Interest Rate Hand-Wringing

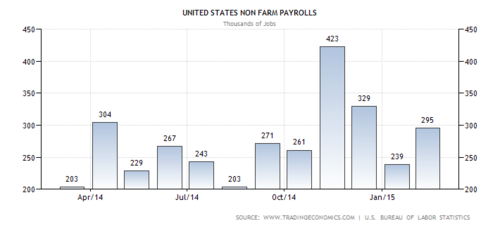

US equity markets sold off sharply on Friday driven principally by a very strong jobs report showing the US economy added 295,000 jobs in February.[i]

This very strong news spooked equity investors as they awakened to the reality of higher US interest rates from the Federal Reserve Board. Higher interest rates impact stocks because companies might have to pay more to borrow which hurts profits, and consumers might have to pay more to borrow for their homes, cars, and consumables.

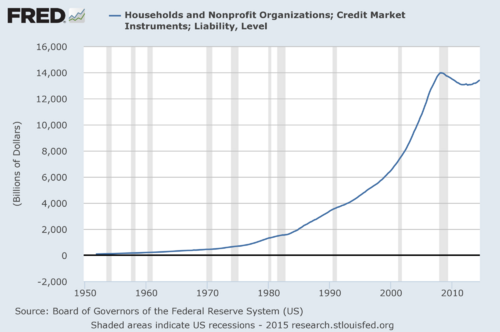

US companies in the S&P 500 have $7.4 trillion in debt and the US consumer borrows over $13 trillion, so it's no small matter when rates go up.[ii,iii]

Notice I used the word "might". Traditionally when the Federal Reserve raises the Fed Funds Rate (the rate charged to banks when they borrow from the Fed), this causes banks to raise their rates to companies and consumers.

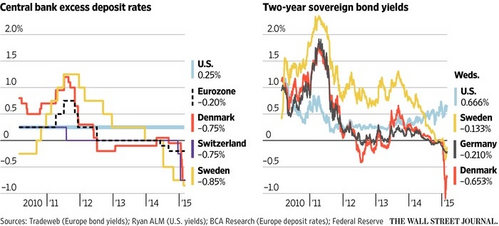

However, something else might be going on that we have never seen before. Currently 16% of all world debt issued by countries is at a negative interest rate.[iv,v]

We are not talking about real interest rates being negative (interest - inflation), but actual negative interest rates.

According to Vox:[v]

- In early February, Nestlé (which is headquartered in Switzerland) saw its four-year euro-denominated bonds trading at a negative interest rate.

- Countries like the Netherlands, Sweden, Denmark, Switzerland, and Austria all saw bonds trade at negative rates.

- In early February, Finland became the first European government to see negative rates on the initial sale of bonds.

- On February 28, Germany sold five-year bonds at negative rates.

Why would anyone want to loan their money to a country and not get paid interest? In fact, why would anyone want to loan their money to a country and actually pay interest to that country for taking their money?

It's counterintuitive to understand, as the history of negative rates is limited and typically used to discourage deposits.[vi]

- Many decades ago and again this year, Switzerland discouraged incoming Swiss-franc deposits by imposing negative interest rates.

- During the financial crisis in the US, the Bank of New York imposed negative interest rates on deposits over $50 million, effectively telling customers to remove their money.

Some reasons investors would pay to lend their money could be:[iv,v]

- Fear of keeping their money in the banks, as bank accounts are only government-guaranteed up to a certain extent (100,000 Euros in most European countries).

- Cash is hard to keep safe, so investors are willing to pay banks or the government to hold their cash in the form of a negative interest rate.

- European investors seem very pessimistic about the overall economic outlook in Europe, creating high demand for government debt in well-run countries. However, supply of new debt in many of the countries listed above is limited, which is pushing rates into negative territory as investors buy up their debt.

- Investors who fear or expect deflation tend to find nominal bonds attractive, even with negative yields, as long as expected deflation makes real yields positive.

- Investors may be buying Swiss or Danish government bonds to speculate on Swiss or Danish currency appreciation.

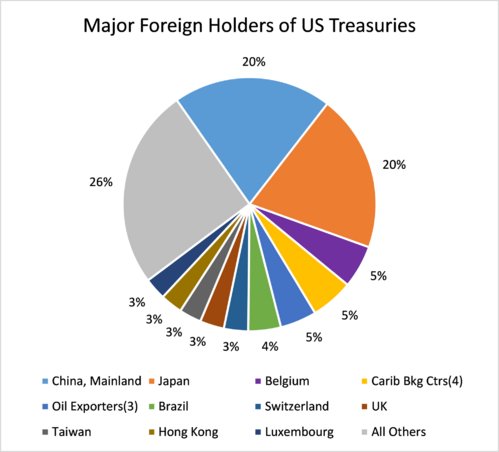

The implications of all this might play out in our economy. While the Fed tries to tick rates up, perhaps foreign buyers of our debt could keep it at historically low levels. When compared to paying countries to hold their money, why wouldn't they simply buy our debt? Especially since we continue to run budget deficits.

Further, we continue to have foreign buyers of US debt dominate our Treasury market. Approximately 34% of the $18.1 trillion US debt is held by foreign investors, mostly by China and Japan.[vii,viii]

All of this hand-wringing about higher rates may be for naught. The world is exporting some serious deflation and we might just be importing it in the form of lower rates much longer than the Fed can control.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] TradingEconomics.com. (Mar 9, 2015). United States Non Farm Payrolls.

[ii] Bloomberg LP. (Mar 9, 2015). Short and Long Term debt for S&P 500 companies.

[iii] Federal Reserve Economic Data. (Mar 9, 2015).

[iv] Durden, T. (Jan 31, 2015). 16% of Global Government Bonds Now Have A Negative Yield: Here Is Who’s Buying It. ZeroHedge.com.

[v] Yglesias, M. (Feb 26, 2015). Something economists thought was impossible is happening in Europe. Vox.com.

[vi] Kotok, D. (May 30, 2013). Negative Interest Rates. Cumberland Advisors.

[vii] JustFacts.com. (Mar 9, 2015). National Debt (as of January 8, 2015).

[viii] US Treasury. (Mar 9, 2015). Major Holders of Foreign Treasury Securities (as of Dec 2014)