Inflation Again (But Not for Long?)

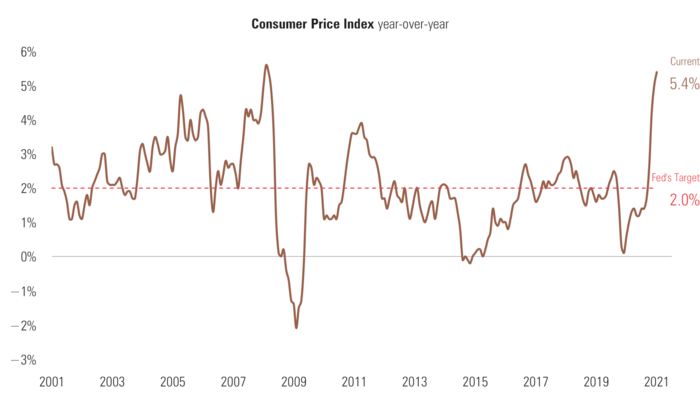

The latest reading on inflation once again pointed to higher prices for consumers. On a year-over-year basis, headline CPI was up 5.4% in June – the largest increase since August 2008. [i]

This was on top of a May jump of 5% in consumer prices.

Our view is that inflation will likely moderate to much closer to the Federal Reserve target of 2%.

Behind the headline inflation numbers lies the reasons why we believe inflation is still transitory.

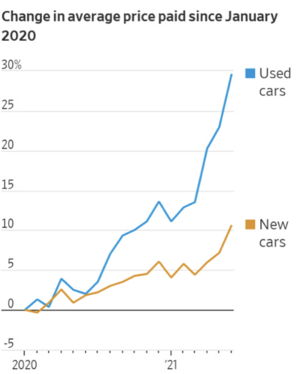

New and used vehicle prices continue to rise due to supply shortages. [ii]

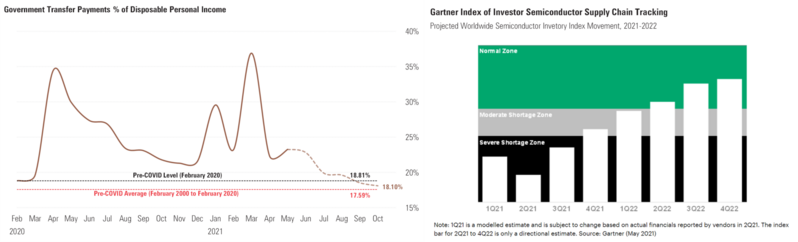

Much of the supply-demand imbalance in the auto sector is driven by a shortage of microchips on the supply side and the excess fiscal support to individuals on the demand side. Apparently, consumers wanted cars when they couldn’t fly. With government transfer payments set to decline by October and a return to normal for semiconductors in Q1 2022, the imbalances have a very good chance of moderating. [iii] [iv]

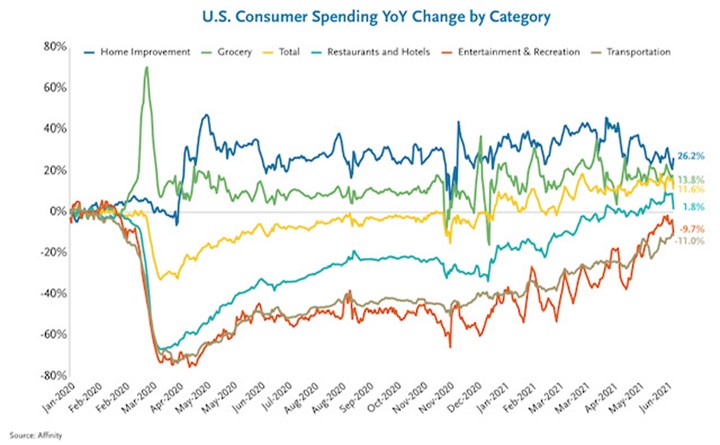

Further, the pandemic drove the consumer away from services and towards goods. The ratio of services to goods in personal consumption is near multi-decade lows. [v]

You can see inflation of goods jumped while inflation on services dropped dramatically.

As many restaurants, hotels, concerts, and movie theaters are set to open this coming quarter, we should see more supply come back online. That should moderate the demand on goods and normalize the demand for services.

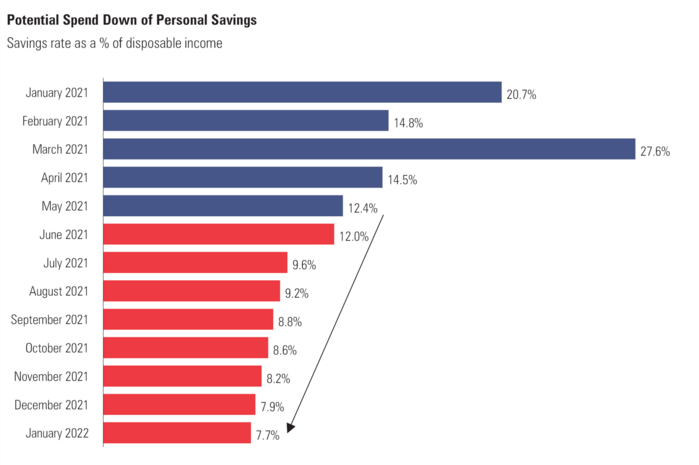

Another “deflationary” trend is the consumer spending down their precautionary savings. At the current pace, we should see that moderate at the end of this year. [vi]

You can already see some of the moderation occur in lumber prices. The headline still remains that housing prices are skyrocketing and new home sales are booming—All true, yet lumber prices have moderated and are now down back around the levels seen before the pandemic. [vii]

Further data suggests bond investors are continuing to confirm the transitory nature of inflation. Just track the 10-year yield: It’s down 30% since May. [viii]

Inflation is erosive to fixed income investors. So, why are they buying bonds instead of selling bonds? It’s likely they don’t see runaway inflation on the horizon.

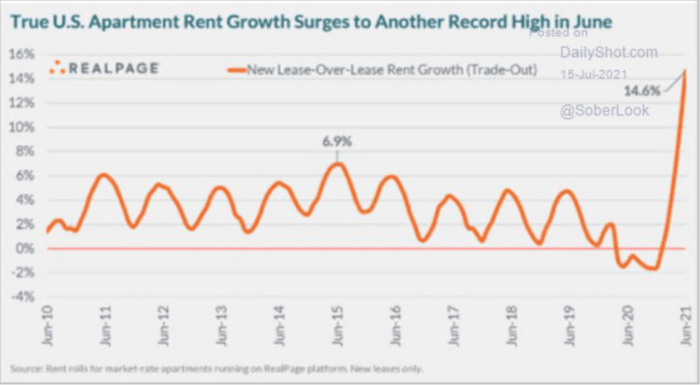

One area of concern is in rents being paid. Inflation in rents is real and, on average, rents have risen by 14.6% over the last year. [ix]

Rents make up 32.35% of CPI and we will need to be watchful to see if rents moderate in the coming months.

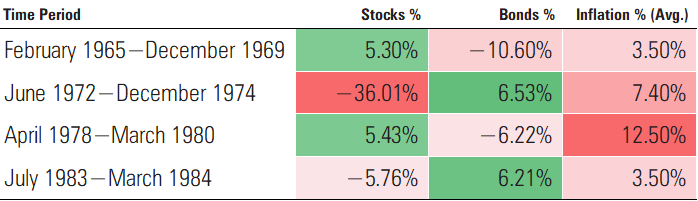

Returns on stocks and bonds during prior inflationary periods are inconclusive.

This current round of inflation should not morph into the type of inflation the U.S. consumer experienced in the 60’s and 70’s. You can see assets (stocks and bonds) react differently at various inflationary periods. Sometimes they go up and sometimes they go down. Like most things in life, it’s hard to predict. However, we do expect the inflation debate to rage on until we see some of the transitory effects wear off. We should also be prepared to consider various asset classes that react favorable to inflationary periods. More on that in our coming posts. We expect we’ll be talking about inflation again.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/graph/?g=FxaV

ii. https://www.wsj.com/articles/selling-your-used-car-you-could-turn-a-profit-11626606000

iii. https://fred.stlouisfed.org/graph/?g=FxwY

iv. https://www.gartner.com/en v. https://fred.stlouisfed.org/graph/?g=FxAY

vi. https://PHILLIPSANDCO.COM/files/2316/2525/2701/Quarterly_Look_Ahead_-_Q3_2021_-_Final.pdf

vii. https://www.bloomberg.com/quote/LB1:COM

viii. https://www.bloomberg.com/quote/GT10:GOV

ix. https://www.realpage.com/analytics/topics/multifamily-research-trends/