Inflation, Rising Rates, War and Volatility

At this stage of the economic cycle, all eyes are on the negatives. Rightfully so, as the headlines are filled with nothing but bad news.

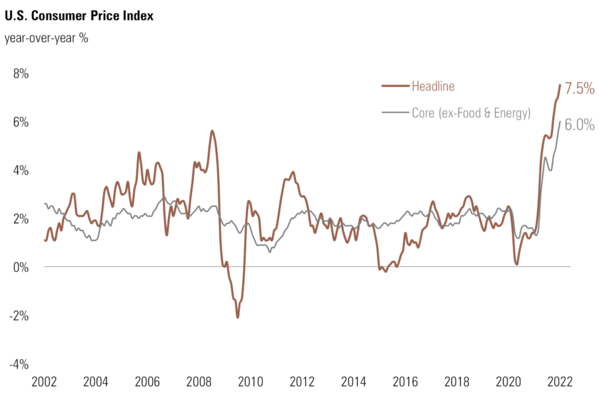

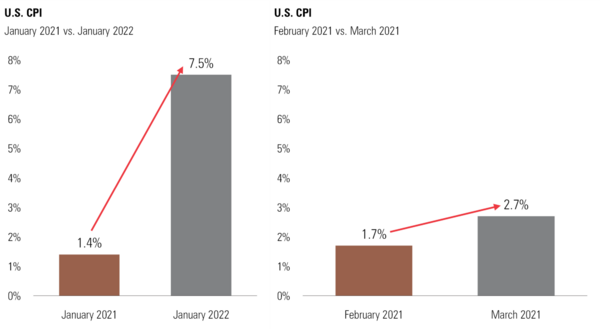

The January inflation print, reported last Thursday, came in at a record setting 7.5% measured against a year ago. 1

Again – and I know I sound like a broken record – we should soon be working our way to better year over year comparisons. 1

Based upon the base effects (year-over-year rate of change), we should see some moderation in March and even more as we work our way through the year.

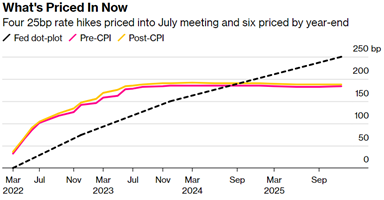

None of that is to suggest the Federal Reserve won’t raise rates several times this year. In fact, Goldman Sachs just raised their expectations for the Federal Reserve to raise rates seven times this year. Investor expectations are similarly aggressive, with six rate increases baked into the interest rate futures market by year-end. 3

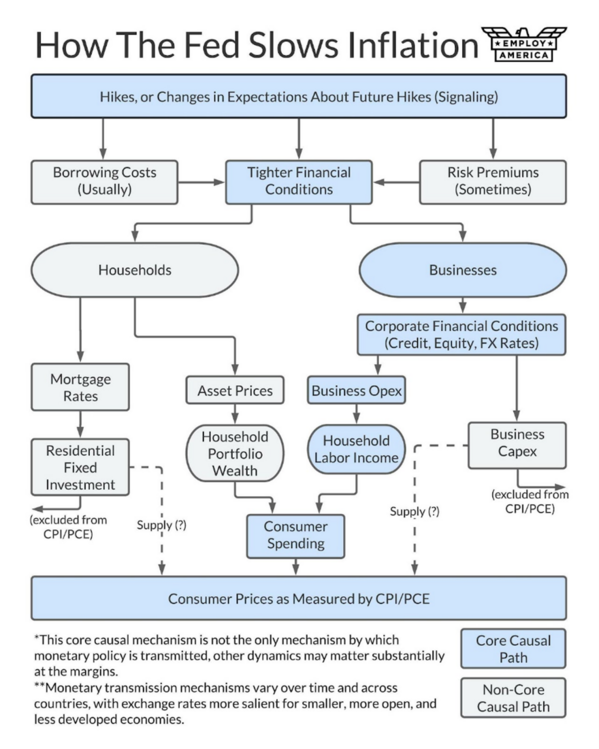

I came across a very interesting and succinct chart on the impact the Federal Reserve can have on the economy. It’s a little counterintuitive, but informative nonetheless. To paraphrase the study, the traditional thinking is rising rates impact consumer credit in the form of more expensive mortgages and credit. While true, according to this study, rising rates won’t likely tame inflation on the consumer as much as on the corporate entities. 4

Rising rates impact the value of a company’s public stock by reducing the value of its future cash flows. Additionally, capital expenditures get crimped and employment and wages are impacted. All of this has a dampening effect on the consumer.

Essentially, we would slide into an earnings recession and, perhaps, a real recession. While my base case is for modest earnings growth this year; with seven implied rate increases, an earnings recession is a growing possibility. Let’s hope the inflation base case, while currently ephemeral, becomes much more apparent in March and April.

Let’s add to this the Russia/Ukrainian conflict brewing in the headline media. While this seems to be about Russian aggression, it looks to me to be more of a manufactured crisis. Certainly, this is about Russian protecting their energy interests from falling prey to an expansion of NATO. 5

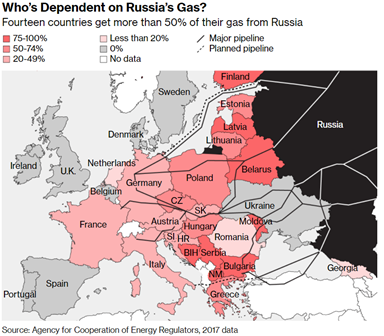

Let’s walk through this: 40%-50% of Europe’s gas needs are meet from Russia via Ukrainian pipelines. The brand-new Nord Stream 2 would circumvent Ukraine and that has geopolitical implications for this geographically important country. Beyond Ukraine acting as a natural buffer between Moscow and Eastern Europe, it’s also a transmission path for gas. 5

Here are just a few tidbits of critical data: Ukraine generates about $1.2 billion a year in transmission fees from Russia using their pipelines—that’s a big deal. Using an alternative route (Nord Stream 2) around Ukraine would reduce transmission costs by about 37%, providing Europe with cheaper natural gas. By the way, the current transmission agreement between Russia and Ukraine expires in 2024, likely just after Nord Stream 2 comes online. Further, Nord Stream 2 is up and ready to move gas, only awaiting German permitting before becoming fully operational.

So, will there be a war between Ukraine and Russia? I’m doubtful. Russian aggression would jeopardize the certification of Nord Stream 2 by Germany and eliminate Russia’s negotiating power over transporting gas through Ukraine.

Even if there were an armed conflict, markets tend to react favorably. 6

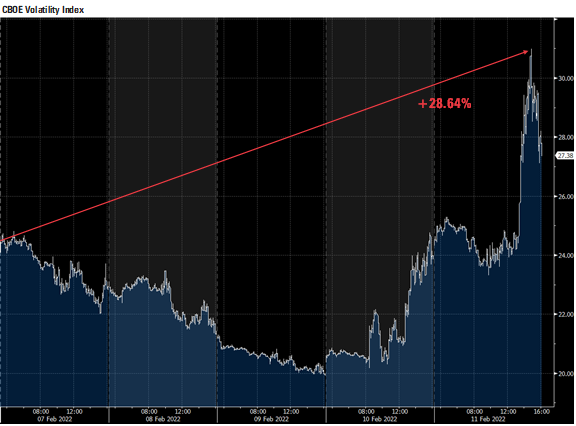

Chalk it all up to more volatility for investors to digest. In fact, volatility spiked last week, driven by inflation concerns and geopolitical instability. 7

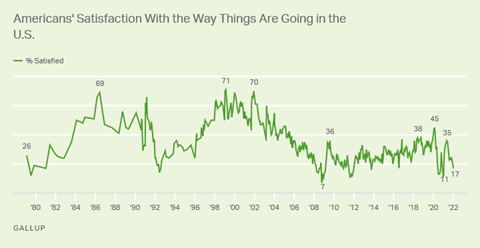

It’s no wonder the latest survey by Gallup suggests the U.S. is on the wrong track. Covid, rising rates, inflation, and the Western war drumbeat are driving any optimism out of the consumer. Only 17% of Americans are satisfied with the way things are going and 82% are dissatisfied. These are historically terrible numbers. 8

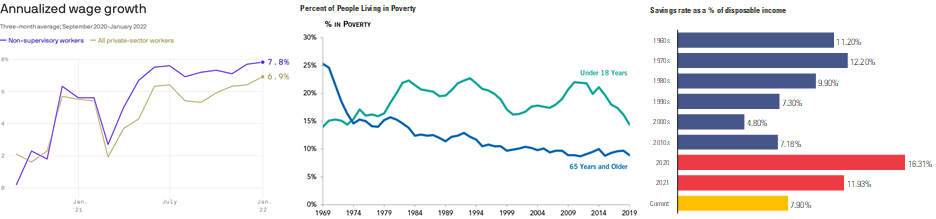

Considering wages are rising, unemployment is at near historic lows, child poverty is at record lows, and the consumer has a strong savings account; the consumer just can’t find a happy place. 91011

I expect much of this to pass in the coming months, but let’s keep bracing for some investor pain until the collective mood of the consumer changes. I predict better times ahead.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bls.gov/news.release/cpi.nr0.htm

- https://www.bloomberg.com/news/articles/2022-02-10/fed-swaps-show-a-full-percentage-point-of-hikes-by-july

- https://www.employamerica.org/researchreports/how-the-fed-affects-inflation/

- https://www.bloomberg.com/news/articles/2021-01-20/why-the-world-frets-over-russian-nord-stream-pipeline-quicktake

- https://www.schwab.com/resource-center/insights/content/market-perspective

- https://stockcharts.com/h-sc/ui?s=$VIX

- https://news.gallup.com/poll/1669/general-mood-country.aspx

- https://fred.stlouisfed.org/series/CES0500000003

- https://www.pgpf.org/blog/

- https://fred.stlouisfed.org/series/PSAVERT