Interest Rates on the Rise

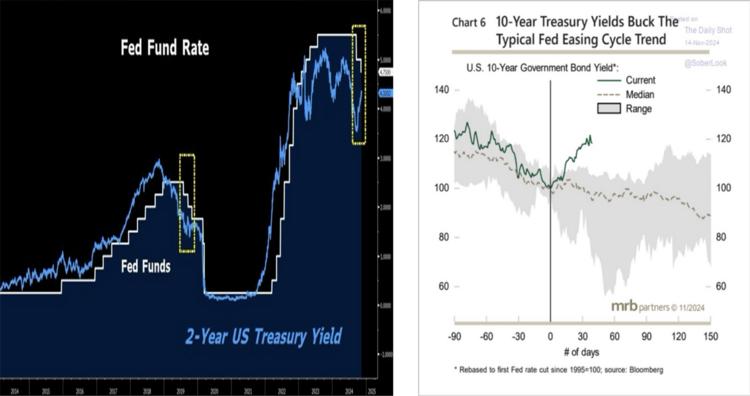

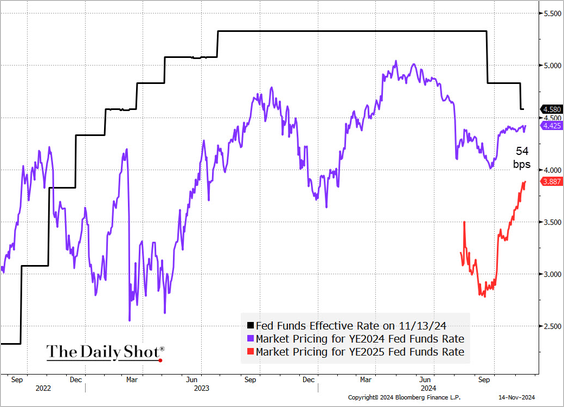

While we have been focused on the U.S. Presidential election, something is amiss with interest rates. The Federal Reserve has been cutting the Fed Funds rate, but treasury rates are still rising both on the 2-year and 10-year. 1

What’s going on?

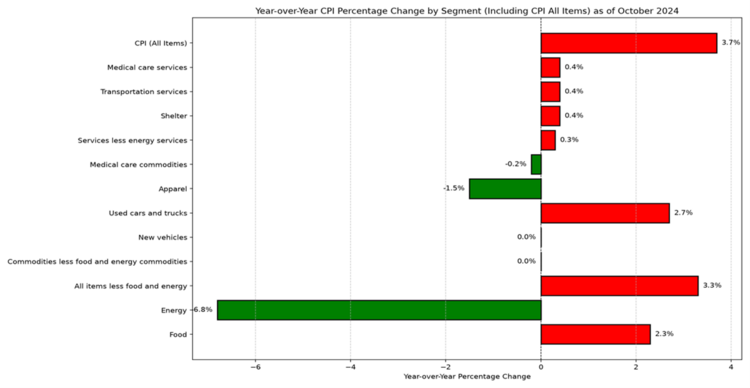

For one, inflation continues to be sticky, with the most recent reading on consumer prices suggesting inflation is not abating as much as hoped. Overall inflation is at 3.7% and when you subtract out energy and food, you get closer to 3.3% on a year-over-year basis. 2

It’s still nowhere near the 2% level the Federal Reserve is targeting.

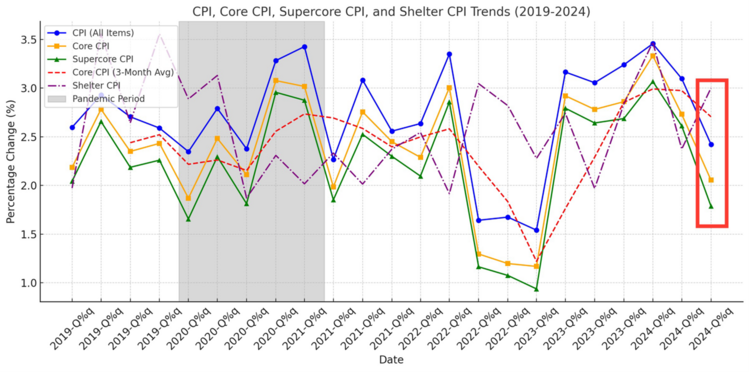

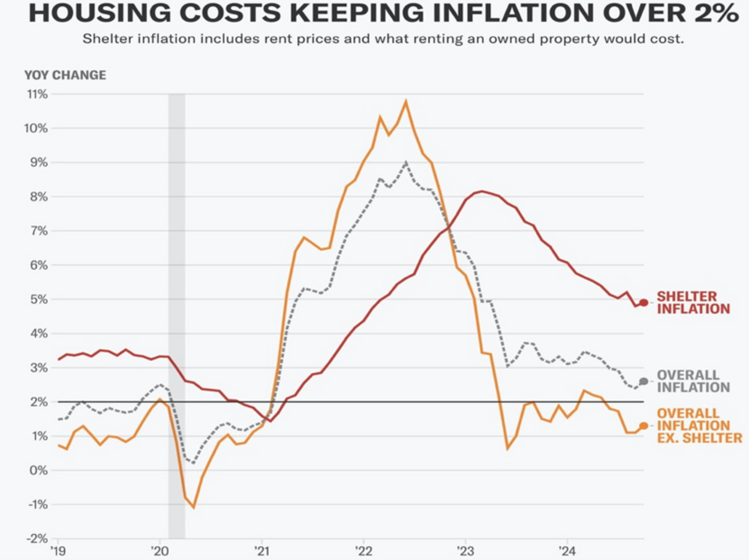

On a quarterly basis, inflation is moderating and moving closer to the magical 2% target – except for shelter, which makes up nearly 40% of the consumer basket of goods and services. 2

Shelter inflation is an ongoing issue in our economy. Without it, inflation would be below the Fed’s 2% target. 3

Perhaps that’s why the Fed Chairman made the following statement last week after cutting rates: 4

“Ongoing economic growth, a solid job market, and inflation that remains above the 2% target means the U.S. central bank does not need to rush to lower interest rates and can deliberate carefully.”

“We know it is time to recalibrate our (interest rate) policy to something that’s more appropriate given the progress on inflation.”

It’s not surprising that market expectations are calling for a slightly higher Fed Funds rate than in the past. 5

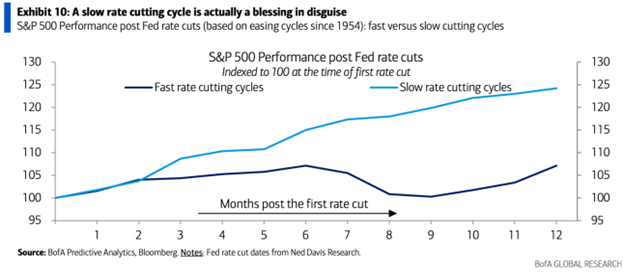

Taking time to cut rates is not particularly bad for equity returns. The slower approach has historically produced better results for the S&P 500. 6

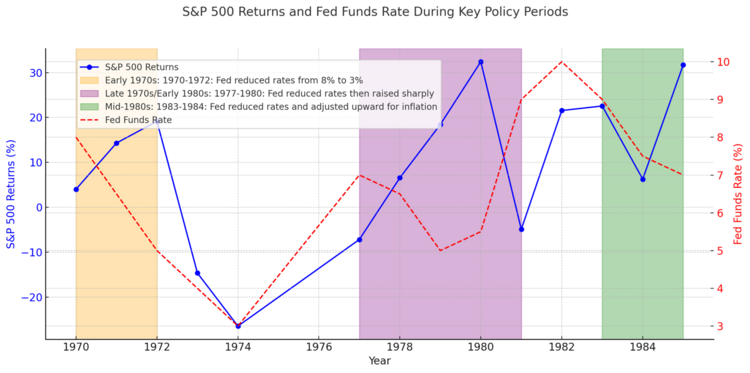

However, sticky inflation or re-inflation can create significant volatility. (The shaded areas in the chart below represent inflationary periods or a resurgence of inflation). That was the case in the 1970s-1980s. While it worked out ok for investors, it was a wild ride. 7

Perhaps some of the current interest rate pressure is being driven by the significant policy uncertainty around tariffs, federal spending, and tax cuts – all of which can be inflationary. While there’s frequent discussion about cutting the federal budget (a deflationary measure), we haven’t seen meaningful cuts since the Clinton administration. Investors clearly maintain a healthy skepticism toward the D.O.G.E. (Department of Government Efficiency).

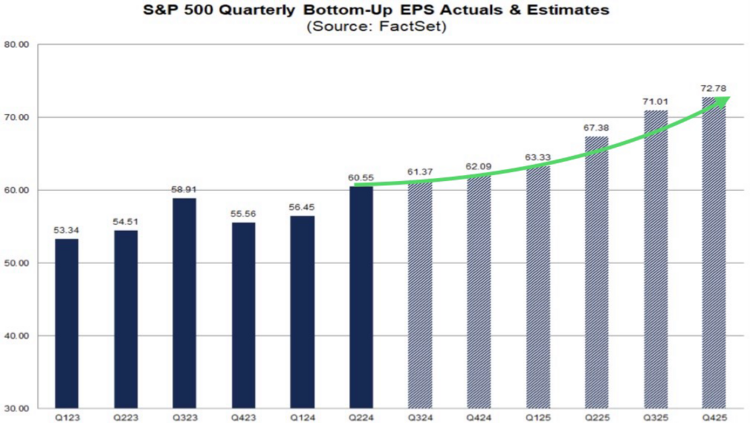

If not for the focus on elections or interest rates, we might focus on what really can drive equity prices: Earnings. We are at a trough in earnings expectations, and those earnings are expected to grow from here. 8

While interest rates might be on the rise due to sticky inflation or policy uncertainty, earnings are also on the rise. It’s my view that earnings growth will overcome sticky rates and inflation for a while.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://thedailyshot.com/

- https://www.bls.gov/news.release/cpi.nr0.htm

- https://finance.yahoo.com/news/housing-inflation-accelerates-in-october-amid-slower-progress-on-inflation-fight-151653653.html

- https://www.reuters.com/markets/us/view-powell-says-no-need-fed-rush-rate-cuts-given-strong-economy-2024-11-14/

- https://dailyshotbrief.com/the-daily-shot-brief-november-15th-2024/

- https://x.com/MikeZaccardi/status/1856140284981129309

- Bloomberg

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_111524.pdf

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.