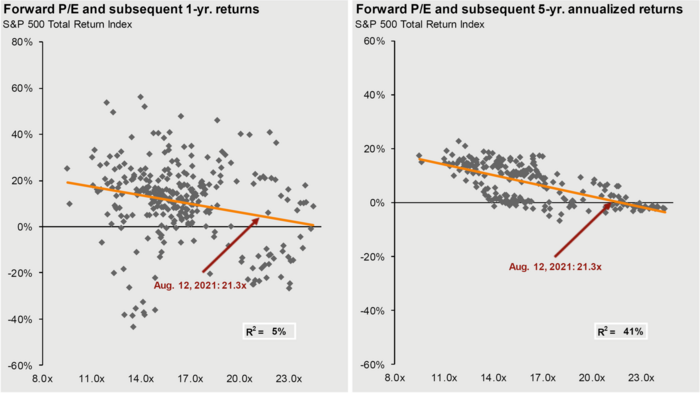

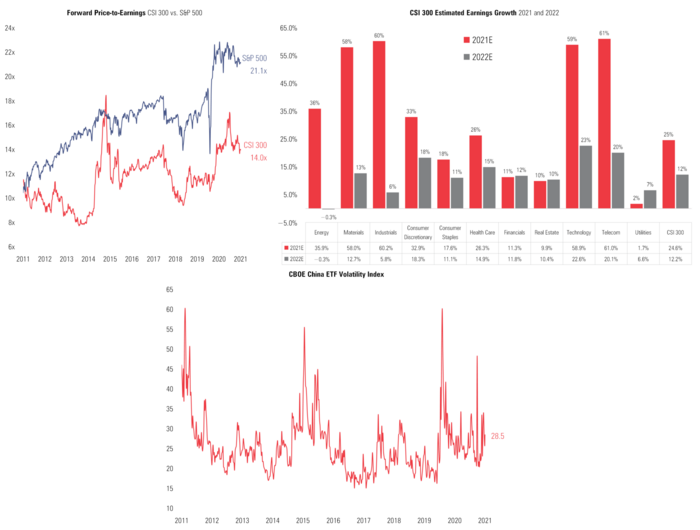

Based upon current forward price-to-earnings levels, returns in U.S. stocks tend to look very muted. On a one-year basis at current valuations, the S&P 500 historically returns approximately 4% and on a five-year basis it returns approximately 1%. [ii]

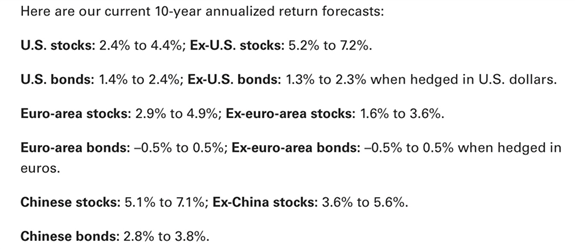

Vanguard on the other hand forecasts more promising returns over a longer timeframe (10 years vs. GMO’s 7 years). [iii]

It is interesting to note, Vanguard shows some of the best forward projected returns coming from China. As active investors in China’s domestic equity markets, we concur. Of course, that’s not to say investing in China is not without its perils and volatility.

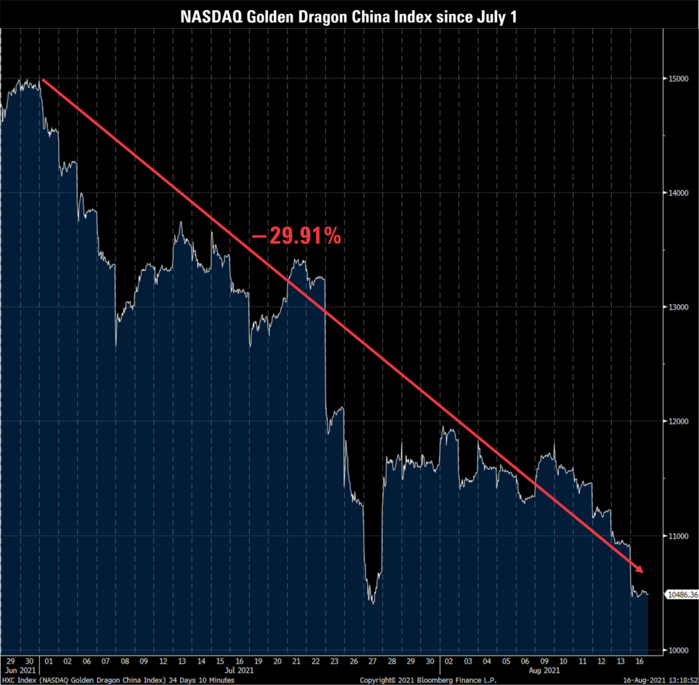

Recently, the Chinese Communist Party (CCP) announced some heavy-handed regulation that spooked investors in U.S.-listed Chinese stocks. The NASDAQ Golden Dragon China Index, which tracks U.S.-listed Chinese stocks, has declined 29.91% since July 1st. [iv]

It’s one thing to spook investors in U.S.-listed Chinese stocks but, it is an entirely different thing to rattle the nerves of China’s domestic markets. The domestic A share market is made up of mostly local retail investors. It simply isn’t good policy to spook citizens in China. [v]

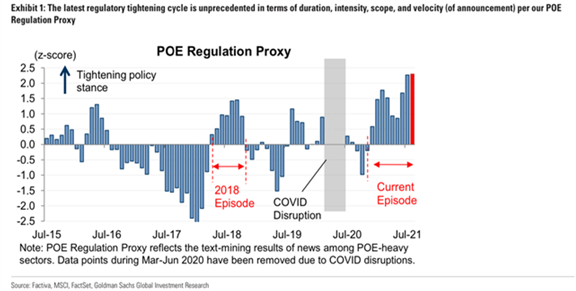

The A-share market took a tumble out of fear the CCP would move unilaterally against other industries. It’s been a very long period of regulatory involvement, according to Goldman Sachs, who are also investing in China. [vi]

The current pullback in China A shares has created a tremendous opportunity to find great growth rates with reasonable valuations if you can stomach the volatility. [vii] [viii]

Traditionally, investors would run for cover during increased volatility, however, in a world with few places to invest with great growth and low valuations, they have been buying the dip in China. Fund flows have increased while the index retreated. [ix]

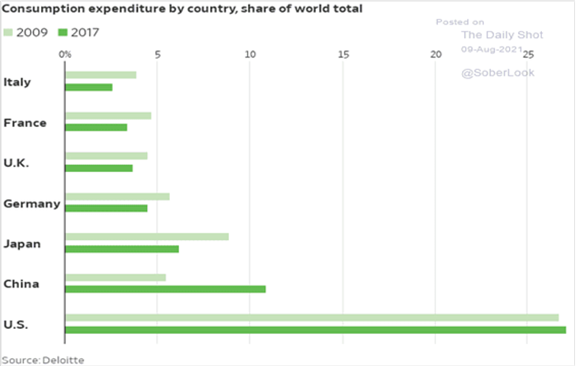

Much of the current flows are likely coming from institutional investors that want to find opportunity in the second largest global economy that represents over 10% of global consumption. [ix]

China has been growing its share of consumption expenditures at a rapid pace while most developed economies are shrinking. This gives China tremendous global clout and draws the attention of the investor class.

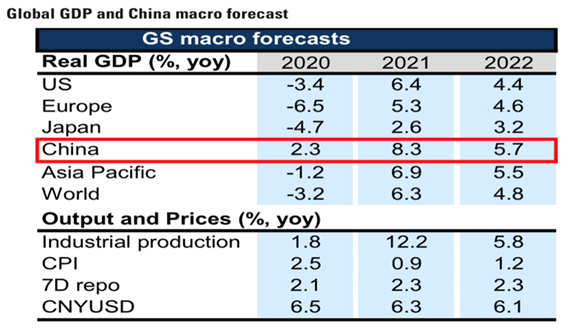

China will also likely grow their overall economy at a much faster rate than other leading economies in the world. [vi]

The good news is the CCP understands the importance and, in some respects, is mindful of not disrupting their domestic markets. After rattling global markets with their unprecedented policy interventions in July, the top securities regulators in China told representatives of global banks and investment firms that Chinese authorities would carefully consider the market impact of policy changes before making future changes.

Valuations aside, recent macroeconomic data reflects some slowing of the China economy, likely driven by an outbreak in Covid cases.

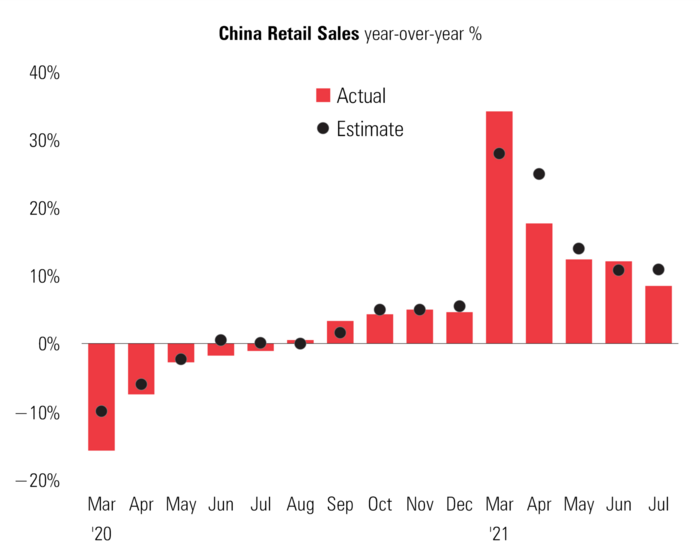

Retail sales grew by a whopping 8.5% in July but, that was below the 10.5% expectations by analysts. [x]

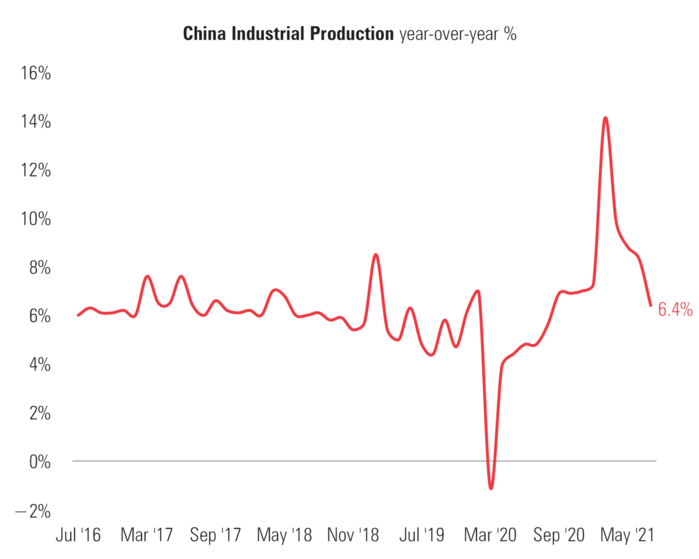

Industrial production has also been trending down, similarly affected on a temporary basis by the recent outbreak. [xi]

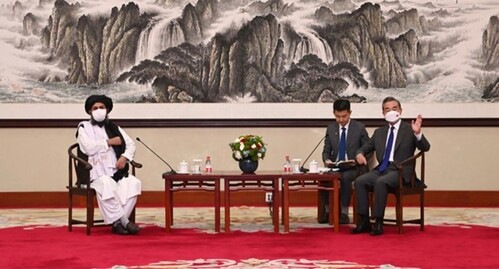

As it relates to the recent and tragic collapse of the Afghan government that was so hard fought for by the United States; China and many other world leaders have been having quiet conversations with the Taliban in recent weeks. There is no chance China wants civil unrest with their Muslim minority fueled by the Taliban on their border. It’s an unfortunate set of circumstances that will certainly be a stain on U.S. engagement. China will be a stabilizing force if they continue to engage with Taliban leadership.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.gmo.com/americas/research-library/gmo-7-year-asset-class-forecast-july-2021/

ii. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

iii. https://advisors.vanguard.com/insights/article/amidyearupdateonoureconomicandmarketoutlook

iv. https://indexes.nasdaqomx.com/Index/Overview/HXC

v. https://www.bloomberg.com/quote/SHSZ300:IND

vi. https://research.gs.com/

vii. Bloomberg terminal

viii. https://www.cboe.com/us/indices/dashboard/vxfxi/

ix. https://thedailyshot.com/

x. https://tradingeconomics.com/china/retail-sales-annual

xi. https://tradingeconomics.com/china/industrial-production